Tax Trackers Impact Wealthy Americans' Holiday Plans

The article discusses how tax trackers influence the holiday plans of wealthy Americans, highlighting the impact of tax strategies on their travel and spending decisions during the holiday season.

All articles tagged with #wealthy americans

The article discusses how tax trackers influence the holiday plans of wealthy Americans, highlighting the impact of tax strategies on their travel and spending decisions during the holiday season.

Many affluent Americans underestimate key retirement risks like inflation and healthcare costs, which can significantly impact their financial security if not properly planned for, especially considering long-term care expenses and inflation's effect on expenses over time.

Wealthy Americans in the top 10% now account for nearly half of US consumer spending, supporting the economy amid a slowdown in hiring and rising debt issues among other income groups, but this reliance on the wealthy's spending could pose risks if their economic confidence wanes.

Wealthy Americans are investing record sums into private credit funds, indicating a growing interest in alternative investment opportunities.

The Trump administration's tax bill primarily benefits the wealthy, businesses, and certain industries like fossil fuels and defense, while imposing cuts on Medicaid, food stamps, and clean energy incentives, and increasing taxes on immigrants and elite universities, with some provisions expiring or phased out over time.

Wealthy Americans are increasingly opting to rent high-end apartments instead of buying homes due to high mortgage rates, record home prices, and attractive rental deals. The surge in apartment construction has led to numerous discounts and amenities, making renting a more appealing and cost-effective option for those with higher incomes. This trend is expected to continue until the current wave of apartment construction slows down around 2025-2026.

Wealthy Americans are increasingly seeking second passports through dual citizenship programs offered by countries like Portugal, Malta, Greece, and Italy as a hedge against potential "volatility and uncertainty." The law firm Henley & Partners has noted a surge in U.S. citizens pursuing this option, citing concerns about financial safety, business travel, and geopolitical risks. The trend reflects a broader global migration of millionaires seeking retirement options abroad, with the United States remaining a top destination for the wealthy despite an increase in millionaire migration to other countries.

A new report by Henley & Partners reveals that a growing number of wealthy Americans are considering relocating from the U.S., with motivations including mitigating political risk, seeking business opportunities abroad, lower taxes, and enhanced global mobility. The U.S. remains a top destination for millionaires, but the American wealthy are increasingly seeking backup citizenship and residence in other countries. Concerns such as antisemitism and homophobia have prompted some to move to countries like Portugal, Malta, Spain, Greece, and Italy. While the U.S. remains the top country for private wealth creation, the pandemic and domestic challenges have led to a decrease in the net inflow of millionaires, with countries like Australia, the United Arab Emirates, and Singapore becoming popular alternatives.

A consultancy reports that a record number of wealthy Americans are seeking residence rights abroad or additional citizenships, with Portugal's "golden visa" being the most popular option. This trend is attributed to the desire for an "ultimate insurance policy" against economic and political uncertainties, as well as the opportunity to mitigate political risk, create business opportunities abroad, and reduce taxes. The consultancy anticipates continued strong demand in 2024 as high-net-worth individuals seek to hedge uncertainty.

