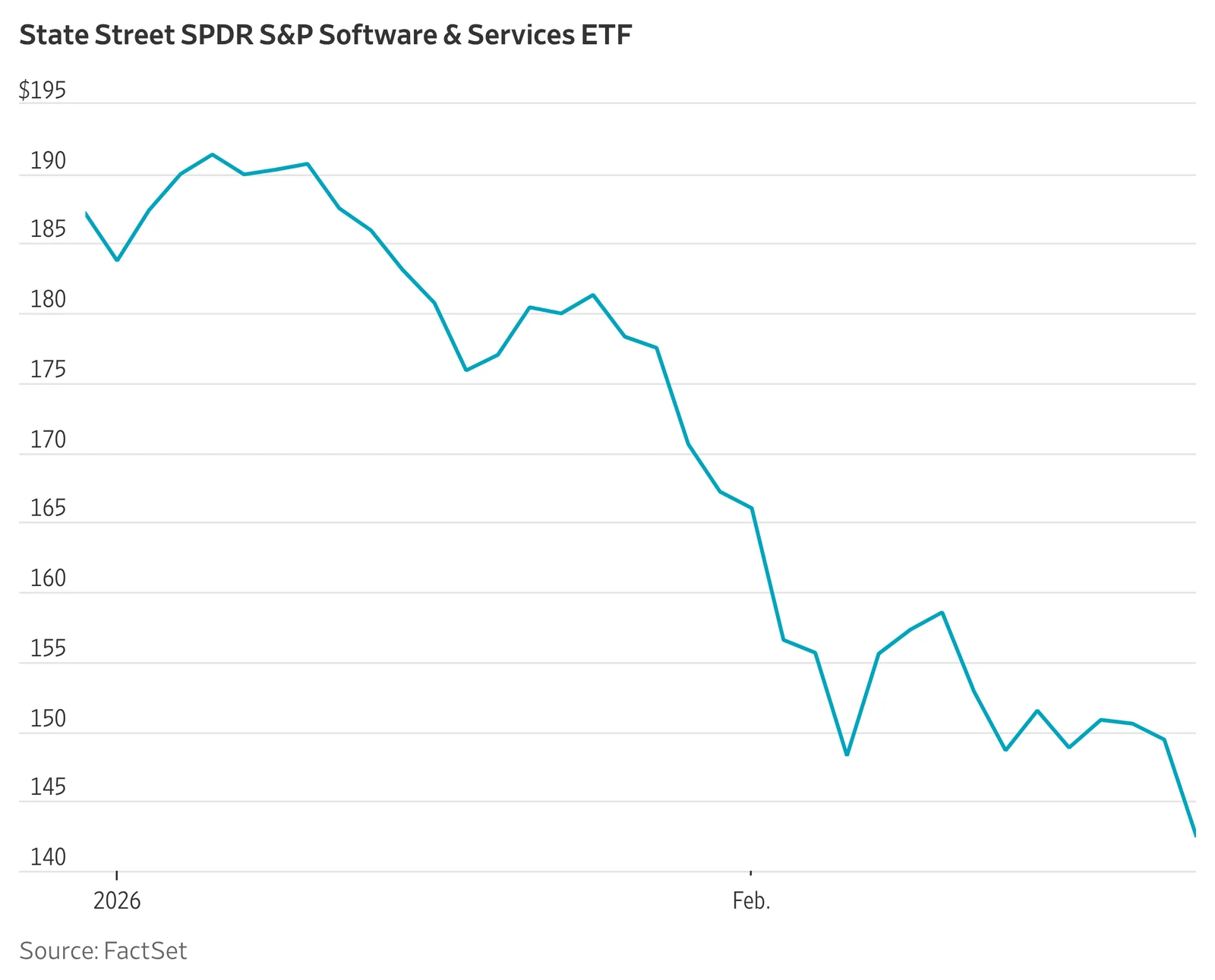

Software Stocks Slump as AI Fears Weigh on Markets

Software stocks extended their decline as AI concerns rattled investors, with AppLovin, CrowdStrike, Datadog and Expedia among the S&P 500's worst performers, each off at least 7%, and a software and services index fund dropping more than 5%.