Warren says Trump could rally GOP to curb Wall Street housing purchases

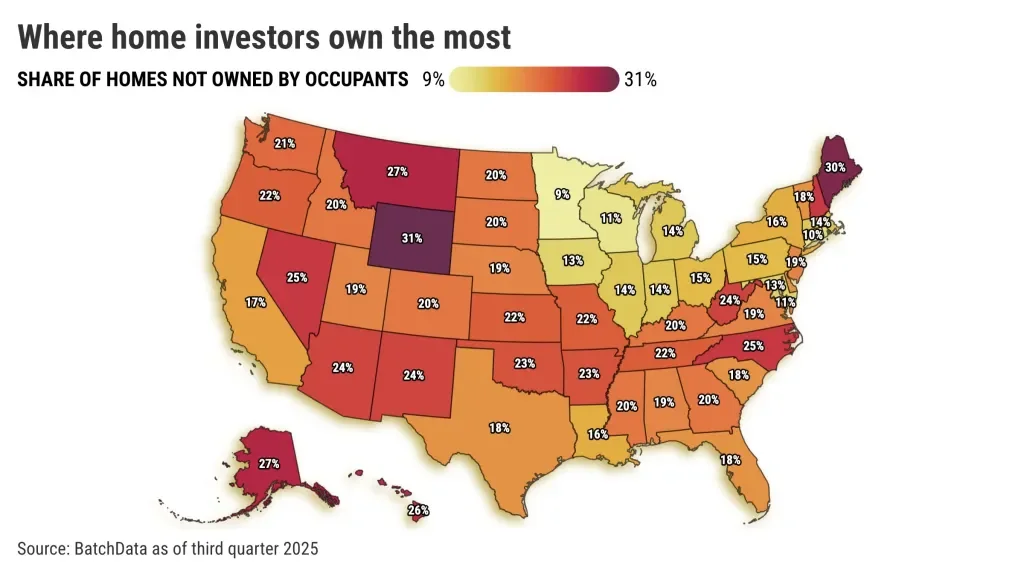

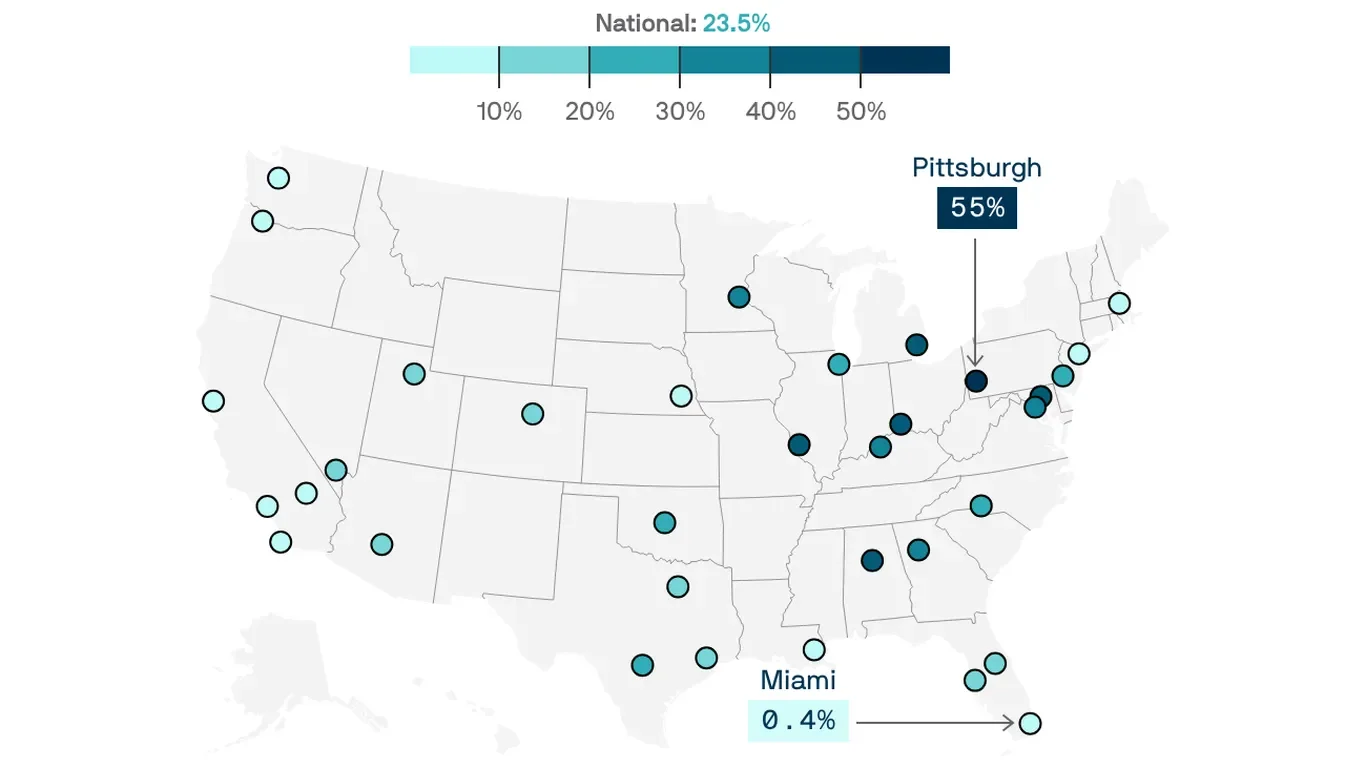

Sen. Elizabeth Warren told POLITICO that President Trump could turn a GOP push to curb Wall Street’s single-family home purchases into law if he rallies Republicans, as Senate and House housing bills seek to boost supply and lower costs. The White House wants restrictions on institutional investors not currently in the bills, while Warren remains open to adding private-equity provisions and backs a separate tax-break removal measure, signaling alternative approaches. Whether the bills will be reconciled remains uncertain.