FICO's Direct Licensing Boosts Stock, Bypassing Credit Bureaus

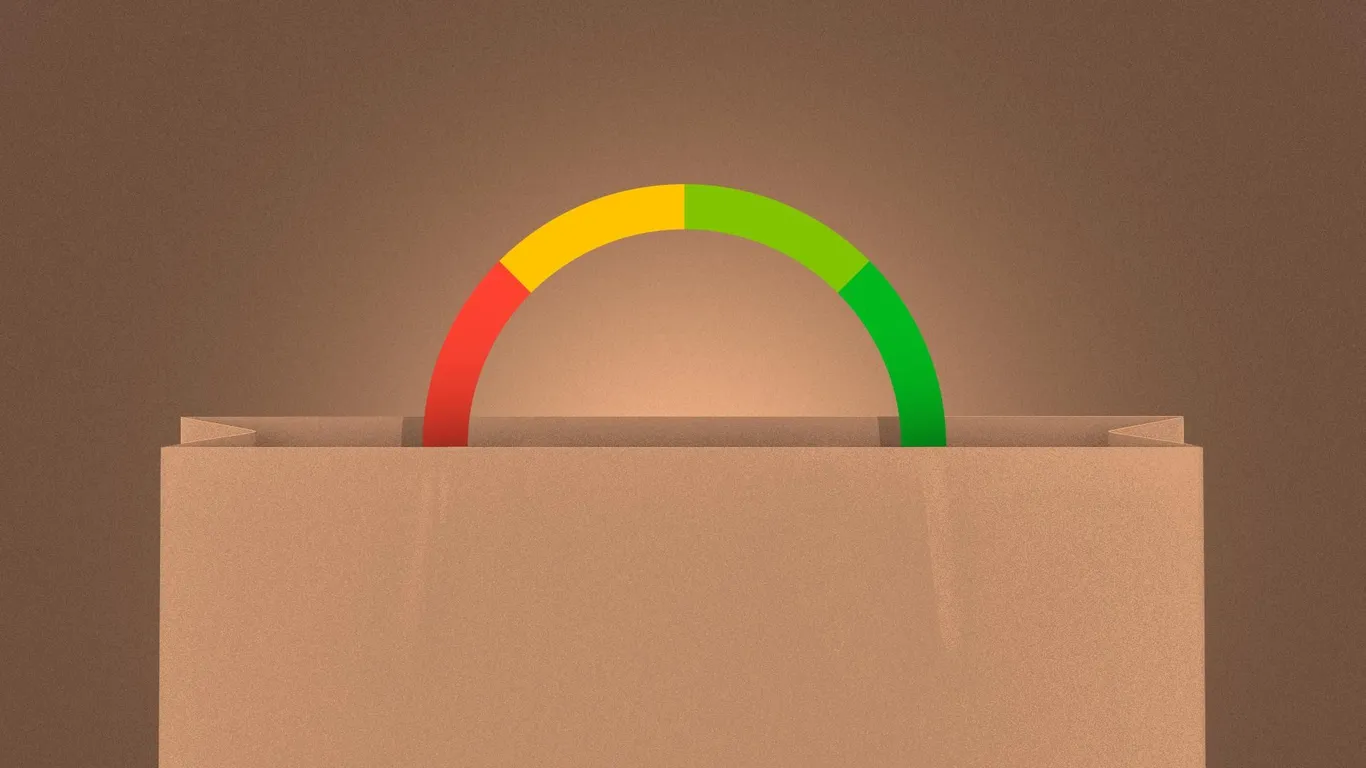

FICO's announcement to provide its credit scores directly to mortgage industry players led to a 15% surge in its stock, while shares of credit bureaus like Equifax dropped significantly, reflecting a shift towards more direct and transparent credit scoring processes in the mortgage sector.