Trump's housing plan collides with supply reality

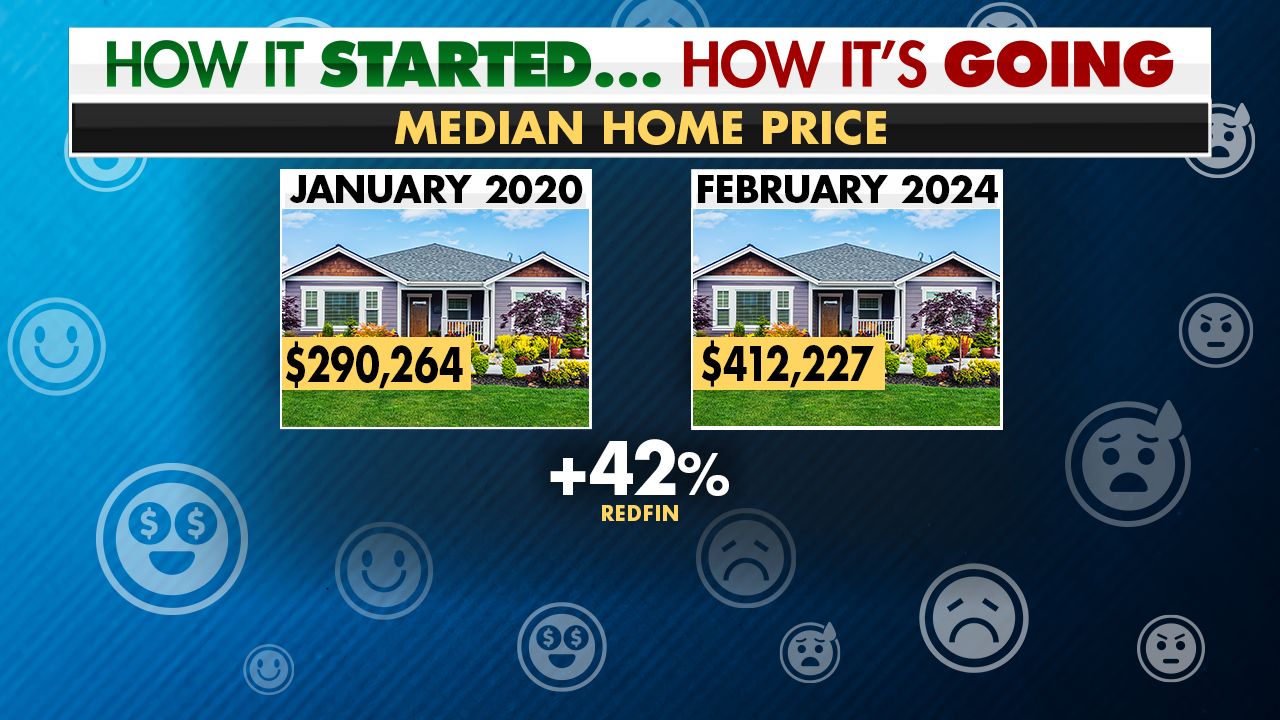

Trump has floated measures to lower housing costs, including a 50‑year mortgage, large-scale government-backed mortgage‑bond purchases, and a ban on institutional investors buying single‑family homes. Experts warn these steps would offer limited relief or could backfire because the core problem is a long‑standing housing shortage. For example, a 50‑year loan on a $500,000 home at 6.1% could incur about $1.1 million in interest (versus $590k on a 30‑year loan), and in Greater Boston a typical home could see roughly $2 million in interest under such a loan. Critics say extending loan terms primarily shifts debt and may push prices higher if supply isn’t expanded; banning investors could reduce rentals in some markets but won’t fix supply. Real relief, they argue, requires boosting housing supply through zoning reform and new construction; Massachusetts estimates 222,000 new homes are needed by 2035. Separately, Trump moved to have Fannie Mae and Freddie Mac buy about $200 billion in mortgage bonds, which nudged rates down slightly but doesn’t address the supply shortage.