Warsh’s Push for a Leaner Fed Balance Sheet Faces Market Realities

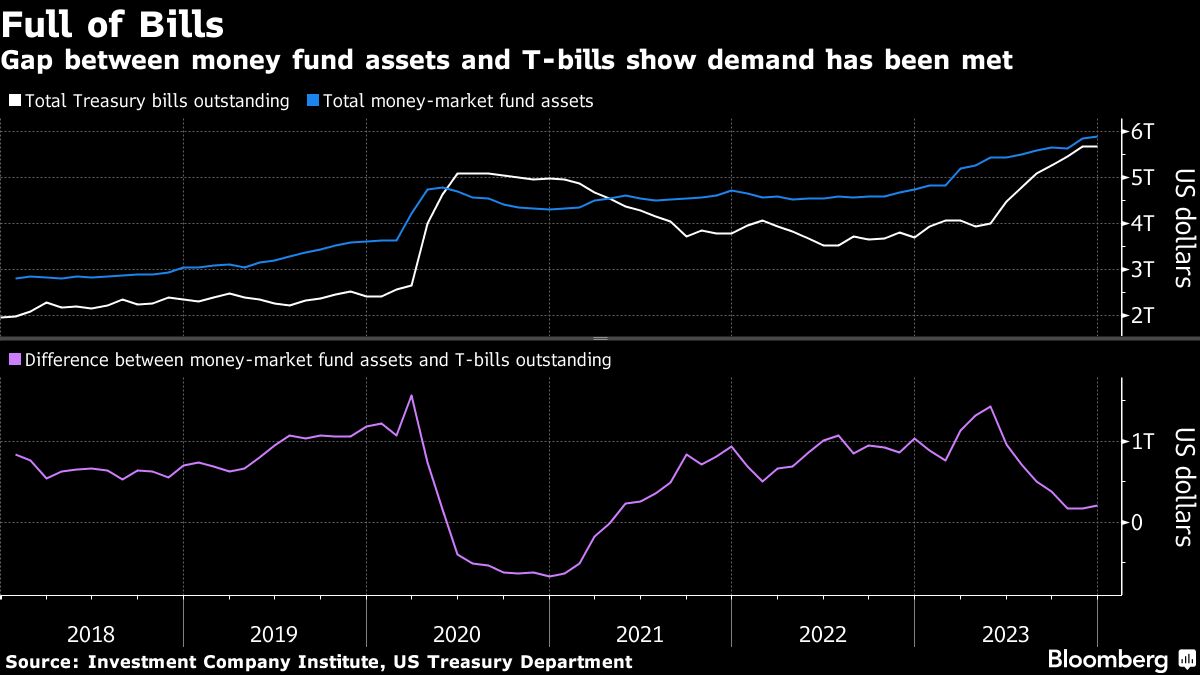

Fed nominee Kevin Warsh advocates a smaller central-bank balance sheet, but experts warn that without broad regulatory changes and tweaks to money-market operations, shrinking it could destabilize markets because banks rely on reserves; QT has cut holdings from about $9 trillion to roughly $6.7 trillion, and any further contraction would likely require policy shifts or Treasury coordination to avoid volatility.