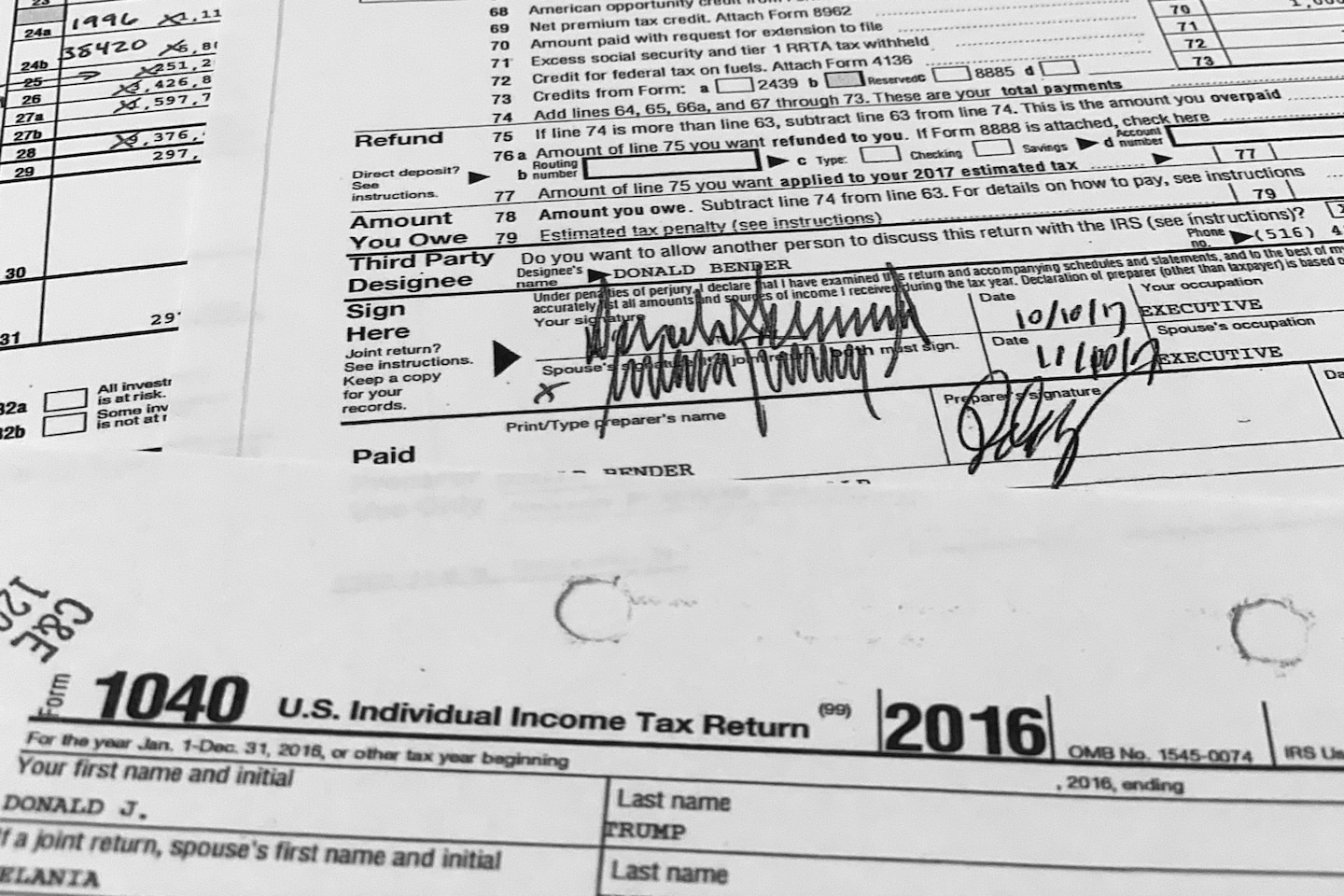

A former IRS contractor, Charles Edward Littlejohn, pleaded guilty to illegally accessing and leaking confidential tax returns, including those of former President Donald Trump, to news organizations such as the New York Times and ProPublica. Littlejohn admitted to obtaining thousands of individuals' tax returns from an IRS database and leaking them, leading to reports exposing how the wealthiest Americans, including Trump, employed strategies to minimize their federal tax bills. The leak sparked a debate on tax policy and income inequality. Littlejohn faces serious consequences for his actions, with sentencing scheduled for January 29. The Justice Department is investigating whether Littlejohn acted alone or in concert with others.

A consultant for the Internal Revenue Service (IRS) has been charged with stealing tax returns of former President Donald Trump and thousands of wealthy Americans in 2019 and 2020. The consultant allegedly provided the stolen information to two news organizations, which reported on the low federal income taxes paid by the super-rich. The charges mark the first public break in the Justice Department's investigation into the disclosures made three years ago. The leaks revealed that Trump paid only $750 in federal income taxes in 2016, sparking criticism and debate over tax laws and enforcement. The consultant, Charles Edward Littlejohn, faces up to five years in prison if convicted.

