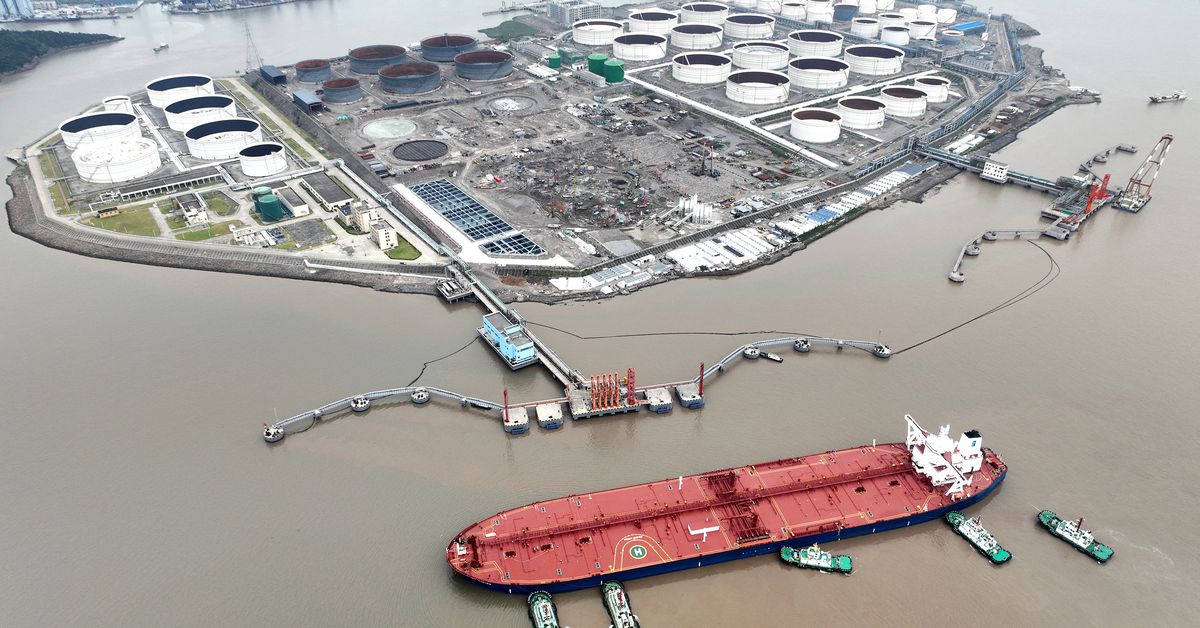

OPEC+ Likely to Announce Further Oil Output Increase Amid Market Uncertainty

OPEC+ has tentatively agreed to increase oil production in October by about 137,000 barrels per day, marking a shift from its previous strategy of defending prices to gaining market share, which could lead to the unwinding of 1.66 million barrels of production cuts by the end of 2024, despite ongoing market tensions and supply concerns.