"Finding the Best Savings Interest Rates: Your Ultimate Guide"

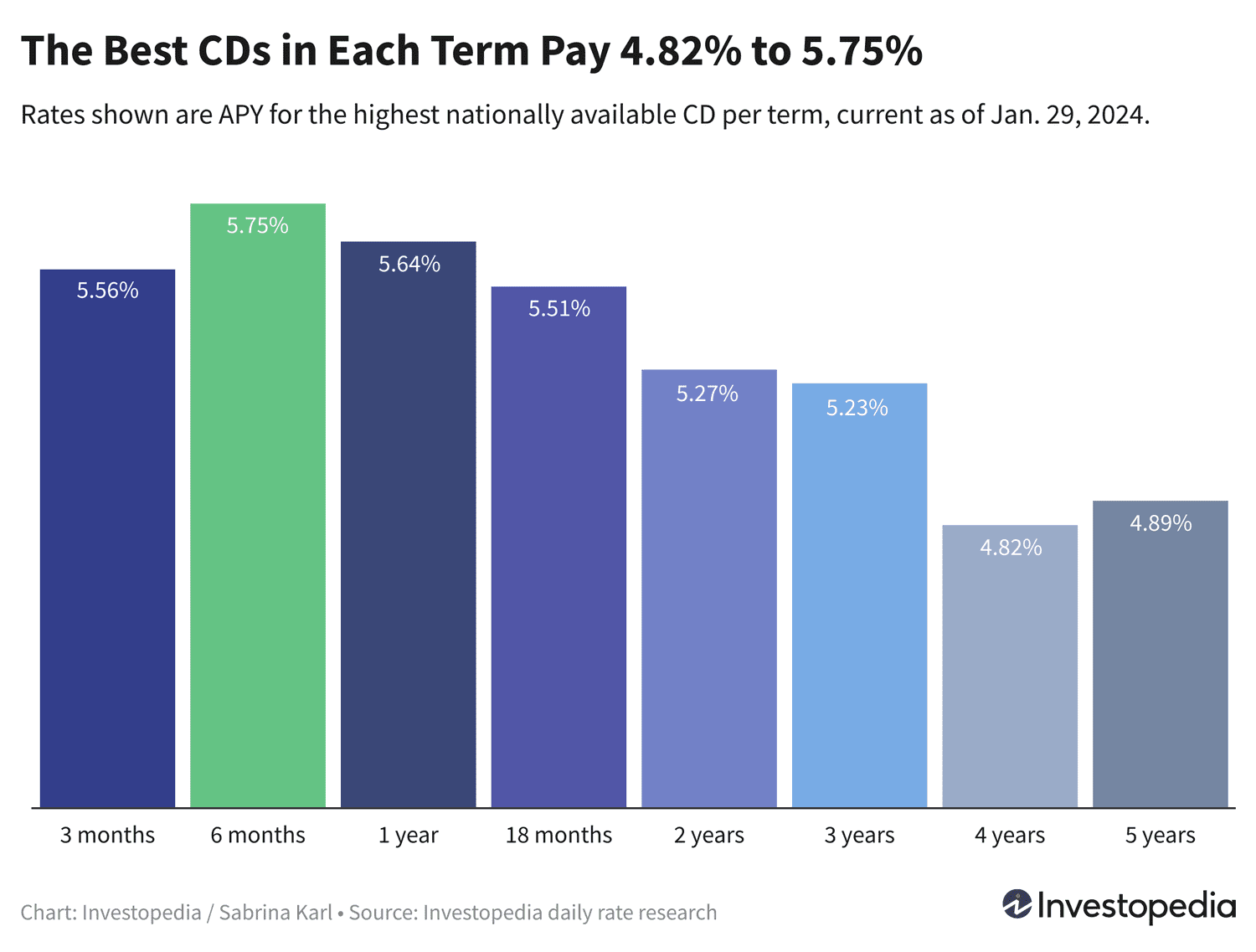

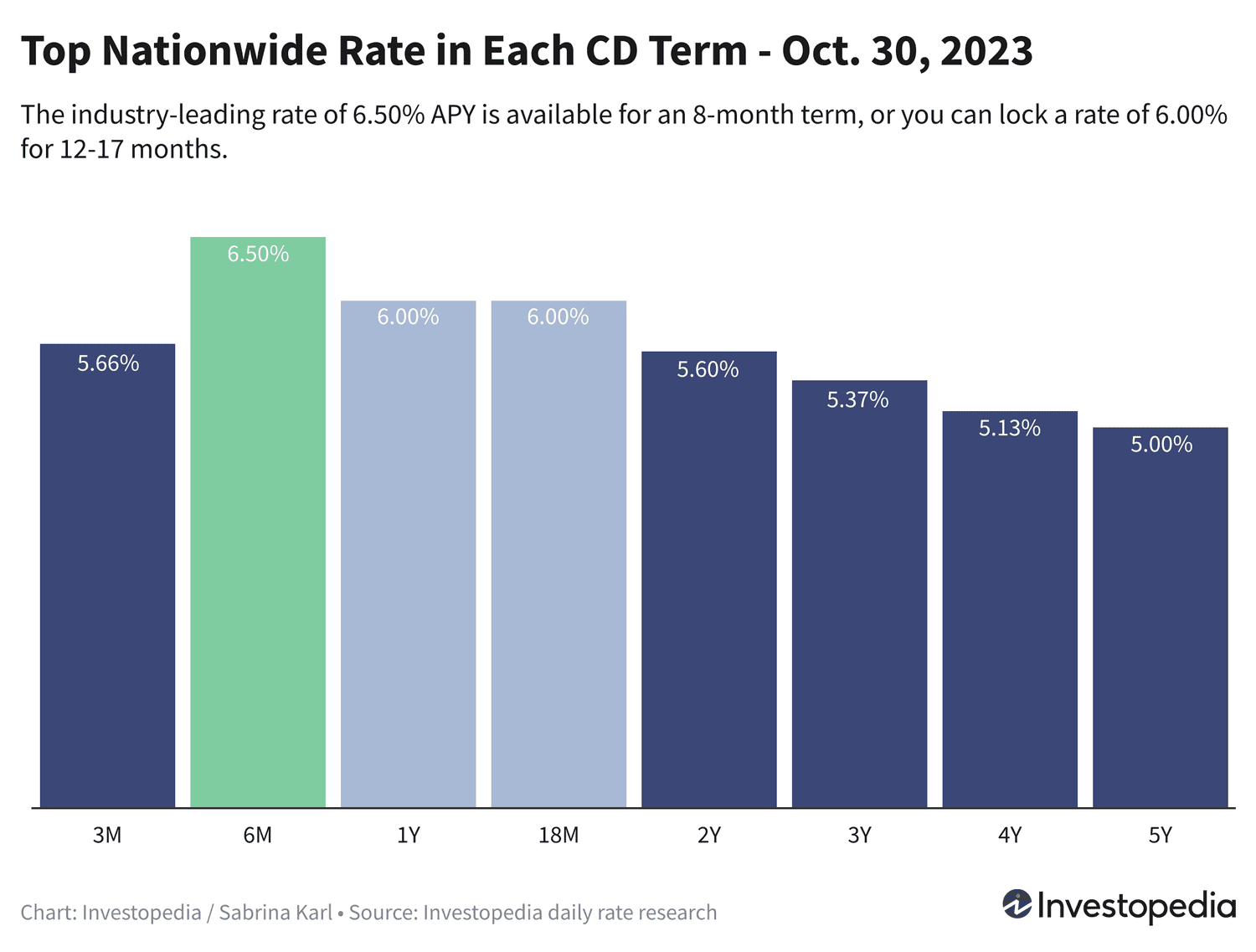

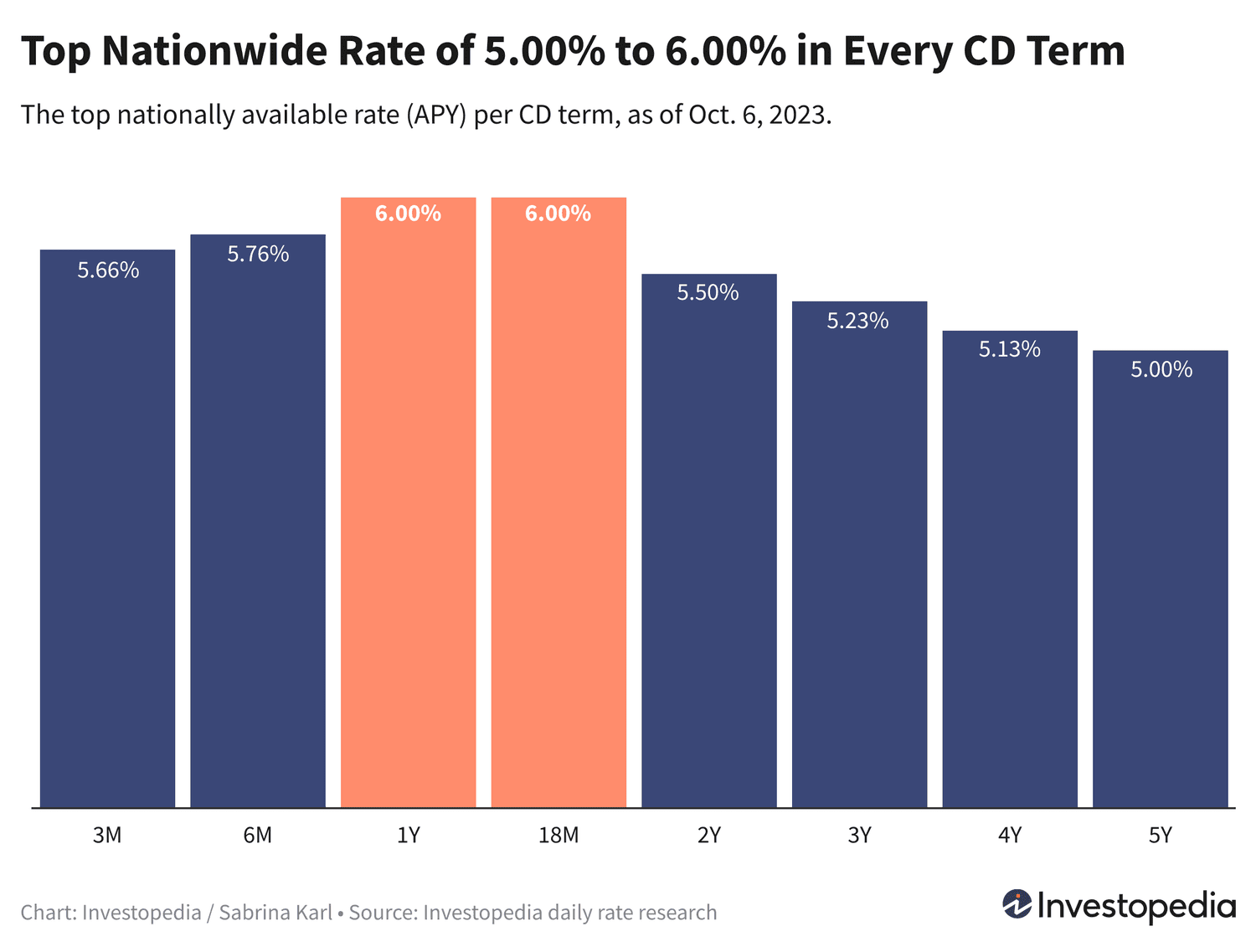

Online-only personal savings accounts offer the highest interest rates, beating traditional accounts and even one-year CDs, while credit union checking accounts have significantly higher rates and lower fees compared to regional banks. Credit unions also offer the best CD rates across all maturities, while business accounts are the most expensive and offer the lowest rates. Overall, electronic statements are recommended to save money, and students can benefit from checking accounts with the lowest fees.