ALS diagnosis buys Medicare relief, but premium cliff still threatens retirement

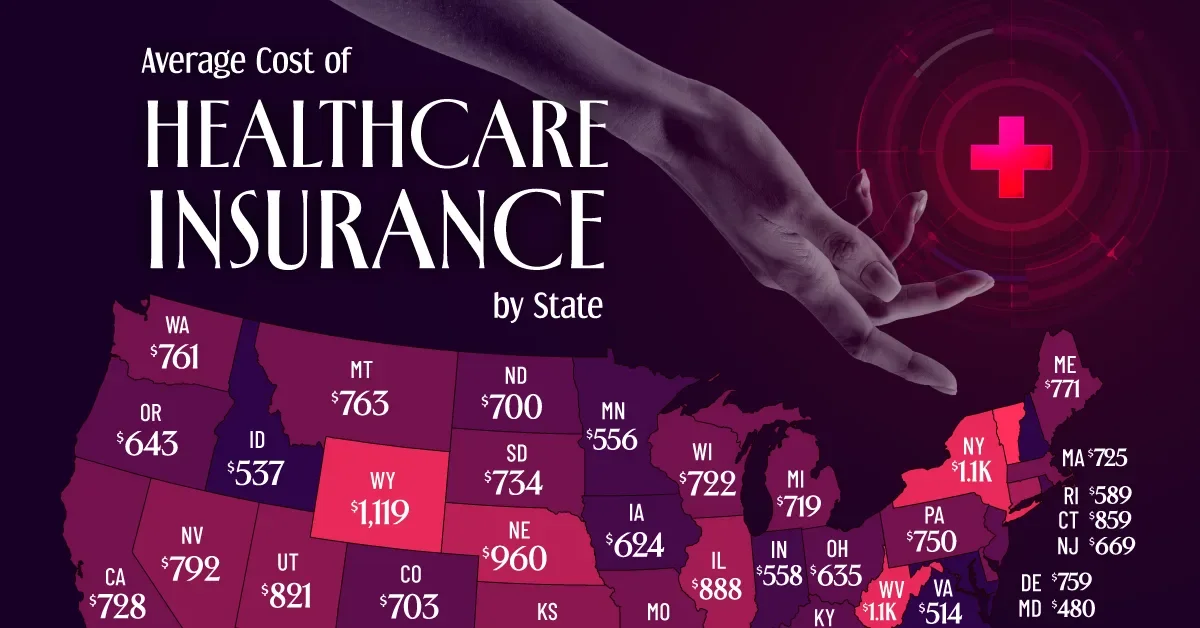

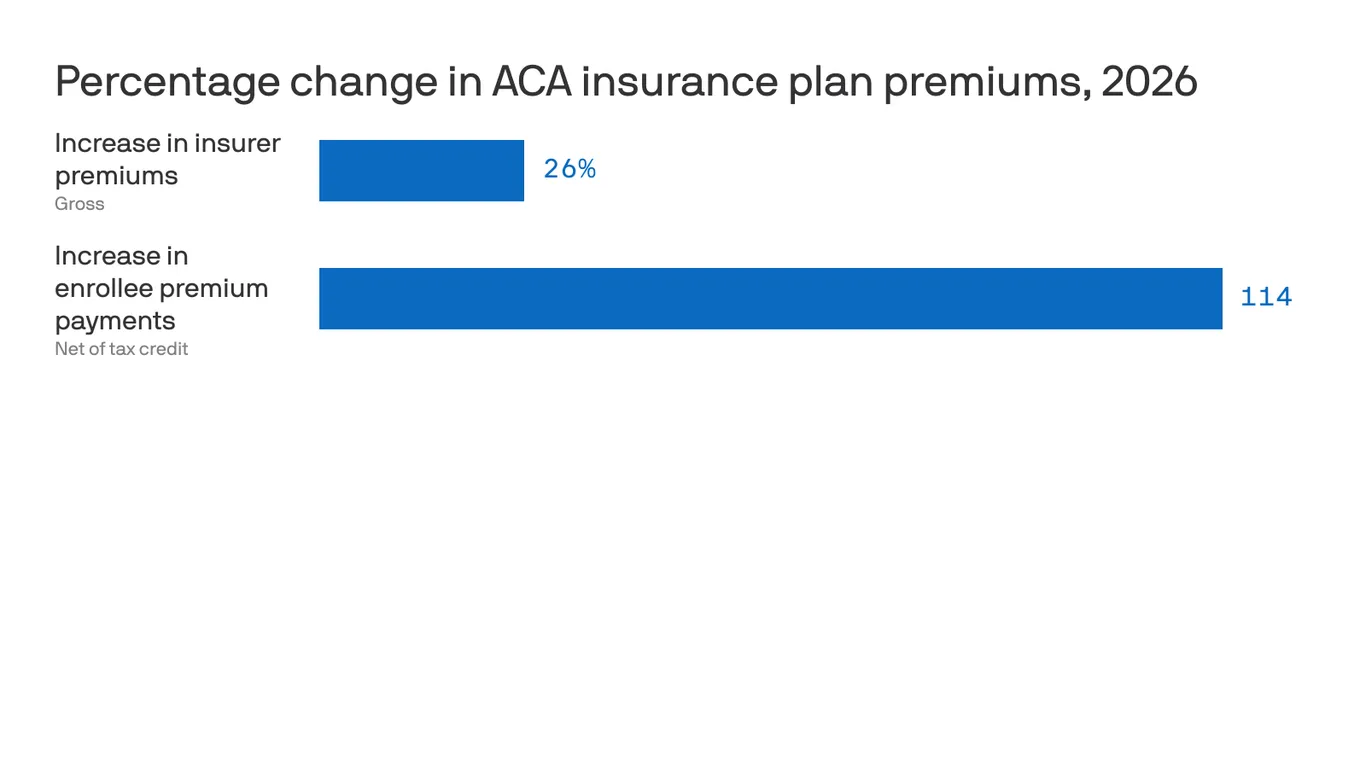

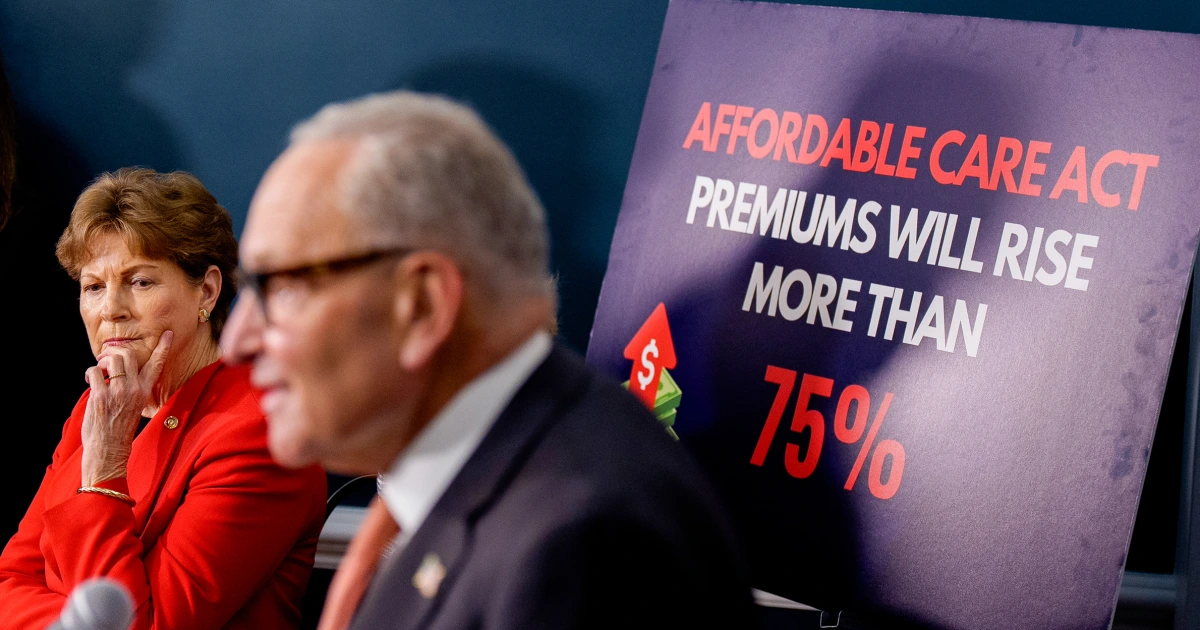

A California couple’s health care bills surge after Congress let enhanced ACA subsidies lapse, with monthly premiums rising sevenfold and threatening retirement savings. Jean Franklin’s ALS diagnosis enabled Medicare enrollment that saves about $1,600 a month, but the combined costs—including premiums for her plan and her husband’s coverage—remain a heavy burden as millions near retirement face a similar “premium cliff,” contributing to coverage losses and financial strain nationwide.