US Housing Market Faces Decline Amid Economic Uncertainty

Housing starts in May dropped by 9.8% to a 5-year low, indicating a slowdown in new home construction due to waning demand, which could benefit home buyers by reducing competition and prices.

All articles tagged with #housing starts

Housing starts in May dropped by 9.8% to a 5-year low, indicating a slowdown in new home construction due to waning demand, which could benefit home buyers by reducing competition and prices.

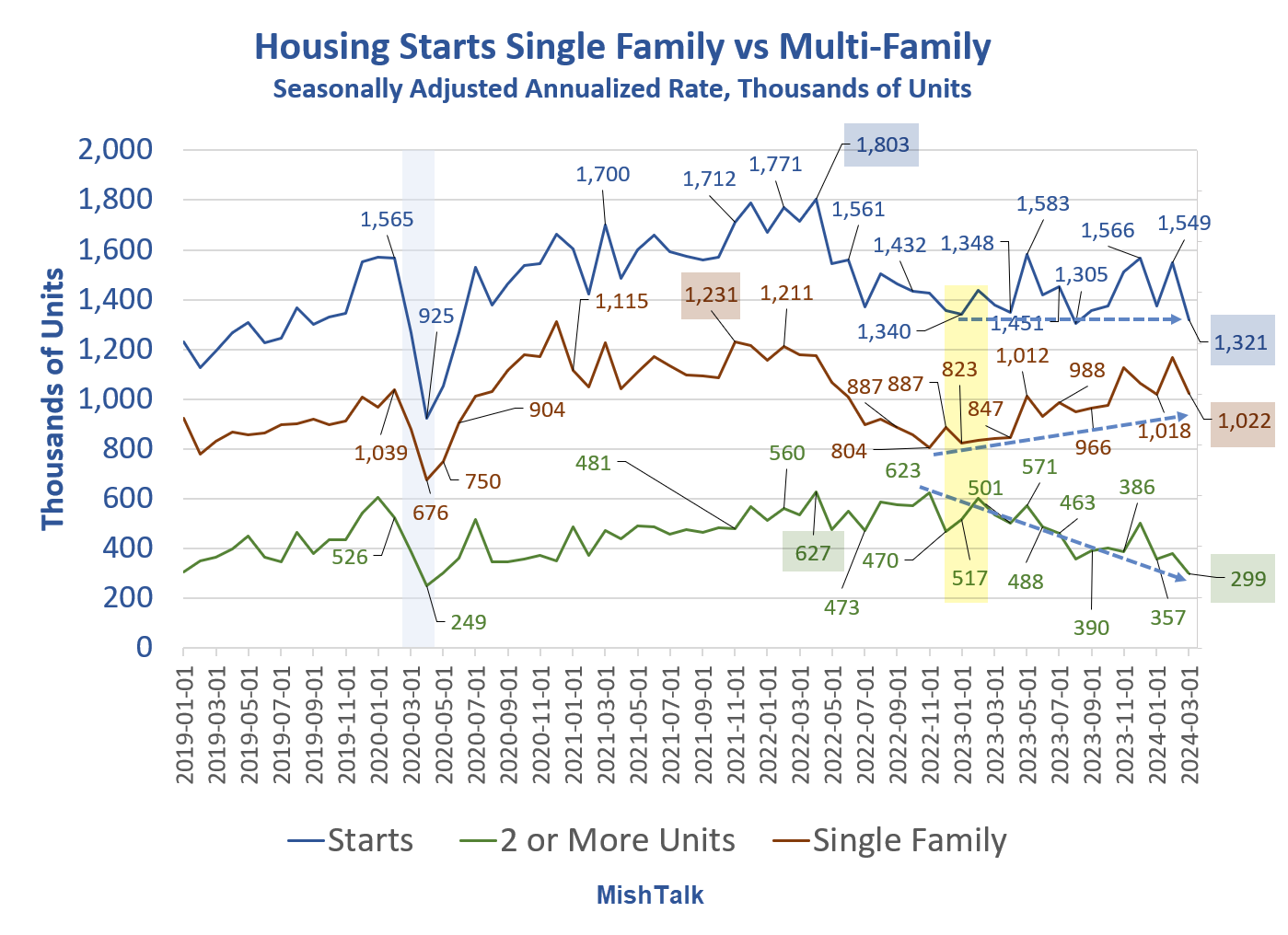

Housing starts plunged 14.7 percent in March, with multi-family construction notably weak over the past year, experiencing a 42.2 percent decline since January 2023. Single-family housing starts, on the other hand, increased by 24.2 percent during the same period. Building permits for privately-owned housing units also decreased by 4.3 percent in March, while single-family authorizations fell by 5.7 percent. Despite significant fluctuations, the data suggests a stagnant housing market, with expectations of continued weakness, particularly in the single-family sector.

