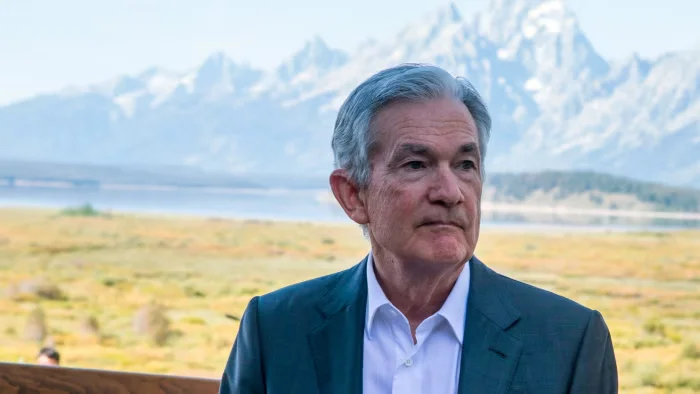

Trump renews threats to sue Fed's Powell over alleged incompetence

Donald Trump has renewed his threats to sue Federal Reserve Chair Jay Powell, accusing him of incompetence, amidst ongoing political tensions.

All articles tagged with #jay powell

Donald Trump has renewed his threats to sue Federal Reserve Chair Jay Powell, accusing him of incompetence, amidst ongoing political tensions.

Federal Reserve Chair Jay Powell indicated support for further interest rate cuts as the US job market shows signs of cooling, suggesting a potential shift in monetary policy to support economic growth.

The Federal Reserve is facing a dilemma as rising inflation and unemployment create a division within the Fed over whether to cut interest rates to support the labor market or hold steady to prevent inflation, leading to market uncertainty and a stock sell-off.

Federal Reserve Chair Jay Powell indicated that further interest rate cuts in the US are not guaranteed, signaling a cautious approach to monetary policy amid economic uncertainties.

The Federal Reserve is expected to cut interest rates by a quarter-point, marking the first reduction since December, amid internal disagreements and market expectations of more aggressive cuts in the future, while balancing concerns over inflation and economic stability.

The Federal Reserve is expected to cut interest rates by a quarter point amid internal disagreements and political pressure, with some members advocating for larger cuts due to economic uncertainties and the impact of tariffs, while others prefer to hold rates steady. The meeting occurs against a backdrop of political attacks on Fed officials and mixed economic signals, including rising jobless claims and low unemployment.

Jay Powell's cautious approach at Jackson Hole was seen as a missed opportunity to address economic challenges more boldly, reflecting a risk-averse stance that may influence future monetary policy decisions.

The article discusses the upcoming changes in US monetary policy, with Fed Chair Jay Powell hinting at possible interest rate cuts amid economic uncertainties, and highlights the potential influence of President Trump on the Federal Reserve's future leadership and policies, which could lead to a more Trump-friendly Fed with different dynamics and market reactions.

Federal Reserve Chair Jay Powell indicated that the shifting economic risks are increasing the case for a rate cut to support the economy, amid uncertainties that could influence future monetary policy decisions.

Jay Powell's upcoming speech at Jackson Hole faces challenges from political and internal Fed pressures, including attacks from Donald Trump and the potential appointment of a rate-cutting advocate, Stephen Miran, which could lead to internal dissent and complicate monetary policy decisions amid mixed economic data and trade tensions.

The Federal Reserve signaled it may hold interest rates steady through September despite President Trump's calls for a rate cut, with Fed Chair Jay Powell emphasizing a data-dependent approach amid ongoing trade uncertainties and economic slowdown concerns. Market reactions included a rally in the dollar and a sell-off in short-term Treasuries, as traders adjusted their expectations for future rate cuts.

The White House is urging the Federal Reserve to implement 'dramatically lower' interest rates ahead of a key policy meeting, criticizing Fed Chair Jay Powell for being too late in cutting rates and expressing concern over the Fed's headquarters refurbishment. The administration's push for lower rates comes amid ongoing trade tensions and inflation concerns, with the Fed expected to hold rates steady in the upcoming meeting, though a rate cut remains possible if inflation remains low.

Donald Trump has launched a critique against the Federal Reserve, specifically targeting Chair Jay Powell, in what appears to be a confrontation over monetary policy and economic management.

Donald Trump publicly clashed with Federal Reserve Chair Jay Powell during a visit to the Fed's headquarters, criticizing the cost of the renovation project and accusing Powell of keeping interest rates too high, marking a rare and tense confrontation between a US president and the central bank chief.

Donald Trump plans to visit the Federal Reserve to pressure Chair Jay Powell into cutting interest rates more aggressively, amid ongoing criticism of the Fed's $2.5 billion headquarters renovation and broader frustrations with monetary policy. The visit, which includes other administration officials, marks a rare move to scrutinize the central bank's spending and policy decisions.