Toyota taps Kenta Kon CEO to navigate tariff headwinds and fierce EV rivalry

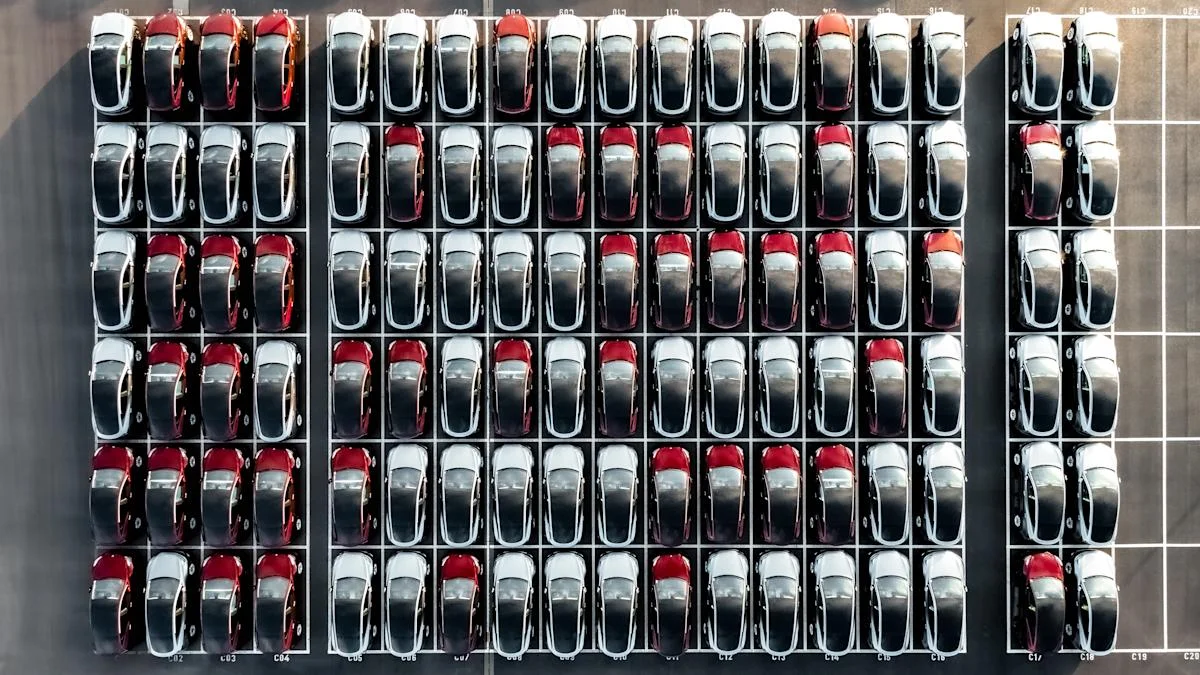

Toyota named CFO Kenta Kon its next chief executive, effective April 1, replacing Koji Sato who becomes vice chairman, as the company faces U.S. tariff pressures and rising Chinese competition while pursuing a software-driven strategy and a continued hybrid-and-EV mix; Sato will coordinate with government on supply chains and Akio Toyoda’s influence remains central, and the company lifted its full-year profit outlook.