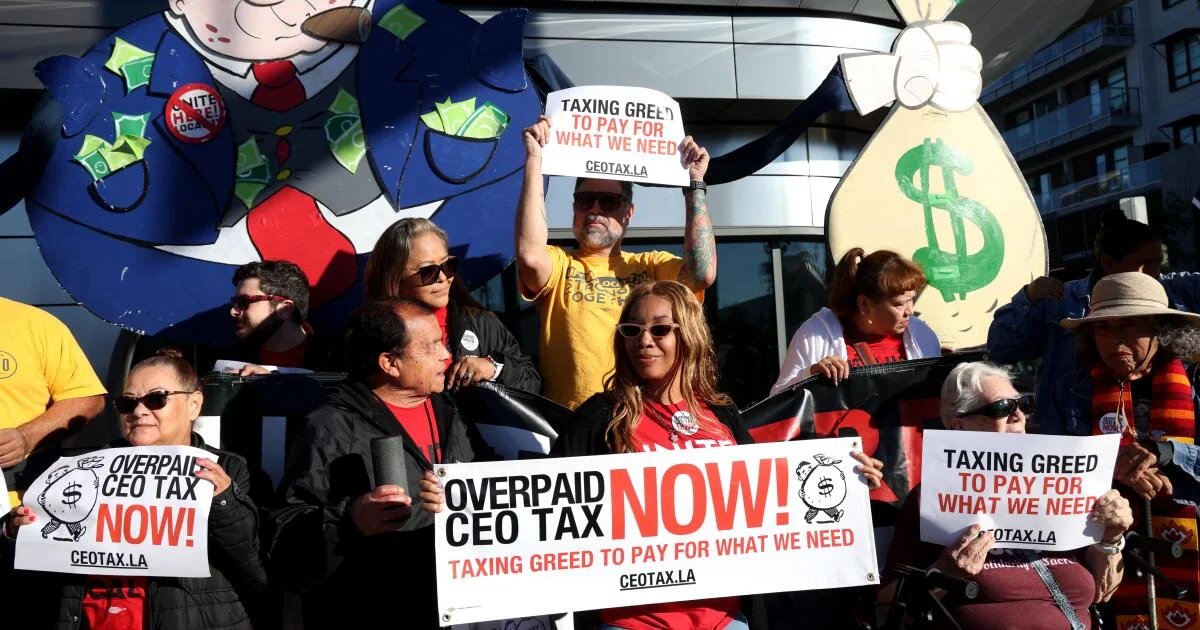

California Debates Billionaire Tax as L.A. Pushes CEO Pay Levy

TL;DR Summary

Unions back a statewide billionaire tax and an L.A. measure to tax firms with CEOs paid at least 50x the median, including a one-time asset tax (up to 5%) on >$1B that would fund housing, street repairs, and programs. Backers pursue roughly 875,000 signatures by June 24 to place the measures on the November ballot, while Gov. Newsom opposes the wealth tax and business leaders warn of capital flight and lost jobs if it passes; similar efforts are underway in San Francisco.

Topics:nation#billionaire-tax#california-politics#counts-above-show-five-are-required-ensure-five-tags-only#housing-affordability#los-angeles#note-extra-tag-included-but-need-only-five-adjust#overpaid-ceo#politics

- Amid rising costs, California and L.A. initiatives aim to tax the ultra-rich Los Angeles Times

- Making billionaires illegal by taxing their wealth wouldn’t even fund the government for a year, budget expert says Fortune

- California’s hatred for capitalism is killing the goose that laid its golden egg Fox News

- The Proposed California Wealth Tax Is Far Higher than 5 Percent Tax Foundation

- Gavin Newsom Vows to Stop Proposed Billionaire Tax in California The New York Times

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

10 min

vs 11 min read

Condensed

96%

2,017 → 82 words

Want the full story? Read the original article

Read on Los Angeles Times