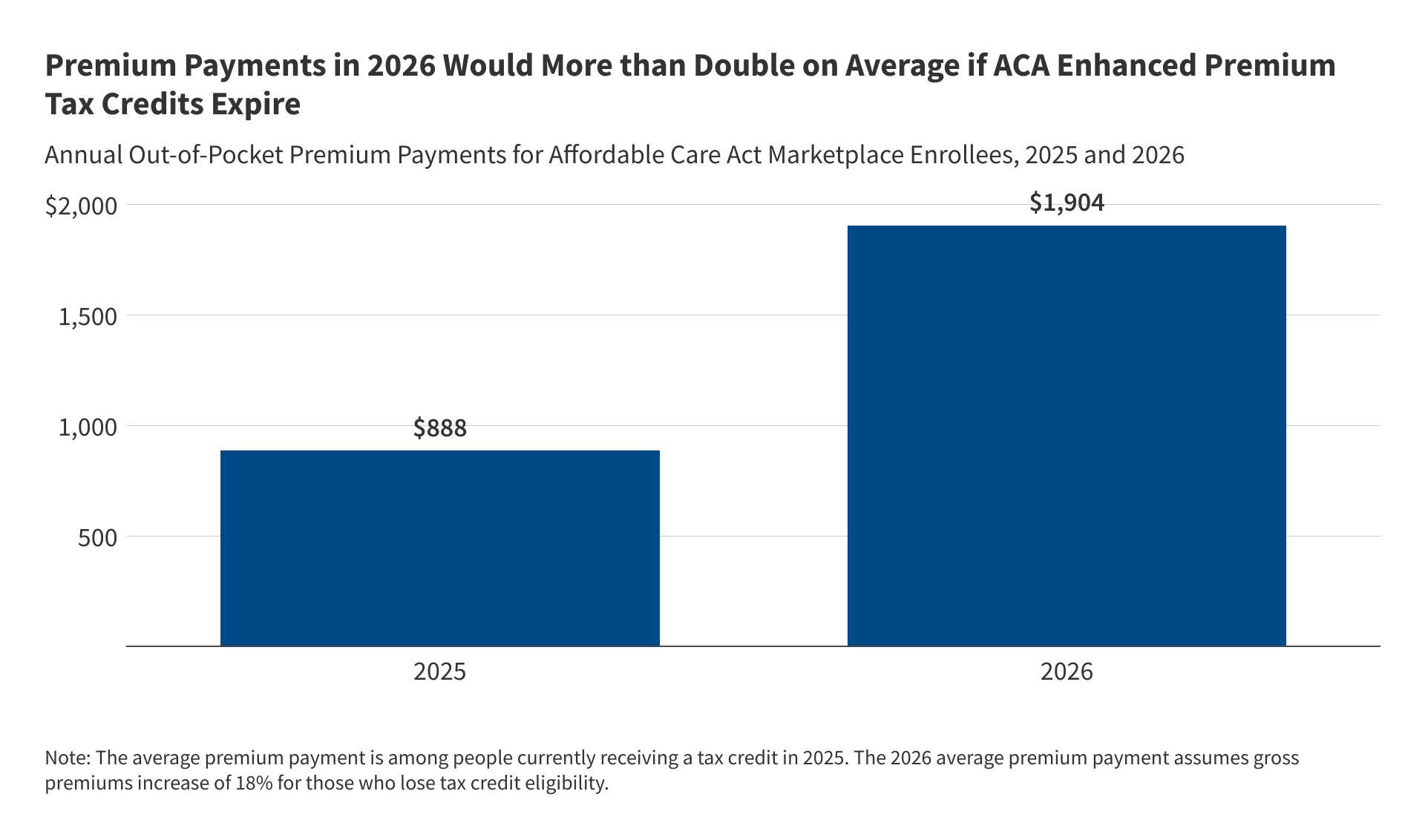

States face challenges as ACA subsidies expire and sign-ups stabilize

While overall Obamacare sign-ups are steady compared to last year, some states are experiencing higher termination rates, fewer new enrollees, and increased consumer calls for help, raising concerns about the impact of the expiration of enhanced subsidies in January, which could lead to higher premiums and lower enrollment if not extended by Congress.