Finance And Economy News

The latest finance and economy stories, summarized by AI

Featured Finance And Economy Stories

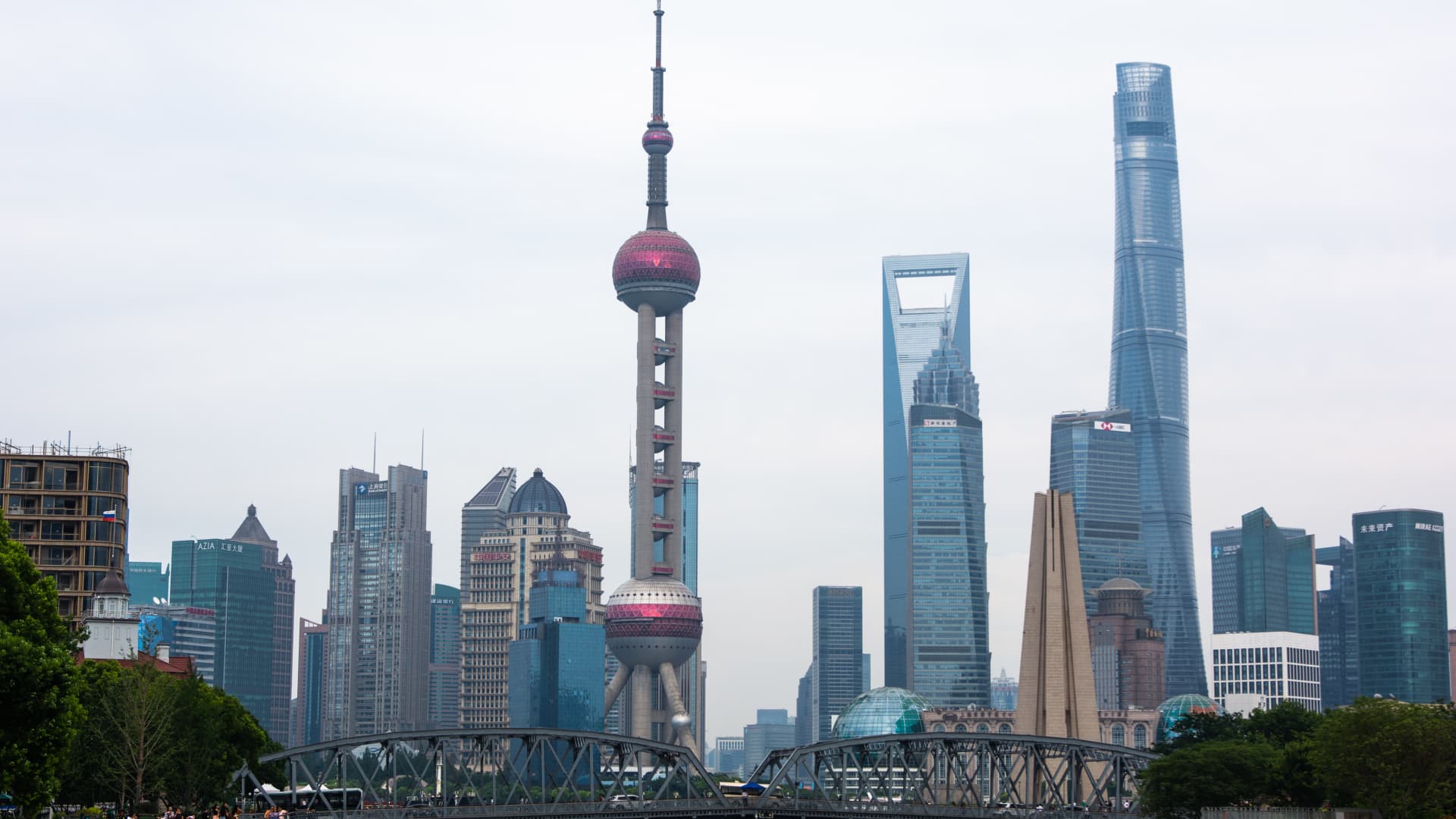

"Asia-Pacific Markets Closed for Holiday, Japan and China Stocks Rise"

Japan and China stocks rose while most Asia-Pacific markets were closed for a holiday. Japan's Nikkei 225 index gained 0.5% and the broader Topix rose 0.65%, while China's CSI 300 index closed 0.47% higher. Japan's finance minister stated that the government will not rule out any measures in response to volatility in the yen, which recently hit 34-year lows against the U.S. dollar. Additionally, overall consumer price index for Tokyo rose 2.6% in March, and South Korea's retail sales dropped in February while industrial production rose. The S&P 500 and Dow Jones Industrial Average closed at record highs, and oil prices rose on strong demand and lower supply.

More Top Stories

More Finance And Economy Stories

Asian Stocks React to Mixed Market Conditions and Tech Sector Volatility

Asia-Pacific markets traded mixed with Hong Kong's Hang Seng index jumping 1.86% while Japan's Nikkei 225 lost 0.26% as business sentiment among large manufacturers soured. Japan's exports rose 11.9% in January, beating estimates, but the country posted a trade deficit of 1.758 trillion yen. Australia's annual wages rose at the fastest pace in 15 years, and U.S. crude oil futures pulled back after hitting a three-month high due to the conflict in the Middle East. HSBC reported a 78% jump in pre-tax annual profit, missing market estimates, and its Hong Kong shares dipped more than 2%.

