Q4 GDP Slows as Federal Spending Drops and AI Investment Reshapes the Picture

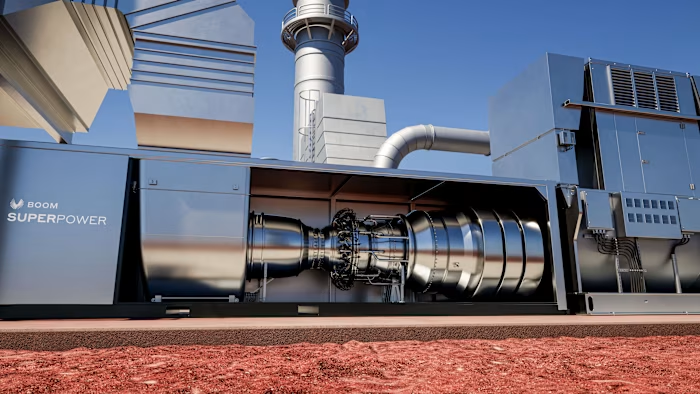

Fourth-quarter GDP grew slower than expected as a 16.6% drop in federal spending—part of it tied to a government shutdown and allegedly caused by Elon Musk’s DOGE-related cuts—dragged overall growth, while consumption was led by healthcare spending; housing and durable goods weakened, and non-residential investment was mixed with AI-related equipment up but other areas soft. Inflation remained stubborn at about 2.9% PCE, complicating Fed policy, and uncertainty remains over tariff policy after a court ruling and the future of the AI-driven investment boom.