"Banks Exploit Fed's Rescue Program for Easy Profits"

TL;DR Summary

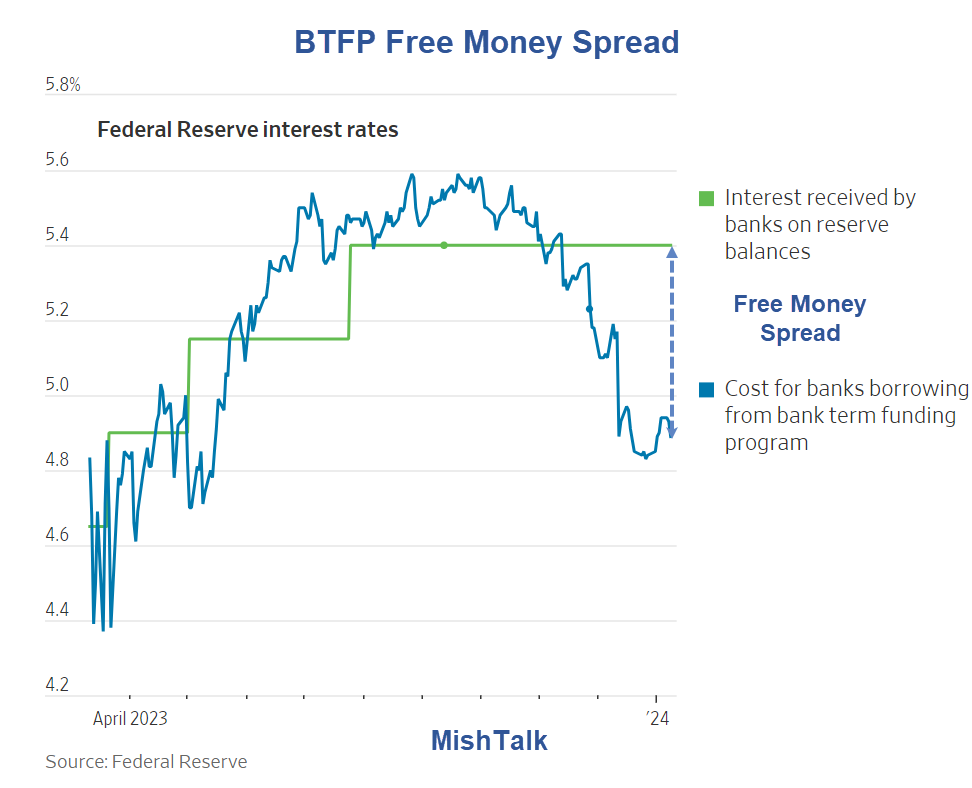

Banks are taking advantage of the Fed's Bank Term Funding Program (BTFP) by borrowing at a rate tied to future interest-rate expectations and then earning from parking the funds at the central bank as overnight deposits. The program, set to expire on March 11, has seen increased usage as investors forecast multiple Fed rate cuts. Despite some analysts attributing the increase to stress on regional banks, it's actually banks seizing the opportunity for free money. In other news, the US debt has surpassed $34 trillion, with interest exceeding $1 trillion, and a spending deal has been reached, though it does not address border funding.

- Banks Take Advantage of a Free Money Arbitrage Opportunity Offered by the Fed Mish Talk

- The Fed Launched a Bank Rescue Program Last Year. Now, Banks Are Gaming It. The Wall Street Journal

- Are banks now gaming the Fed’s rescue program? Greater Baton Rouge Business Report

- Fed Tool Raises Small-Bank Profits, Yet Risks Remain Bloomberg

- Fed's Emergency Lending Program Providing Banks 'Easy Money' PYMNTS.com

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

2 min

vs 3 min read

Condensed

76%

442 → 104 words

Want the full story? Read the original article

Read on Mish Talk