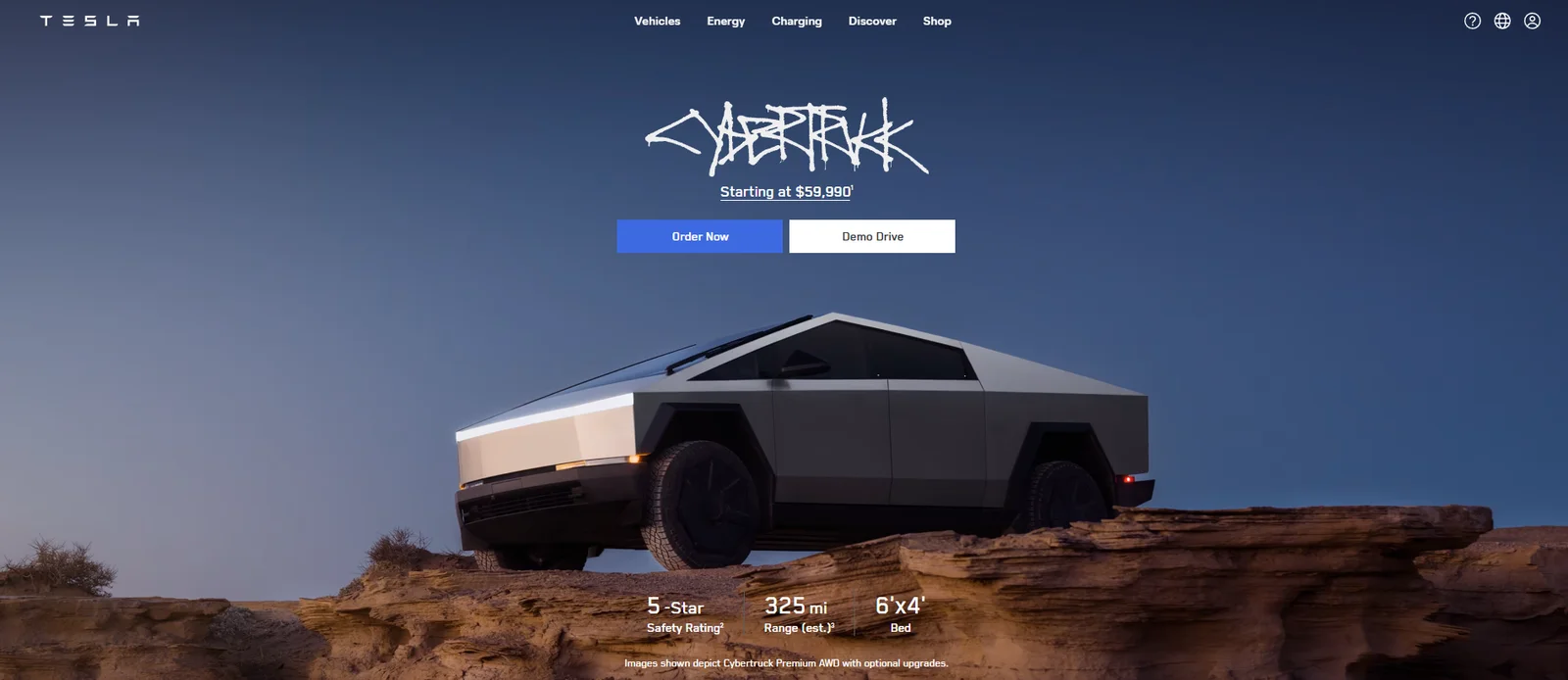

Tesla hints Cybertruck price may rise after 10-day window, tied to demand

Elon Musk said the $59,990 Dual Motor AWD Cybertruck price is a temporary window that could increase depending on demand, with the 10-day period intended to test interest; the strategy may not reflect broad market awareness, and the most compelling Cybertruck variant could persist even if the price changes.