"Rising Auto Insurance Costs: 5 Reasons and Solutions"

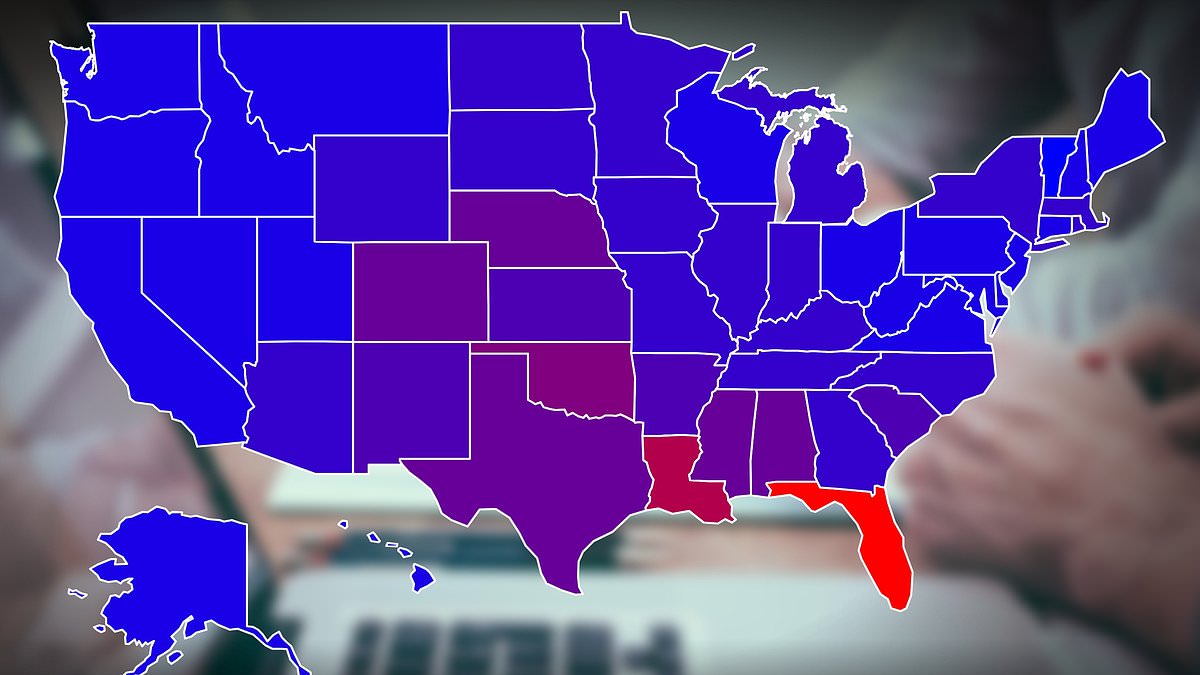

The cost of auto insurance in the US has risen over 22% in the past year, with a 43.7% increase since January 2020, largely due to the high-tech gadgetry and safety equipment now common in cars, driving up repair costs even for minor accidents and contributing to high inflation.