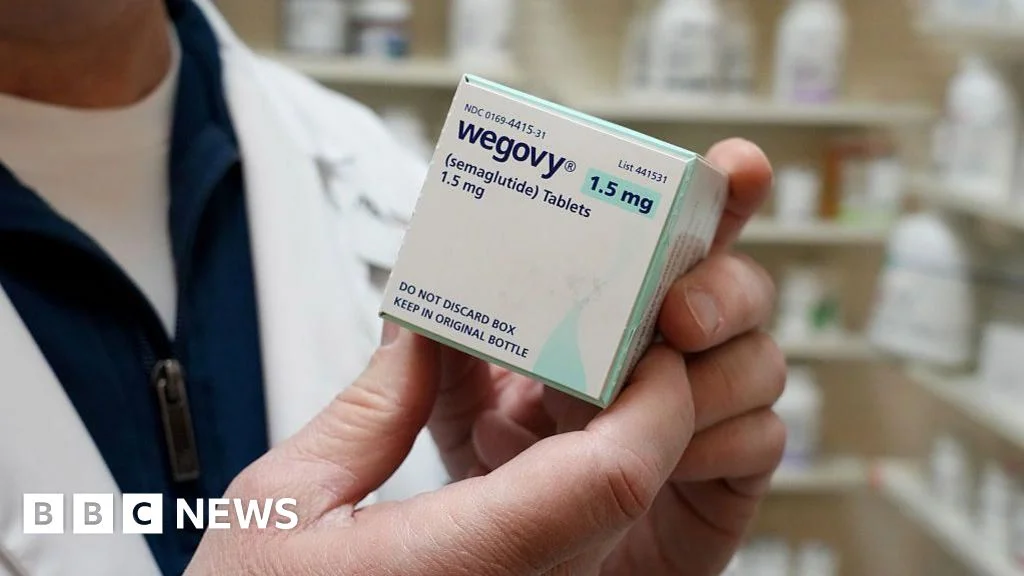

Mounjaro access in England still a postcode lottery, patient says

Brian Kinsella, who has privately used Mounjaro since December 2024, says he has lost more than 44.5 kg (seven stone) at up to £1,000 a year, highlighting uneven access as England’s NHS rolls out weight‑loss drugs. GPs are to receive £3,000 annually to prescribe these treatments, but since a limited NHS rollout began in June last year not all practices prescribe them. Kinsella expects the new incentives won’t help much due to workload and the system’s complexity, noting the requirement for two 85‑minute consultations, a 20‑minute follow‑up every four weeks, and a 60‑minute dietitian appointment. He calls the situation a “postcode lottery” and says a mechanism is needed to widen access to this drug.