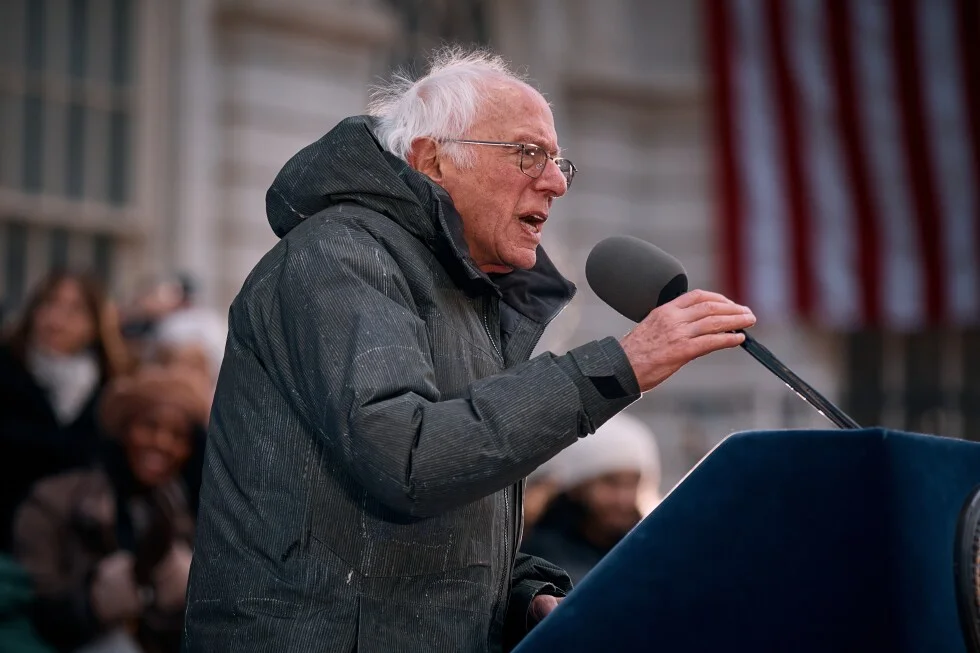

California billionaire wealth tax sparks intra-Democratic clash between Sanders and Newsom

A proposed one-time 5% wealth tax on the assets of billionaires to backfill federal health-care funding cuts is stirring a rift within California Democrats, with Bernie Sanders backing the measure and Gov. Gavin Newsom opposing it over concerns about state finances and competitiveness. Supporters push to qualify the measure for the November ballot amid intense fundraising and political campaigning as midterm dynamics unfold.