Finance And Economics News

The latest finance and economics stories, summarized by AI

Featured Finance And Economics Stories

AI's productivity payoff remains elusive despite rapid advances

AI is advancing rapidly and solving complex tasks (even aiding theoretical physics), but its impact on measured output and productivity remains limited so far, echoing the Solow paradox that breakthrough capabilities don't yet translate into broad productivity gains.

More Top Stories

Ultra-Rich Shift Away from Luxury Assets

The Economist•4 months ago

Is the US dollar's dominance coming to an end?

The Economist•7 months ago

More Finance And Economics Stories

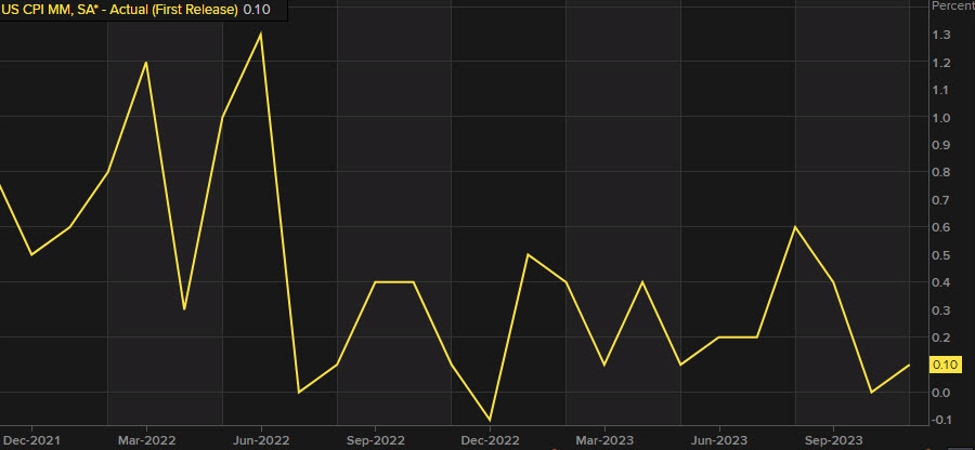

"Upcoming CPI Data from US and China to Headline Economic News"

Upcoming CPI data from the US and China are key focal points for the week, with analysts watching for signs of inflation trends that could influence central bank policies. The US is expected to see a slight rise in CPI, potentially challenging the market's dovish view on the Fed's rate trajectory. China's inflation figures are anticipated to remain low, avoiding a deflationary spiral. Corporate earnings reports in the US will also be in the spotlight, with expectations of modest growth amid concerns over economic slowdown. In Europe, Swiss and Norwegian CPI data will provide insights into inflationary pressures, while the UK's GDP figures could signal the severity of a potential technical recession.

"2024 Gold Forecast: Seasonal Trends, Economic Data, and Job Reports Influence a Volatile Market"

AI models, including GPT-4 Turbo and Google Bard, have made predictions for the gold price by the end of 2024. GPT-4 Turbo's most likely scenario suggests a price between $2,100 and $2,200 per ounce, with potential bullish scenarios reaching up to $2,350/oz and bearish scenarios dropping to $1,900/oz. Google Bard predicts a more conservative price of $2,075/oz, with a possible increase to $2,120/oz or a decrease to $2,005/oz. These predictions are based on gold's historical performance during times of inflation and economic uncertainty, but investors are cautioned to not take these forecasts as absolute and to consider additional information when making financial decisions.

"Dollar Fluctuates on Mixed Signals Ahead of Key US Economic Reports"

The U.S. dollar initially rose after a stronger-than-expected non-farm payroll report, but gains were tempered by downward revisions of previous months' data and a declining participation rate. Despite a solid unemployment rate of 3.7%, the market reassessed the strength of the jobs data, leading to a pullback in the dollar's value against other major currencies. The USDJPY retreated from near 146.00 levels, while the EURUSD and GBPUSD recovered from their post-report lows, with the EURUSD breaking above a key retracement level.

