Trump Leaks Jobs Data on Social Media Before Official Release

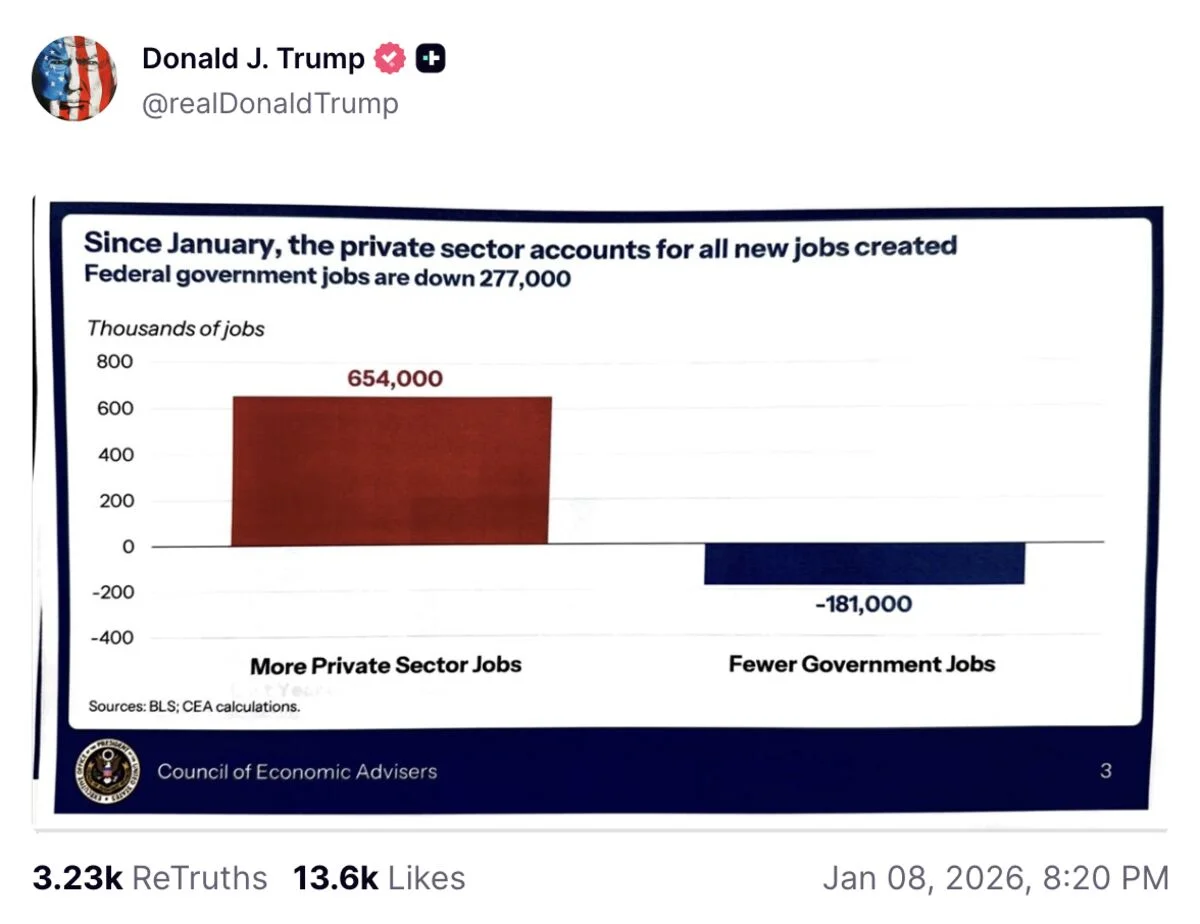

President Donald Trump posted a chart on social media with December employment figures before their official release, partially revealing pre-released data and raising concerns about protocol breaches and market influence. The White House acknowledged the inadvertent disclosure, prompting a review of release protocols, amid broader issues of data trust and politicization.