Financetechnology News

The latest financetechnology stories, summarized by AI

Featured Financetechnology Stories

Nvidia Stock Dips, Market Value Falls Below $3 Trillion

Nvidia's stock fell below the $3 trillion valuation mark in early trading Thursday, after briefly surpassing it the previous day. Despite a significant rally driven by AI enthusiasm and strong financial performance, Nvidia faces growing competition from AMD, Intel, and its own customers like Amazon, Google, and Microsoft. The company announced a 10-for-1 stock split and increased its dividend, while also planning to release new high-powered AI chips in the coming years.

More Top Stories

"Stablecoins: A Growing National Security Concern"

NFX•1 year ago

"AI Stocks: Hidden Gems and Market Risks to Watch"

The Motley Fool•1 year ago

More Financetechnology Stories

SEC Approves Ether ETFs Amid Security Concerns and Market Volatility

Experts warn that the newly approved U.S. spot Ethereum ETFs could pose significant security risks if staking is introduced, due to potential centralization and concentration of power among a few custodians. This could expose the Ethereum network to operational risks and malicious collusion, as seen with the centralization concerns around liquid staking provider Lido. The SEC's stance on staking as a securities service has led to its exclusion from ETF applications, but without guidelines to mitigate these risks, the potential for validator concentration remains a serious concern.

"Fintech Bankruptcy Fallout: Millions of Depositors at Risk as User Deposits Frozen"

Fintech startup Synapse's bankruptcy has left millions of Americans without access to their funds, as the company's disputes with banking partners led to a technology system shutdown, affecting users of various fintech services. Customers, including a Maryland teacher with nearly $38,000 locked in a crypto app, are pleading for help in a California bankruptcy court, highlighting the vulnerabilities in the banking as a service partnership model and the lack of regulatory oversight. Regulators have yet to intervene, leaving impacted customers in a precarious situation.

