"Federal Reserve Officials Prepare for Escalating Inflation"

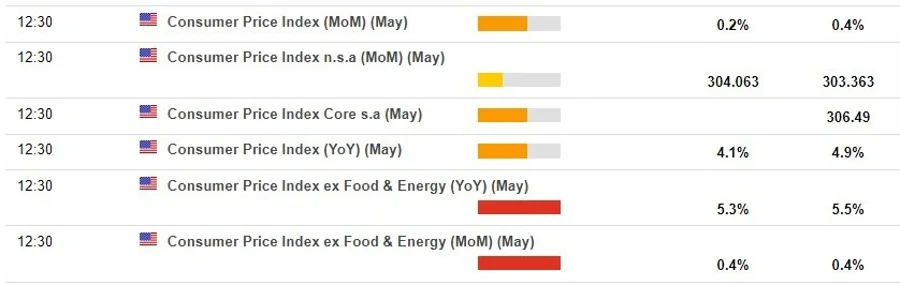

Federal Reserve minutes from the March meeting revealed that all 19 officials were concerned about worsening inflation, with some disputing the idea that the high prices were one-time increases. Recent government data confirmed these concerns, showing consumer inflation rising at a pace faster than the Fed's target level for a third consecutive month. This has raised fears that inflation is stuck above the 2% target, making it less likely for the Fed to implement projected rate cuts.