Regulators Advocate Stricter Rules for Banks' Liquidity and Discount Window Usage

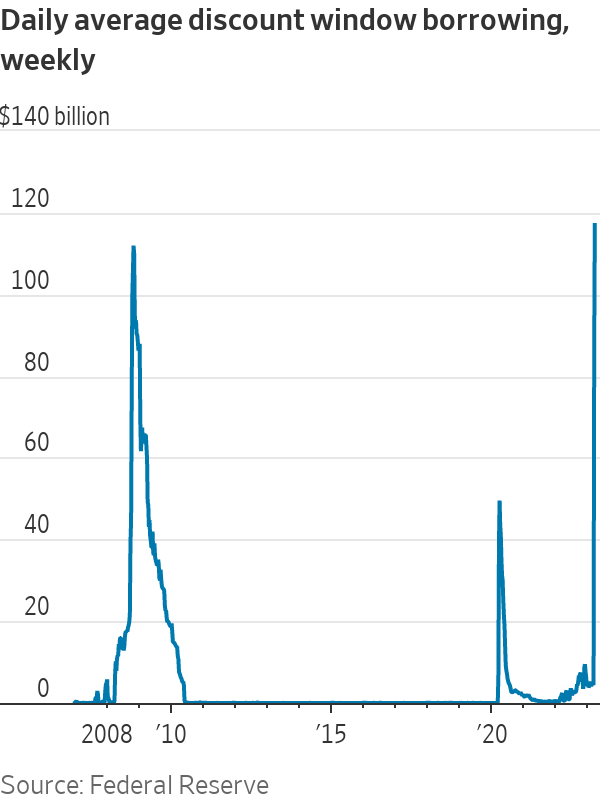

US regulators are working on a plan to mandate that banks access the Federal Reserve's discount window at least once a year to reduce stigma and ensure preparedness for financial crises, following last year's regional-bank turmoil that revealed some lenders were not operationally ready to borrow from the window in times of need.