Fed's Rate Pause Bolsters Case for Cooling Inflation and Rallying Stocks.

TL;DR Summary

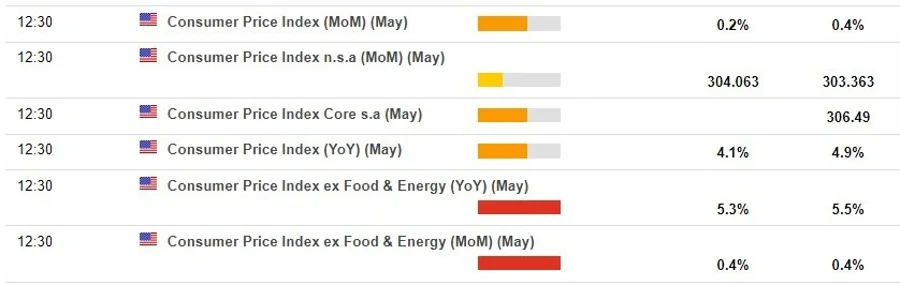

The US core CPI prices are expected to have risen by 0.4% in May, in line with continued strength in the labor market that will have worked to support demand, implying an acceleration in the Fed's preferred sub-category of services ex. housing. However, if core prices were to accelerate to 0.5% in May, policymakers would be compelled to hike rates in June. The data is due at 8.30am user, which is 1230 GMT.

- US CPI preview: 'A hotter advance in categories outside of energy and food' ForexLive

- Fed poised for respite on rate hikes. Now the hurt begins. POLITICO

- CPI preview: Inflation expected to have cooled further in May ahead of Fed decision Yahoo Finance

- 3 Stocks to Rally if the Fed is Done Raising Rates Zacks Investment Research

- Fed Backs Away From Wages Focus, Bolstering Case for Rate Pause Forex Factory

Reading Insights

Total Reads

0

Unique Readers

5

Time Saved

1 min

vs 1 min read

Condensed

64%

201 → 73 words

Want the full story? Read the original article

Read on ForexLive