"Lessons for Regional Banks from SVB Collapse: A Year On"

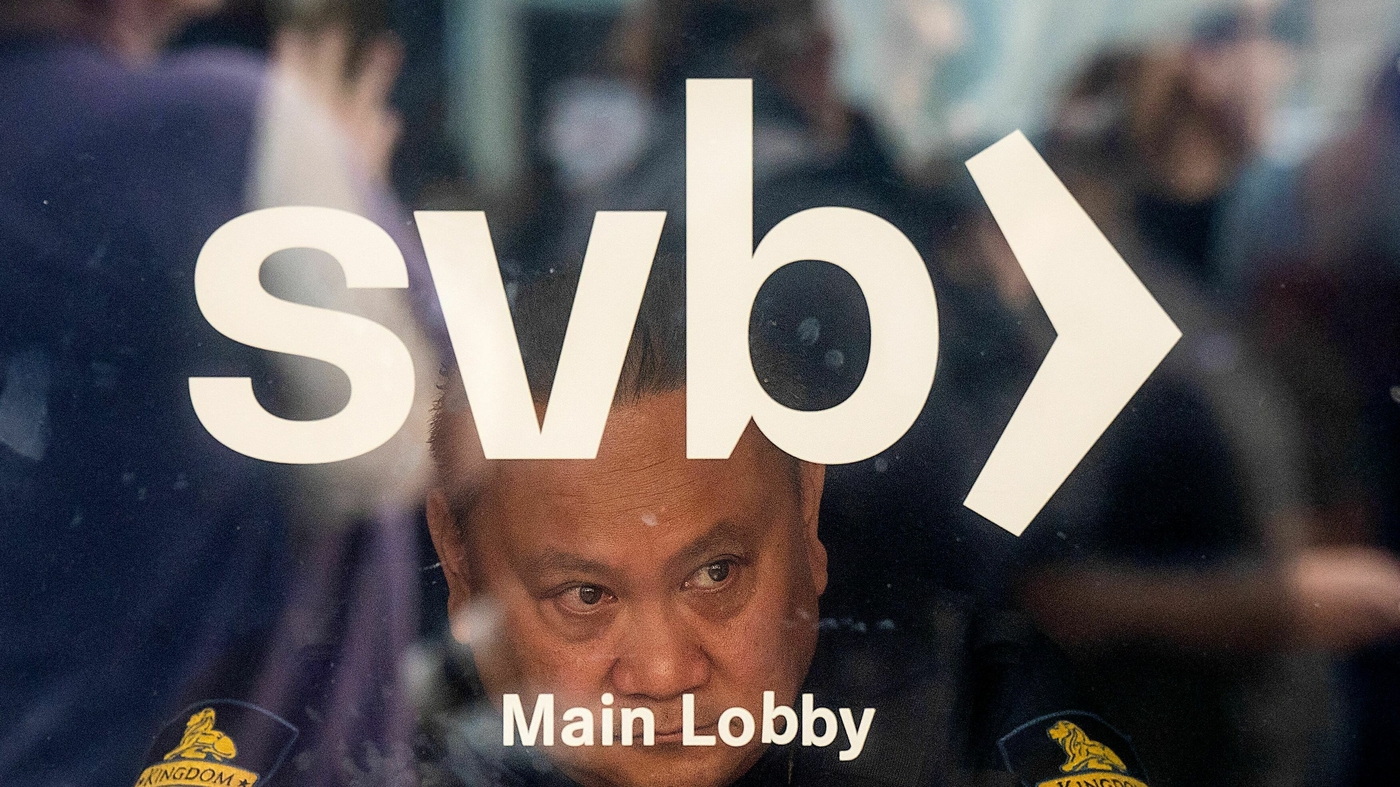

New York Community Bank (NYCB) is facing pressure as its shares continue to drop due to fourth-quarter losses and lack of faith in the regional banking system, with investors reflecting on the upcoming one-year anniversary of Silicon Valley Bank's collapse. Yale Program on Financial Stability's Steven Kelly discusses the lessons learned from the 2023 banking crisis and the differences between NYCB's situation and SVB, attributing fragilities to a higher interest rate environment and market differentiation between strong and weak banks.