Key Medicare and Health Insurance Changes for 2026

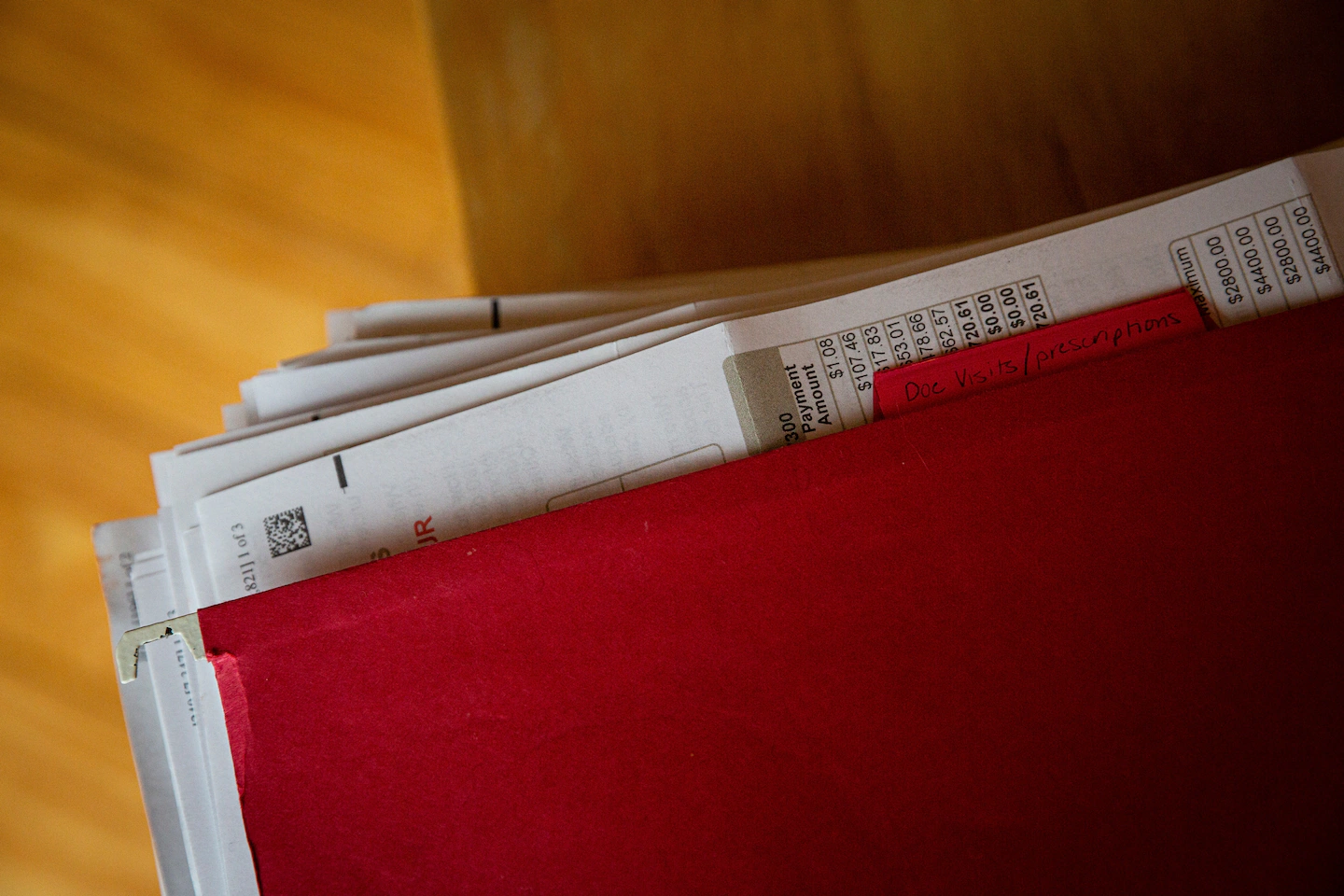

In 2026, Medicare beneficiaries will face increased premiums and deductibles, higher out-of-pocket costs for prescription drugs, and new negotiated rates on 10 common medications, making it crucial to review plans and budget accordingly for retirement healthcare expenses.