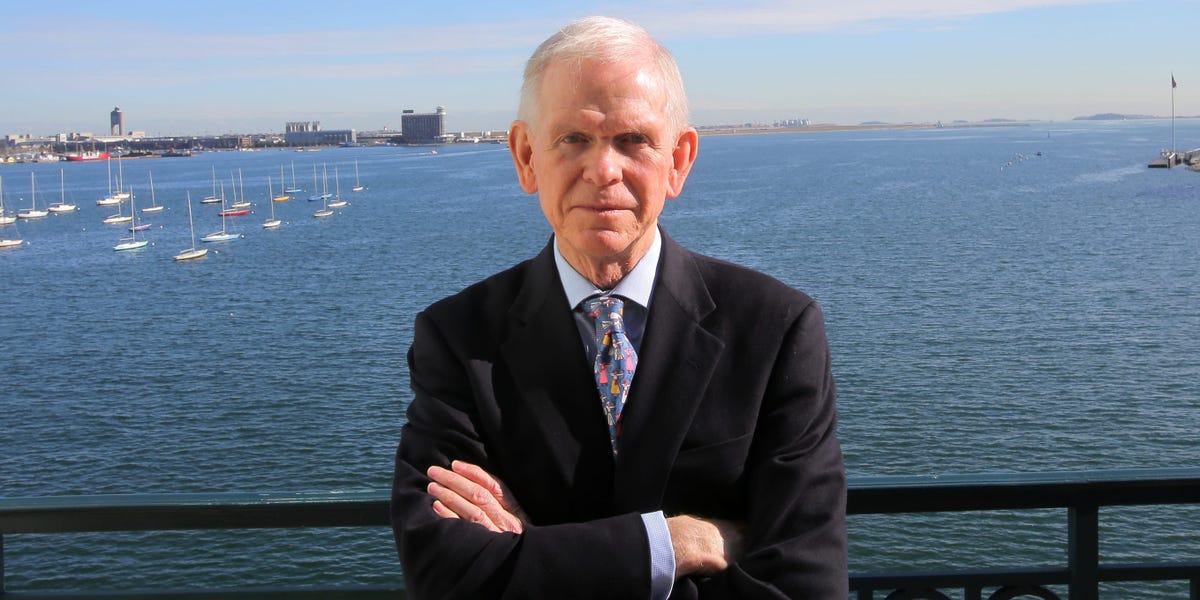

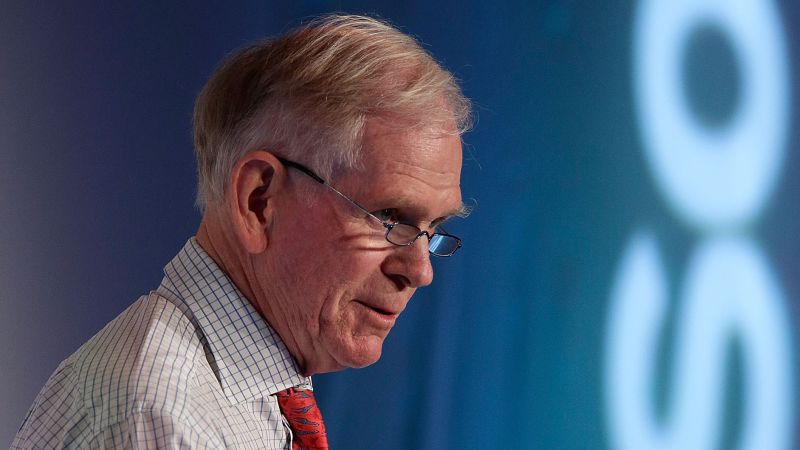

"Elite Investor Jeremy Grantham Warns of AI Bubble and Impending Recession"

Elite investor Jeremy Grantham warns that US stocks are overvalued, the AI bubble is set to burst, and a recession is looming. Grantham advises investors to steer clear of US stocks due to their high prices and suggests seeking undervalued assets in emerging markets, depressed sectors, and growth areas. Despite his previous dire forecasts not materializing, Grantham remains concerned about the economy, geopolitical conflicts, and overvalued assets.