Bessent: US sticks to strong-dollar policy, no yen intervention planned

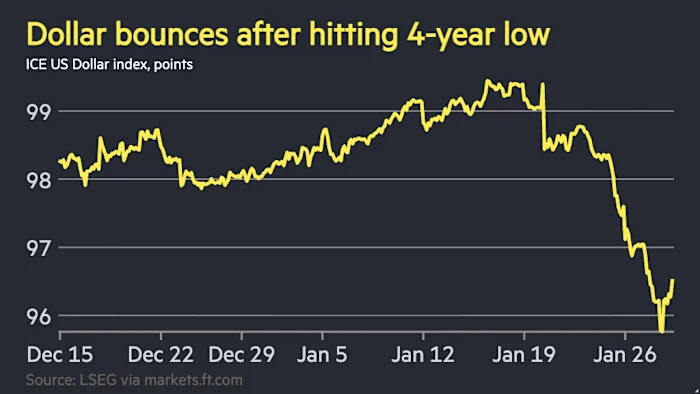

Scott Bessent said the Trump administration remains committed to a strong-dollar policy and is not intervening in dollar–yen markets, fueling a dollar rally as traders reassessed intervention risk; he argued that sound fundamentals and policy will attract capital and strengthen the dollar over time, while speculation of official FX action has been denied.