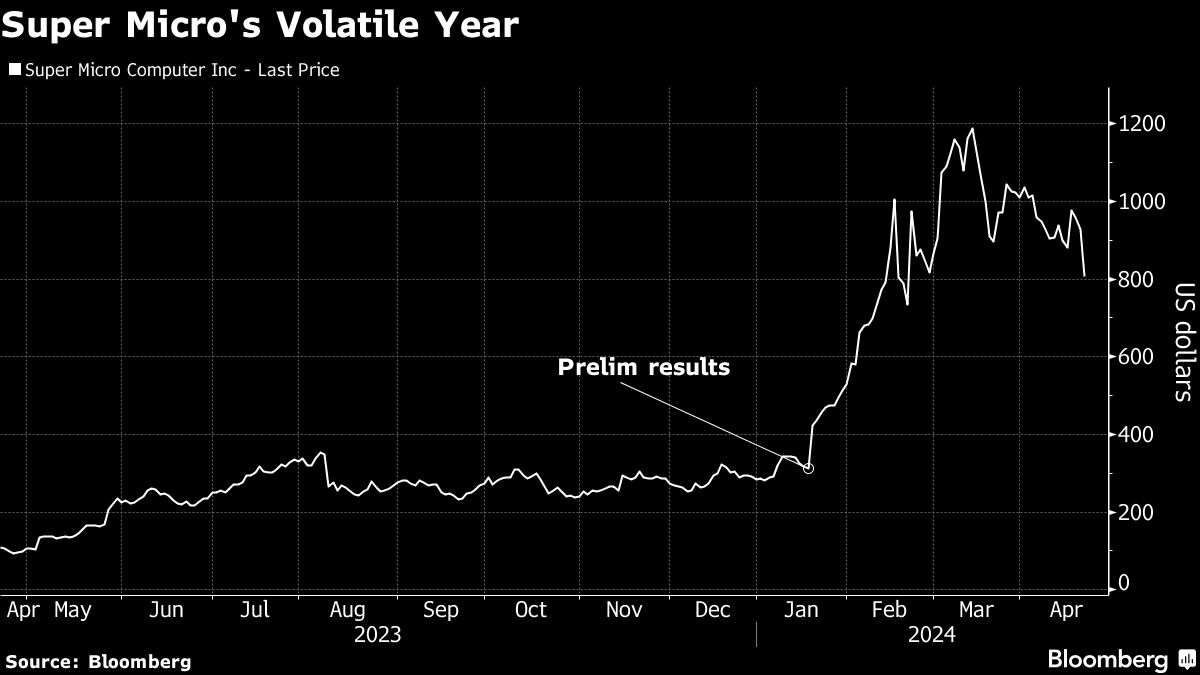

"Super Micro Computer's Stock Plummets Amid Earnings Worries"

Super Micro Computer Inc. shares experienced a significant drop, reaching a near two-month low, after the company announced the date of its third-quarter results without providing a pre-announcement of its earnings. This lack of positive preannouncement, combined with concerns about an important AI datapoint, led to a 15% decline in the stock, its largest one-day drop since February. The broader tech sector also saw declines, with Nvidia Corp and Dell Technologies Inc among the companies experiencing stock price decreases.

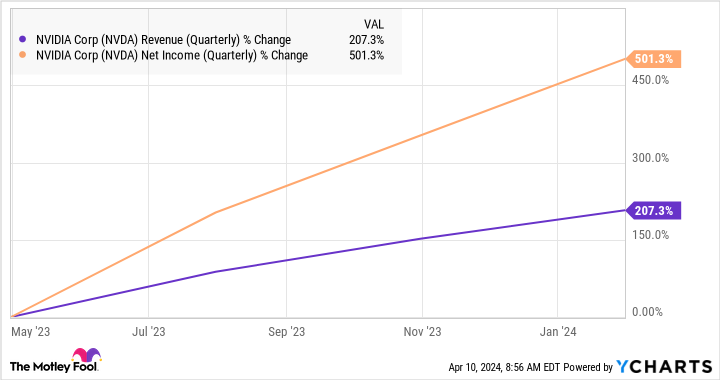

"Unmissable AI Stock Opportunities: Investing in the Future with NVIDIA and Microsoft"

Despite concerns of a potential bubble, Nvidia's remarkable growth in the AI market is backed by substantial revenue and earnings. The company's chips are crucial for driving productivity gains across various industries, and its monopoly-like position in the AI chip market is expected to continue. With the U.S. government's grant to TSMC for building a 2nm chip plant, Nvidia is anticipated to release even more powerful AI graphics cards, leading to significant growth in data center revenue. Analysts expect Nvidia's earnings to increase at an annual rate of 35% for the next five years, potentially driving the stock price to $1,569, an 85% increase from current levels.

"Next $1 Trillion Club Contender: The Unstoppable Stock"

Super Micro Computer, a specialist in AI hardware, is positioned to potentially join the trillion-dollar club alongside tech giants like Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta. With its expertise in creating AI-centric servers and strong partnerships with chipmakers, the company has experienced significant revenue growth and is forecasted to continue its triple-digit growth. While reaching a trillion-dollar market cap will require sustained growth and strong demand for AI-centric servers, analysts believe that Super Micro Computer has the potential to achieve this milestone by 2031 or 2035.

"TSMC's $6.6 Billion U.S. Subsidy Sparks Chipmaking Expansion"

The Biden administration announced a $6.6 billion subsidy for Taiwan Semiconductor Manufacturing Company (TSMC) to support its $65 billion investment in building three chip fabrication plants in Arizona. While the subsidy will reduce a significant fixed cost for TSMC and allow for geographic diversification, it is unlikely to greatly affect the stock. TSMC remains the leading third-party chip fab company and is expected to produce strong returns for investors regardless of where it produces its semiconductors.

"Amazon Surges to All-Time High, Analysts Bullish on Stock Ahead of Earnings"

Amazon's shares reached a record high, joining other tech giants in a post-pandemic rebound, after a period of struggle due to cooling online shopping demand and rising costs. The company's efforts to cut costs and restructure its business have boosted profits and won over investors, with analysts expressing confidence in its retail business and upcoming first-quarter earnings release.

