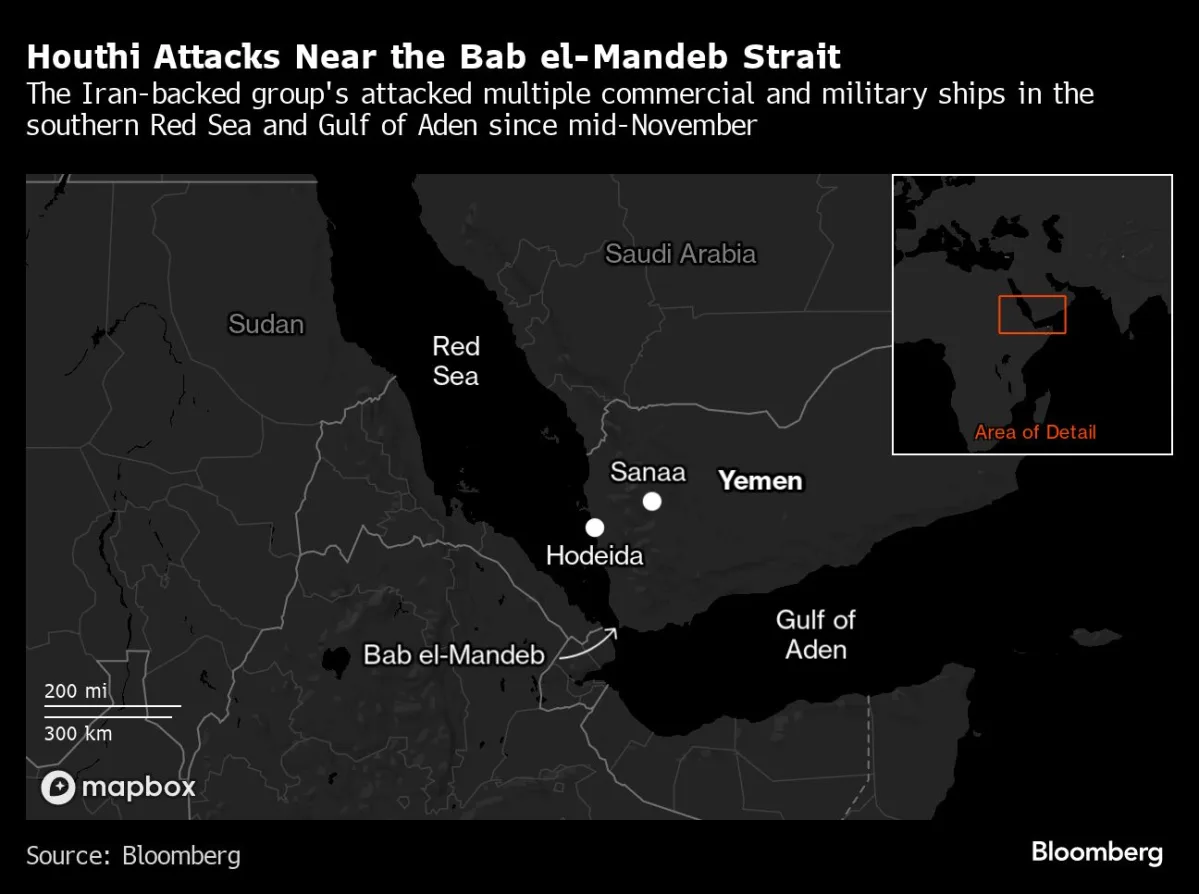

Oil Prices Drop Amid OPEC+ Supply Boost and Market Uncertainty

Oil prices dropped below $64 due to OPEC+ uncertainties and US-China tensions, with potential for further declines if OPEC+ increases output unexpectedly. Saudi Arabia and Russia consider boosting production, while other global oil developments include Canadian wildfires, Libya's instability, Iran's nuclear negotiations, Chevron's exit from Venezuela, and major mergers and deals in the energy sector. The market remains volatile amid geopolitical and economic factors.