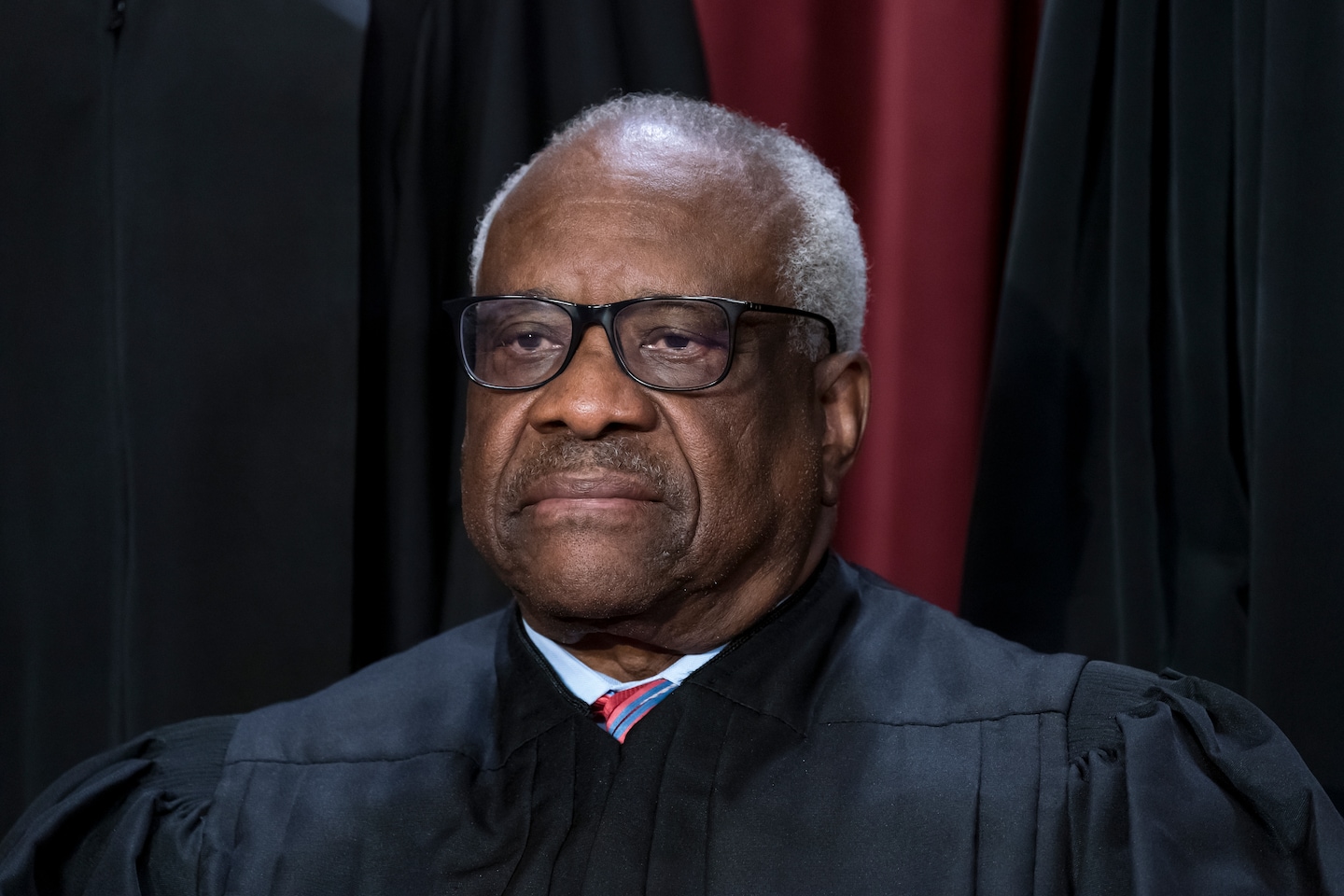

The Horatio Alger Association of Distinguished Americans, a nonprofit organization, has come under scrutiny after a New York Times report revealed Supreme Court Justice Clarence Thomas' long-standing membership and the benefits he has received. Thomas has referred to the organization as a "home" and credited it with helping his dreams come true.

Wealthy Americans who move from New York to Miami can save up to $200,000 a year due to lower taxes and a cheaper cost of living, according to a study by SmartAsset. The cost of living in Miami is 22.8% higher than the national average, compared to 137.6% higher in Manhattan. Florida does not have a statewide income tax, which is why wealthy New Yorkers pay some of the steepest taxes in the nation. The study comes as a growing number of Americans migrate from predominantly blue states with steep taxes to red states with lower taxes.

Wealthier Americans are experiencing a decline in wage growth and discretionary spending, with spending trends falling below those of lower- and middle-income groups. Bank of America Institute data shows that households making over $125,000 are seeing wage growth decline faster than any other income cohort. While unemployment remains low, unemployment benefit claims are rising the fastest in the highest income group. The slowing trends in spending fit in line with other economic data from previous months, and some economists predict that the US economy will slip into a recession in the second half of the year.

The IRS has unveiled its spending plan for the $80 billion funding boost, which includes hiring thousands of new workers to audit wealthy Americans and big corporations, modernizing technology, improving customer service, and cracking down on the tax gap. The agency plans to hire nearly 30,000 new employees by the end of fiscal year 2025, including 8,782 hires in enforcement and 13,883 in taxpayer services. The funding boost was included in the Democrats' Inflation Reduction Act, aimed at improving tax compliance among big corporations and wealthy Americans and shrinking the estimated $600 billion tax gap. The IRS plan repeatedly states that it will comply with Treasury Secretary Janet Yellen's order to not increase audit rates for Americans who earn less than $400,000 a year.