"Tech Rally: Amazon Stock Hits All-Time High Alongside Meta and Nvidia"

Amazon's stock reached a new high, joining Meta Platforms, Microsoft, and Nvidia in a tech rally, as it rose 1.9% to $189.41, surpassing its previous intraday high set in July 2021, marking the last of the five biggest US tech firms to reach an all-time high in the post-pandemic rebound.

"Jamie Dimon: AI's Potential Impact Comparable to Historical Technological Advancements"

JPMorgan Chase CEO Jamie Dimon emphasized the significance of artificial intelligence in his annual shareholder letter, comparing its potential impact to that of the steam engine and stating that it could "augment virtually every job." The bank has identified over 400 use cases for AI across various areas, amassed a team of AI experts and data scientists, and is exploring the deployment of generative AI.

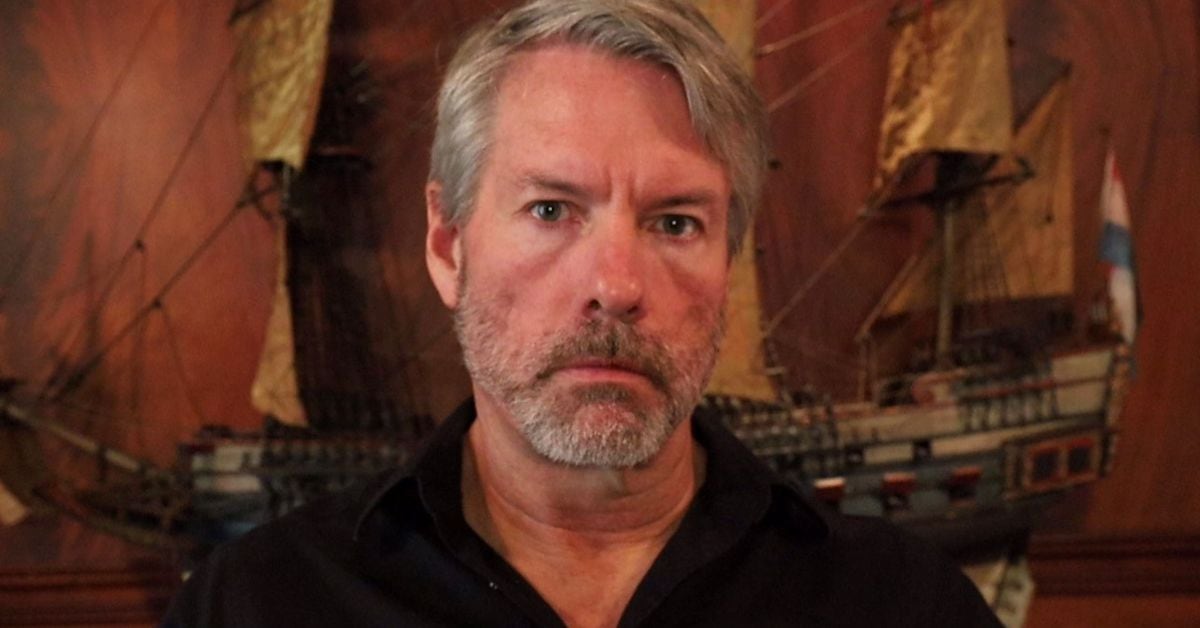

"Bitcoin Halving Boosts MicroStrategy Stock: Analysts Predict Rally to $1,800"

Benchmark raised its price target for MicroStrategy to $1,875 from $990, citing the company's potential to benefit from the upcoming bitcoin halving and its unique business model based on acquiring and holding bitcoin. The report also raised its bitcoin 2025 year-end price forecast to $150,000 and expects MicroStrategy to continue adding to its bitcoin stash using proceeds from capital markets transactions and excess cash generated by its enterprise software business.