ACA enrollment deadline looms as subsidy talks stall in Congress

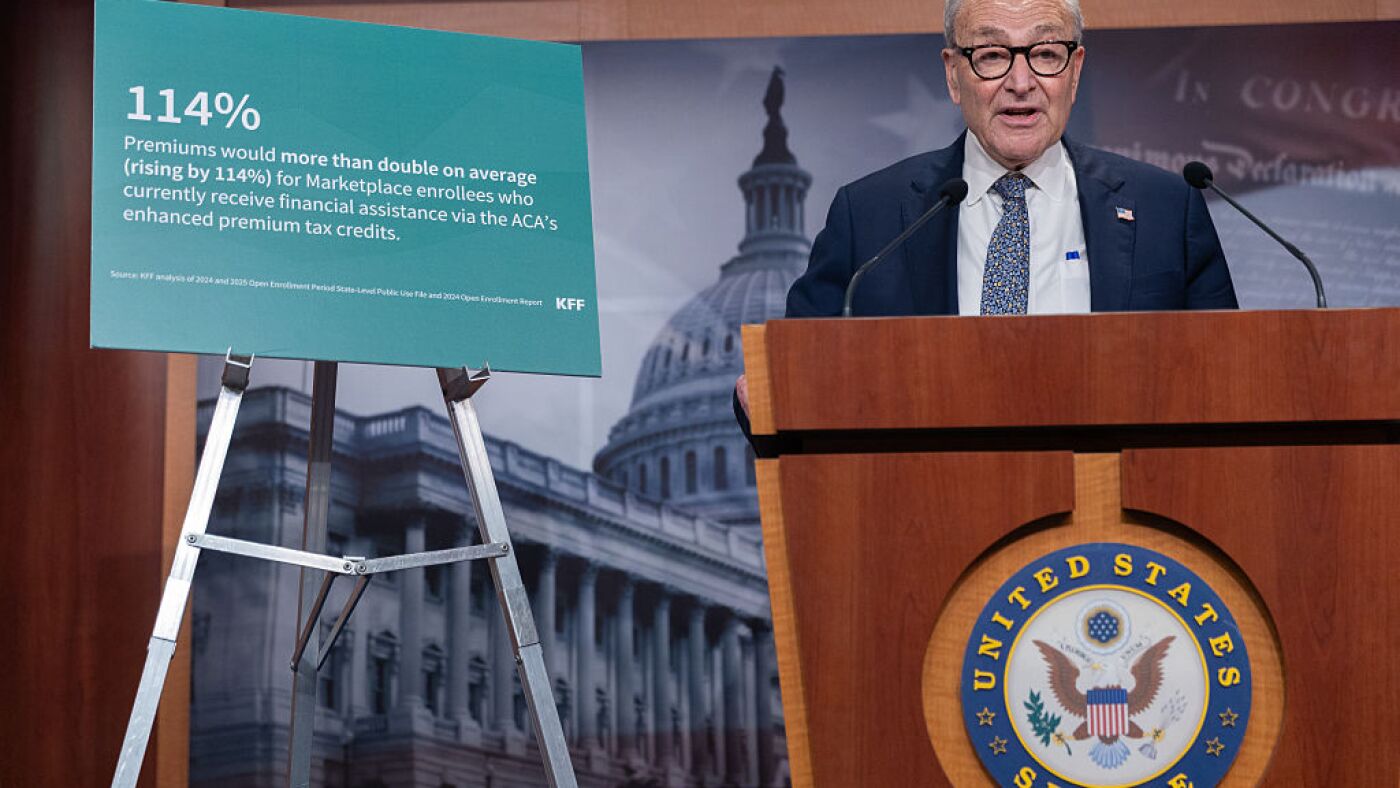

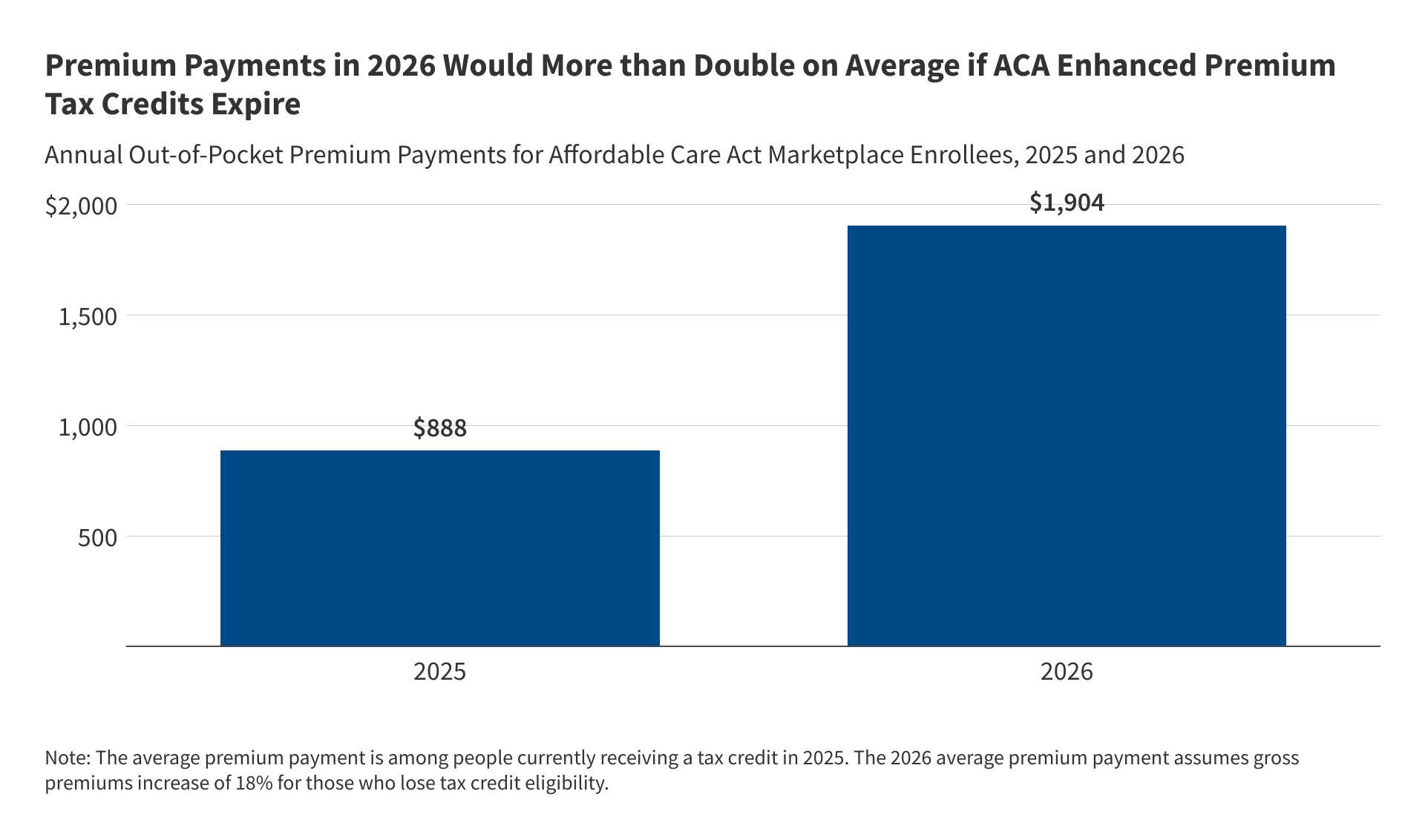

Most states’ open enrollment for ACA plans ends today as Congress stalls on extending enhanced premium tax credits; 10 states have extended deadlines into late January, while a House-backed three-year extension faces Senate resistance and a bipartisan two-year compromise has stalled. Without subsidy relief, silver-plan premiums could rise around 22% in 2026, according to Urban Institute, complicating enrollment for millions. About 22.8 million people had enrolled in ACA marketplace plans as of Jan. 12, down from last year. Extensions could be retroactive, but mid-year changes would complicate logistics and timelines.