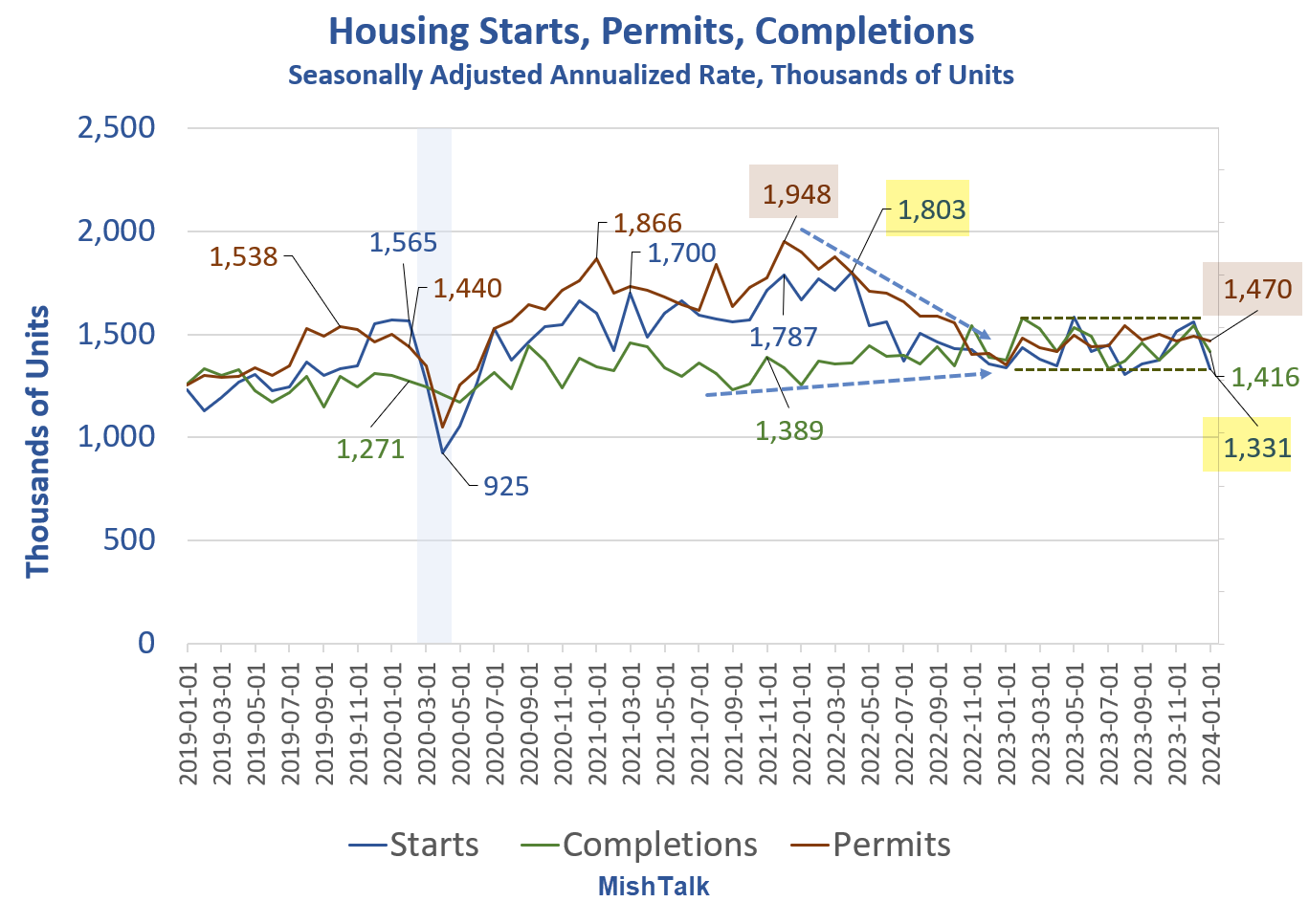

The housing market saw a surge in new-home construction in February, with privately owned housing completions and housing starts both experiencing significant increases. The rebound is attributed to warming weather and improved supply chains, signaling a recovery from pandemic-related volatility. The construction of single-family properties is expected to alleviate pressure on the market, and building permits for new-home construction also rose, indicating a positive outlook for the year. As warmer weather approaches and interest rates are expected to decrease, activity in the housing market is anticipated to pick up even more during the prime spring home-buying season.

