Buy Now, Pay Later Loans to Start Affecting Credit Scores

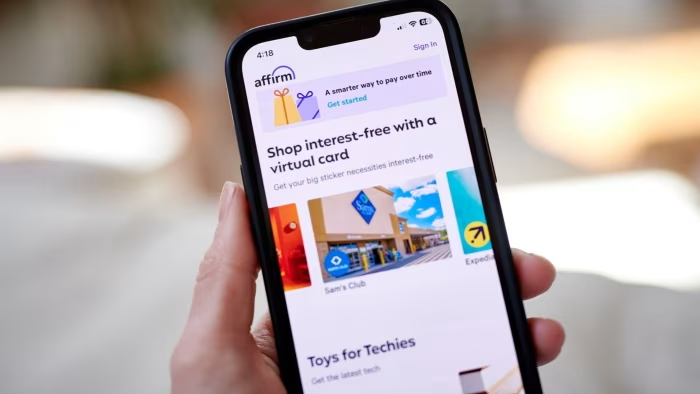

FICO is launching a new credit scoring model that will incorporate Buy Now, Pay Later loans, potentially affecting the credit scores of millions of Americans by providing a more accurate assessment of their creditworthiness, especially for younger and less established borrowers. However, adoption may be slow due to inconsistent data sharing among BNPL providers and credit bureaus, and concerns remain about the impact on vulnerable communities.