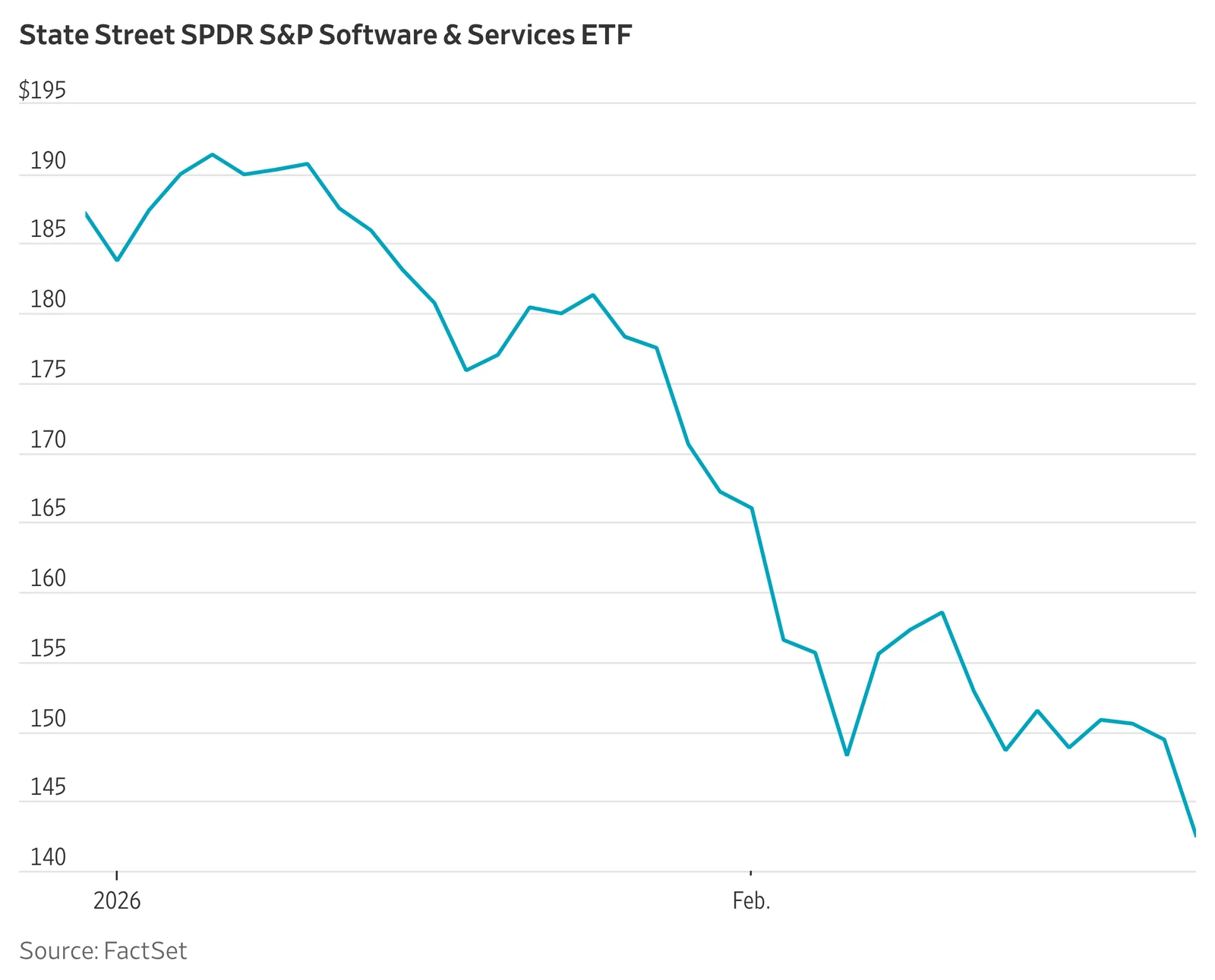

Claude's AI Upgrades Trigger Tech Stock Selloff

Anthropic’s Claude AI updates—including legal tools in Claude Cowork, a new Code security scan, and COBOL modernization—have helped spark a broad selloff in software and cybersecurity stocks early in 2026. The iShares Expanded Tech Software Sector ETF is down about 26% this year, with names like CrowdStrike, Okta, Zscaler and IBM among those hit as investors fear AI-enabled disruption could reshape software and related industries.