"Federal Reserve Closes $161 Billion Arbitrage Opportunity for Banks"

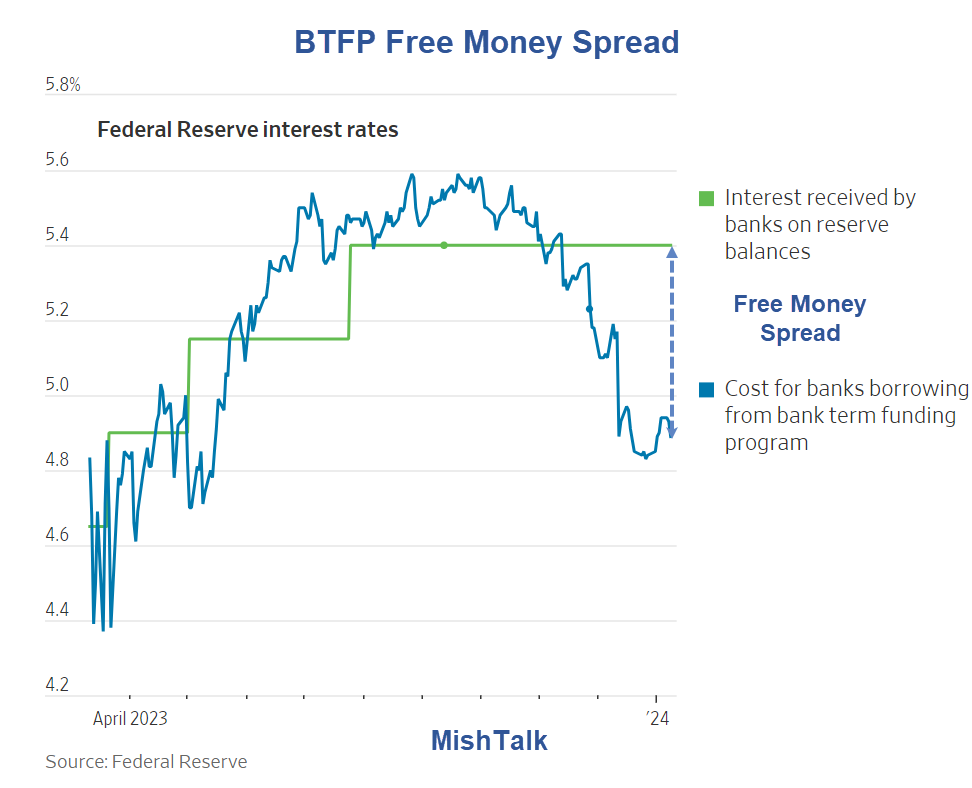

The Federal Reserve is ending its Bank Term Funding Program, which had provided an opportunity for banks to profit from arbitrage. The program, set up during last spring’s regional banking crisis, will conclude on March 11, and new loans made before then will be at no lower than the interest rate on reserve balances. The decision comes as the program's usage reached $161.5 billion, prompting questions about its impact on regional bank stock prices and potential market sentiment.