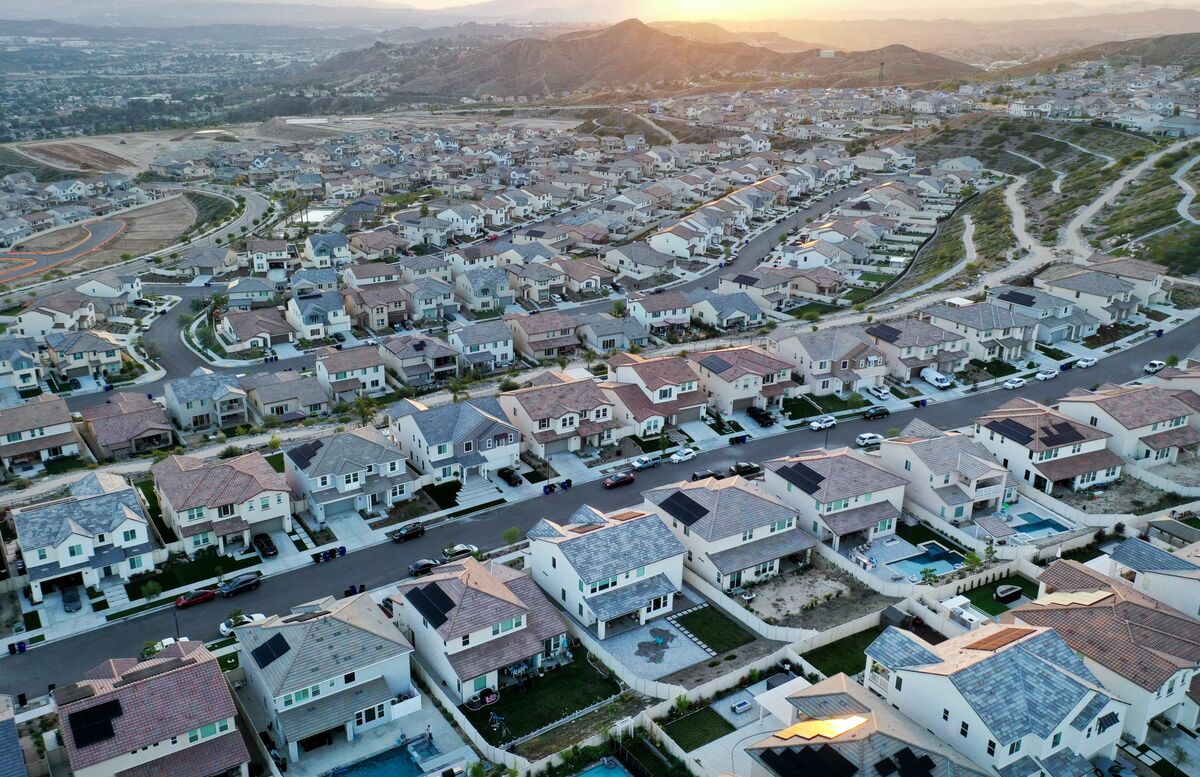

"California's Growing Insurance Crisis: Two More Property Insurers Exit Market"

Two more insurance companies, Tokio Marine America Insurance Co. and Trans Pacific Insurance Co., both owned by Tokio Marine Holdings Inc., are ending property insurance coverage in California, impacting over 12,500 policyholders. This adds to the growing list of insurers fleeing the state, leaving homeowners facing loss of coverage and surging premiums. California's insurance commissioner has called it "a real crisis," as seven of the 12 largest insurance groups in the state have either paused or restricted new homeowner policies in the past year.