"Nikkei Approaches Record High as Asian Markets Rally"

Japan's Nikkei 225 approaches all-time high, with Hong Kong leading gains in Asia; Singapore's non-oil domestic exports rise in January; Coinbase shares surge after posting first quarterly profit in 2 years; Japan's finance minister monitors yen's moves with urgency; Beijing urged to provide clear signals for aggressive policy easing to support growth downturn.

"Tech-Led U.S. Exceptionalism: The Key to High Oil Prices and Big Tech Rally"

The U.S. economy continues to outperform other G7 economies, largely due to its strong technology sector, with chipmaking giant Nvidia leading the way. Despite concerns about inflation, Wall St stocks rallied, and Thursday's economic health checks will provide the next juncture. Japan slipped into recession, while Britain's economy also contracted, putting pressure on their central banks to ease interest rates. The U.S. interest rate picture softened as more dovish Federal Reserve officials suggested potential rate cuts, while the European Central Bank boss cautioned against cutting rates too early.

"Japan's Recession Sparks Market Rebound in Asia"

Japan and Singapore both missed GDP expectations, with Japan entering a technical recession as its GDP contracted for a second straight quarter, causing it to lose its spot as the world's third-largest economy to Germany. Asia-Pacific markets rebounded after Wednesday's sell-off, and Indonesian markets rallied after Prabowo's presumed electoral win. Rakuten shares spiked more than 15% after posting a smaller annual loss, while Renesas shares fell after announcing a $5.9 billion deal to buy Altium. Additionally, Australia posted sharply lower-than-expected employment growth, and Japan's fourth-quarter GDP showed a surprise contraction.

"2024 Market Insights: A Snapshot of Economic Trends and Investor Perspectives"

The Yahoo Finance Chartbook for the start of 2024 highlights a surge in stocks to record highs, moderated inflation, and the potential for interest rate cuts by the Federal Reserve. The US economy and corporate America are proving resilient, with optimism reflected in recent market action. Concerns remain about consumer spending, wage gains, and household debt balances, as well as uncertainty surrounding Fed rate cuts and the upcoming November election. The Chartbook features commentary from Wall Street's top strategists on topics such as inflation, stock market reset, economic forces staving off recession, and the significance of Treasury yields for stocks.

"Alibaba's Stock Surge Boosts Hong Kong Market Amid Mixed Asia Markets"

Hong Kong's Hang Seng index surged almost 2% powered by tech stocks, with Alibaba jumping 6% after founder Jack Ma reportedly bought $50 million of its shares. Meanwhile, Asia-Pacific markets mostly fell, with Japan's exports beating expectations and recording a trade surplus, and New Zealand's inflation rate hitting its lowest level since June 2021. In the oil market, prices remained flat as traders tried to decipher mixed signals in the Middle East and threats to crude supplies.

"Asia Markets React to China's Export Decline: Tokyo Extends Record Rally Amid Mixed Stock Performance"

Asia markets fell as China's annual exports dropped for the first time in seven years, but Japan stocks extended their record rally. China's consumer price index fell less than expected, while its exports for December beat expectations, but overall trade declined in 2023. The Bank of Japan is unlikely to shift its ultra-loose monetary policy soon, with a portfolio manager arguing against a policy unwind. Oil prices rose after U.S. and U.K. strikes on Houthi rebels in Yemen, and shares of Uniqlo's parent company spiked after better than expected first quarter results. Additionally, Goldman Sachs highlighted opportunities in Asian tech stocks, and the Federal Reserve remains ready to cut interest rates despite higher inflation.

"2024's Turbulent Market Debut: A Weak Start Not Predicting the Full Year's Course"

Despite a weak start to 2024 with the S&P 500 dropping 1.5%, historical data suggests that short-term declines don't necessarily predict a bad year for stocks. Market history shows that average annual dips are common, and positive returns often follow strong years, like the 24% surge in 2023. Recent economic data indicates a "Goldilocks" scenario with a soft landing, as inflation cools without leading to a recession. Job growth remains strong, wage growth is cooling, and consumer spending is steady. While the Federal Reserve's tight monetary policy poses challenges, the stock market's long-term outlook remains positive, with the understanding that volatility is a normal part of investing.

"Unprecedented U.S. Money Supply Shift Echoes Great Depression, Signals Major Stock Market Activity"

The U.S. M2 money supply has experienced a notable decline for the first time since the Great Depression, dropping over 4% from its mid-2022 peak. Historically, such declines have often preceded economic downturns and increased unemployment. Additionally, commercial bank credit has also decreased, suggesting tighter lending standards and potential impacts on corporate earnings. While these indicators may signal a challenging year ahead for investors, historical data emphasizes the benefits of a long-term, optimistic investment approach, with the average bull market outlasting bear markets and 100% of 20-year rolling periods in the S&P 500 yielding positive returns.

"2023 Student Loan Payments May Qualify for $2,500 Tax Deduction"

Borrowers who resumed student loan payments in 2023 can potentially deduct up to $2,500 of paid interest on their federal tax return without itemizing. Eligibility for the deduction is subject to income limits, loan ownership, payment responsibility, and dependency status. For 2023, phase-outs begin at a modified adjusted gross income of $75,000 for single filers and $155,000 for joint filers. The deduction is available for interest on federal and private loans, origination fees, capitalized interest, and revolving lines of credit used for education expenses. However, interest paid by employers or from tax-free tuition plans cannot be deducted. While federal student loan forgiveness is not federally taxed, some states may tax this forgiveness.