Three-Quarters of U.S. Homes Are Not Affordable for the Average Buyer

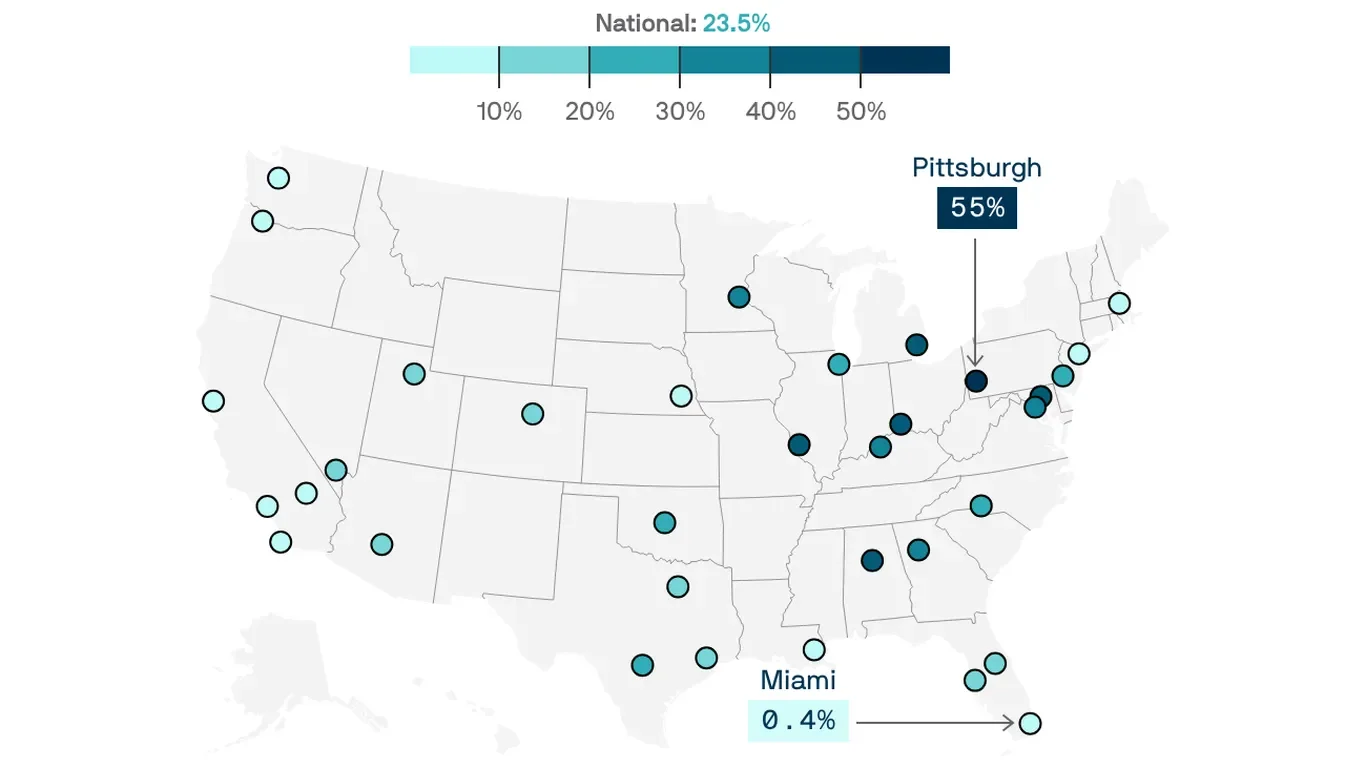

A Bankrate analysis finds that over 75% of U.S. homes for sale are unaffordable for the typical household, driven by high prices, mortgage rates and tight inventories. Only 11 of the 34 largest metros have at least 30% of listings within reach for middle-income buyers; ultra-expensive markets like Miami, Los Angeles and San Diego remain far out of reach. By contrast, some Rust Belt and Southern metros are closer to affordability, helped by more new construction and townhomes. The median U.S. household earns about $80,000, well below the roughly $113,000 needed to afford the median-priced home of $435,000.