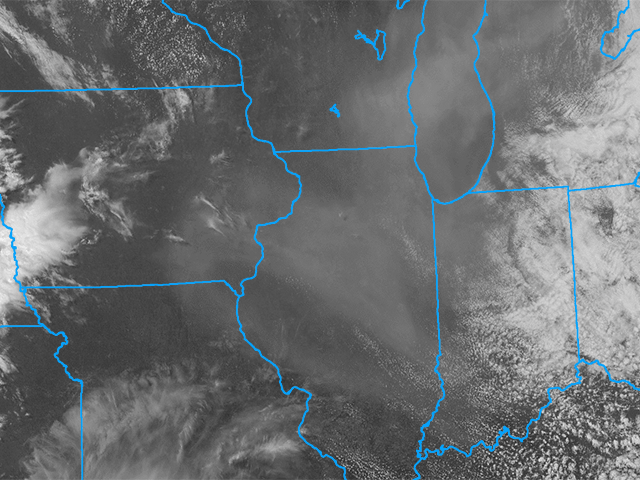

'Corn Sweat' to Amplify Midwest Heat Wave This Week

Corn fields in Michigan contribute to local heat and humidity through evapotranspiration, making temperatures feel up to 15 degrees hotter and creating microclimates, although the impact is less severe than in states with larger corn acreage. The upcoming heatwave will push temperatures into the upper 90s and low 100s.