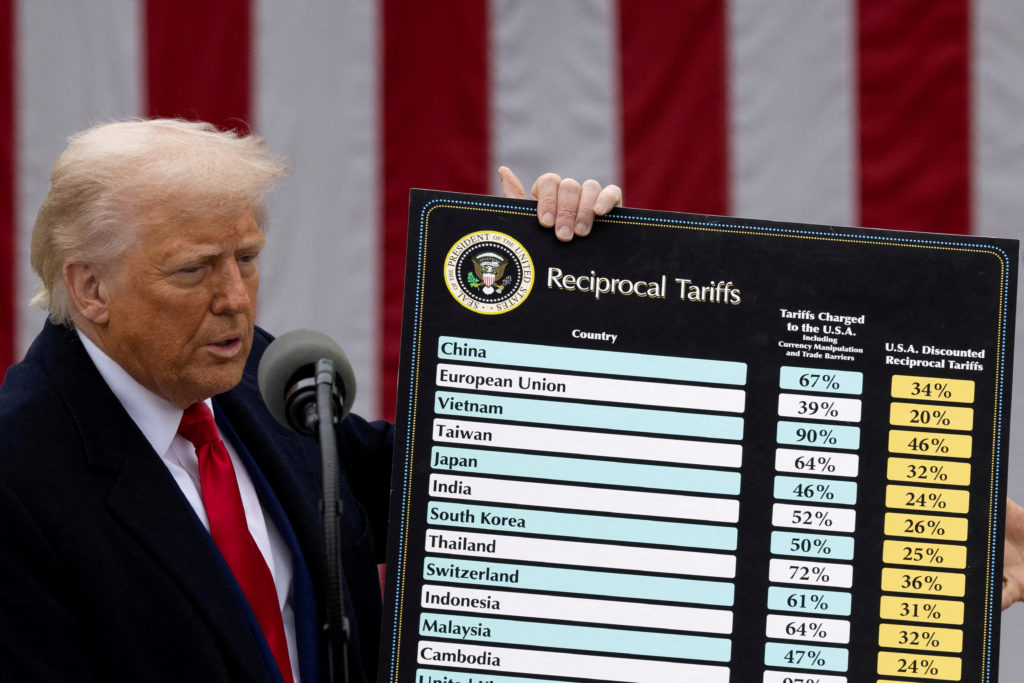

Trump's Tariffs Pose Challenges and Opportunities for Small Businesses

A small business owner in Pittsburgh describes how recent tariffs, especially on fabric imports, have dramatically increased costs, created uncertainty, and threatened the viability of her shop, highlighting the broader impact of trade policies on small retailers and local communities.