Potential Double in Obamacare Premiums if Tax Credits Expire

TL;DR Summary

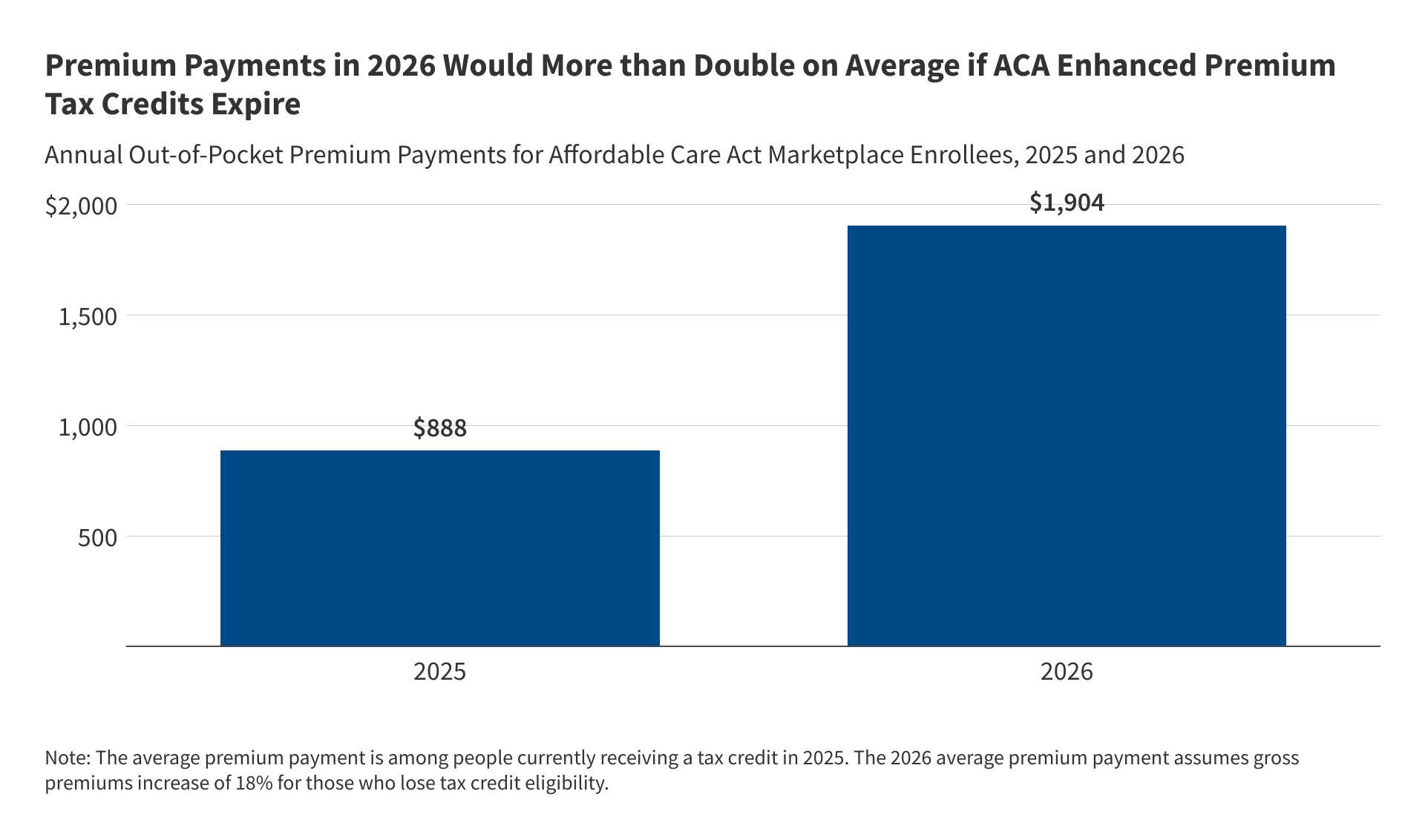

If the enhanced premium tax credits for ACA Marketplace enrollees expire at the end of 2025, average premium payments could more than double in 2026, with middle- and high-income enrollees facing significant increases due to rising premiums and changes in tax credit calculations, potentially leading to substantial financial burdens for many.

Topics:nation#aca#health-insurance#healthcare#medicaid-expansion#premium-increases#premium-tax-credits

- ACA Marketplace Premium Payments Would More than Double on Average Next Year if Enhanced Premium Tax Credits Expire KFF

- Why ACA tax credits for 22 million Americans are at the center of the government shutdown drama CBS News

- Why Obamacare funding is a sticking point in the fight to avoid a government shutdown NBC News

- Why health care tax credits are a sticking point in shutdown negotiations PBS

- Why Obamacare Bills May Double Next Year The New York Times

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

6 min

vs 7 min read

Condensed

96%

1,225 → 51 words

Want the full story? Read the original article

Read on KFF