"Previewing the Impact of US Nonfarm Payrolls on Gold, the Dollar, and Stock Markets"

The upcoming U.S. December jobs report is anticipated to show an increase of 150,000 jobs, potentially influencing the Federal Reserve's monetary policy and impacting market volatility. A stronger labor market could lead to a delay in expected rate cuts, supporting the U.S. dollar and Treasury yields while potentially pressuring gold prices and stocks. Conversely, weaker job growth and wage moderation may prompt a more dovish Fed stance, possibly resulting in lower yields, a weaker dollar, and a rally in gold and risk assets. The report's outcome is crucial for investors as it could guide the Fed's next steps in terms of monetary policy.

"Fed Signals Potential for Rate Cuts Amid Uncertainty, Impacting Bitcoin and Stocks"

The Federal Reserve's December meeting minutes suggest potential interest rate cuts in 2024, which is typically seen as a bullish signal for Bitcoin. However, historical trends indicate that such rate cuts often precede economic recessions and a stronger U.S. dollar, which could lead to a decrease in risk appetite and negatively impact Bitcoin's value. Investment firm Piper Sandler notes that the Fed's pattern of maintaining high rates for too long could lead to a recession, and current market optimism may be overestimating the U.S. economy's resilience.

"Dollar's Resurgence Amid Fed Speculation and Global Currency Dynamics"

The U.S. dollar's recent gains were curtailed following the release of the Federal Reserve's minutes, which suggested a potential easing cycle ahead. The upcoming U.S. jobs report will be crucial for the dollar's trajectory, with strong job growth likely to bolster the currency, while a significant miss could weaken it. Technical analysis indicates potential movements for USD/JPY, EUR/USD, and gold prices, with key levels highlighted for each. Investors and traders are closely watching these indicators to gauge future market directions.

"Speculation Grows on Imminent End to Fed's Balance Sheet Reduction"

The Federal Reserve is considering when to start discussions on ending its quantitative tightening (QT) program, as revealed in the minutes from the last FOMC meeting. Several members indicated it's time to consider the technical aspects of slowing down the balance sheet reduction, suggesting the end of QT might be approaching sooner than anticipated. The plan is to stop shrinking the balance sheet when reserve balances are above the level needed for ample reserves.

"Dollar's Ascent Wavers Amid Speculation on Fed's Rate Cut Plans"

Following the release of the Federal Reserve minutes, the U.S. dollar saw a slight increase, with the EURUSD hitting a new low and the USDJPY reaching a marginal new high. The Treasury yield curve showed mixed movements, with a slight rise in the 2-year yield and a decrease in the 10-year and 30-year yields. U.S. stock markets experienced a minor drop post-release, with the Dow, S&P, and Nasdaq all showing small declines. The Fed minutes suggested potential rate cuts, but the market's expectations for the extent of these cuts may not align with the Fed's current stance.

"Markets Brace for Clarity on Rate Cuts as FOMC Minutes Loom"

The Federal Reserve's December meeting minutes are anticipated to provide insights into the potential timing of interest rate cuts as inflation shows signs of decline. While the Fed held rates steady at 5.25% to 5.5% in December, projections indicated a reduction by at least 0.75 percentage points over the year. Investors expect a rate cut as early as March, but Fed Chair Jerome Powell has not confirmed this timeline. Upcoming economic data, including jobs and inflation reports, will be crucial in shaping the Fed's policy decisions, with the next meeting scheduled for January 30-31.

"Markets Brace for Impact Ahead of Hawkish Fed Meeting Minutes"

The Federal Reserve's Federal Open Market Committee (FOMC) December meeting minutes are anticipated to clarify the central bank's stance on interest rate cuts for 2024. Despite market participants expecting up to 6 or 7 cuts, Fed officials have signaled only about 3, with some expressing it's too early to consider cuts as soon as March. The minutes may temper the market's premature euphoria over rate cuts, aligning with cautious analyst expectations and recent comments from Fed officials suggesting a more measured approach to easing.