DJIA Dips as Layoffs Surge and Hiring Slows

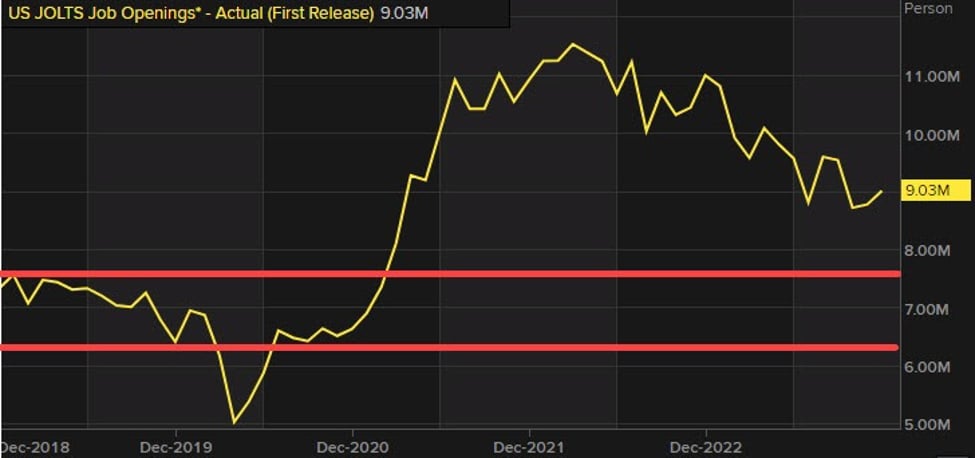

The Dow Jones declined about 0.6% as January planned layoffs jumped 118% year-over-year to 108,435—the highest since 2009—led by UPS and Amazon; hiring slowed to 5,306 new hires, while JOLTS showed 6.542 million job openings (below the 7.25 million expected). Initial jobless claims rose to 231,000 and continuing claims to 1.844 million, signaling softer labor conditions and weighing on the Dow, with tech names and the DIA ETF contributing to the declines.