Financeinsurance News

The latest financeinsurance stories, summarized by AI

Featured Financeinsurance Stories

"Rising Home Insurance Costs: Impact of Climate Change and Strategies to Lower Premiums"

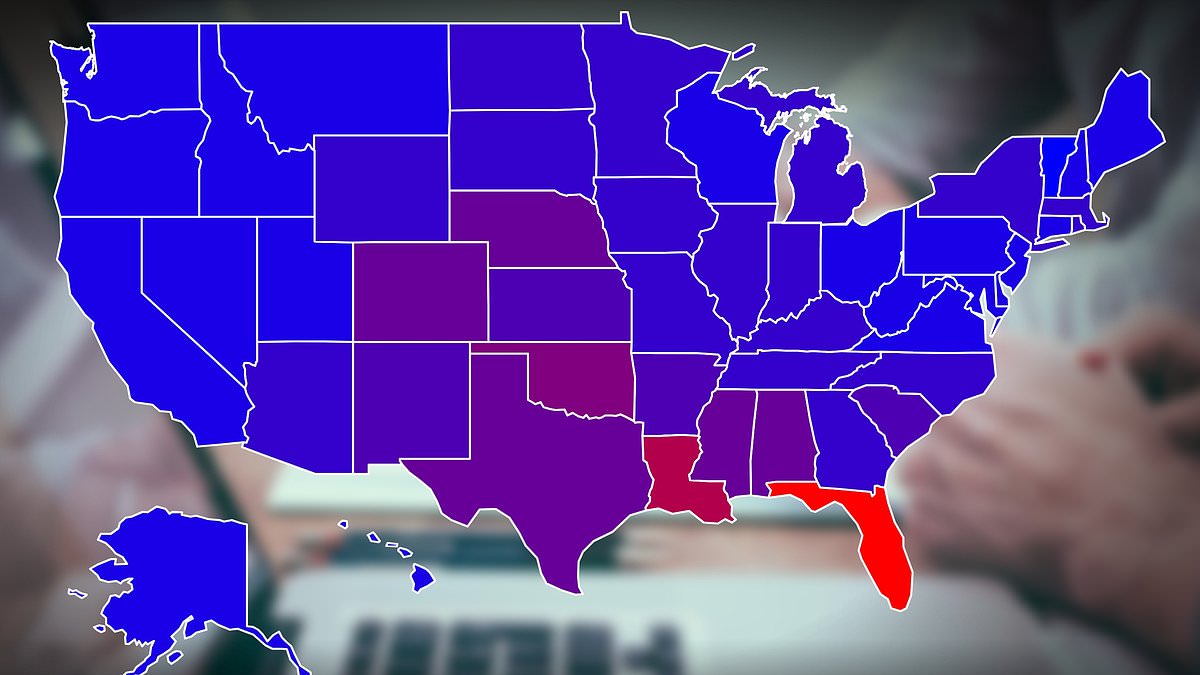

Home insurance costs in the U.S. have surged, particularly in states prone to climate-related disasters, with Florida leading the pack at an average of $9,213 annually. Insurers are increasingly withdrawing coverage from high-risk areas, impacting both home and car insurance. To lower premiums, homeowners can disaster-proof their homes by taking preventive measures and consider relocating to lower-risk states. Comparing quotes from multiple insurance providers is recommended to find the best coverage and rates.

More Top Stories

"Florida's Home Insurance Crisis: Solutions for Affordability and Resilience"

Yahoo Finance•1 year ago

More Financeinsurance Stories

"Florida's Home Insurance Crisis: Challenges and Solutions"

Florida's home insurance market has become dysfunctional due to surging property insurance costs, with average premiums costing homeowners $6,000 a year, more than triple the national average. Factors driving the insurance challenge include more frequent and costly natural disasters, skyrocketing reinsurance prices, and a litigation-friendly environment. Florida's response includes passing Senate Bill 2A, aiming to discourage needless lawsuits and restrict assignment of benefits, but the long-term impact remains uncertain, with other disaster-prone regions watching closely.

"Rising Insurance Premiums: The Impact on Colorado Homeowners and Drivers"

Home and auto insurance premiums are surging across the country, with homeowners seeing an average increase of more than 11% and auto insurance climbing even faster. Insurance companies attribute the surge to the need to catch up after two years of big losses, rising labor and material prices, and a mounting toll of natural disasters. While state regulators have some power to limit price hikes, insurance companies tend to have the upper hand, leading to concerns about escalating rates of uninsured drivers and homeowners.

"Homeowners Insurance Crisis: The Nightmare of Buying Coverage in America"

The cost of insuring homes in America is skyrocketing, with premiums jumping by an average of 21% from May 2022 to May 2023. Weather events are becoming more destructive, leading to underwriting losses for insurers. This is impacting the housing market, with some of the strongest housing markets experiencing stalled home sales and condo buildings becoming ineligible for mortgages. Insurers are abandoning entire states, leaving residents with fewer and costlier choices for protection against costly catastrophes. The rising cost of property insurance is making it difficult for homeowners to afford insurance, impacting real estate development and causing some to forgo insurance altogether.