Housing starts plunged 14.8 percent in January, despite positive revisions, marking a bad start to 2024. Building permits for privately-owned housing units also decreased by 1.5 percent from December, while existing home sales fell to their lowest level since 2010. Additionally, retail sales took an unexpected 0.8 percent dive in January, indicating a challenging start to the year for the economy.

National Association of Home Builders (NAHB) CEO Jim Tobin discusses the disappointing housing start data, noting the expected "bumpy" year for real estate and the disproportionate impact of high capital costs on the multi-family segment. Tobin highlights the challenges faced by first-time buyers due to high shelter inflation and uncertainty around potential interest rate cuts by the Federal Reserve. He emphasizes the need for more supply to address the housing market's current limitations and expresses optimism for the future despite persistent labor shortages and the potential role of AI in improving productivity in the building sector.

US producer prices rose 0.3% in January, with a 0.9% year-on-year increase, driven by strong gains in service costs such as hospital outpatient care and portfolio management, raising concerns about inflation. Single-family housing starts dropped 4.7% due to harsh weather, but permits for future construction rose 1.6%. Financial markets are adjusting expectations for Federal Reserve interest rate cuts as the Fed continues to monitor inflation.

Housing starts in the U.S. experienced a significant 14.8% drop in January, marking the sharpest decline since April 2020, as wintry weather and builder activity curtailment impacted construction. Single-family and multi-family construction both decreased, with the Northeast being the only region to see an increase. Despite the slowdown, builders remain optimistic about future sales and demand due to expected falling interest rates. The housing market's share of new homes in overall sales has risen to 30%, and while the drop in starts may be attributed to weather, mortgage rate increases could continue to weaken housing activity until the Federal Reserve signals a clearer policy intent.

Despite a sharp drop in mortgage rates, U.S. home construction fell in December for the first time in four months, with housing starts decreasing 4.3% to an annual rate of 1.46 million units. However, applications to build rose, indicating future construction growth. The decline in construction was attributed to a substantial drop in single-family home construction. Lower interest rates have improved housing affordability conditions, prompting optimism among homebuilders, but the housing market is facing new challenges such as higher prices and shortages of labor and lumber.

Housing starts in the US unexpectedly surged by 14.8% in November, reaching the highest level since May, as falling mortgage rates attracted consumers back into the housing market. The increase in construction activity was driven by low inventory of existing homes and favorable mortgage rates. However, applications to build fell by 2.5% in November, indicating a potential slowdown in future construction. Despite this, building permits are up by about 4.14% compared to the same period last year.

The annual pace of new home construction in the US surged in November, rising for the third consecutive month, driven by falling mortgage rates and a shortage of housing inventory. Housing starts jumped by 14.8% compared to the previous month, reaching the highest level since May. Single-family building activity was the main driver, with a 40% increase in new single-family homes under construction compared to a year ago. However, building permits ticked down by 2.5% in November. Despite the increase in construction, there is still a significant housing shortfall, leading to rising rents and home prices. Lower mortgage rates are expected to continue to boost affordability and meet pent-up demand, as existing homeowners are reluctant to sell due to their ultra-low mortgage rates.

Housing starts and permits increased in October, with new residential construction rising 1.9% to 1.372 million units and authorized residential permits gaining 1.1% to 1.487 million units. However, the activity remains below trend, and both permitting activity and home building are below expectations. Multifamily construction has slowed down, contributing to a surge in new supply and a slowdown in rent growth. On the single-family side, starts increased slightly, but builders still face challenges due to high demand and limited supply. Wall Street is raising forecasts for housing construction, with expectations of increased activity in 2024 and 2025.

Despite a spike in mortgage rates, housing starts in the US rebounded by 7% in September to an annual rate of 1.35 million units, according to Commerce Department data. However, applications to build fell by 4.4% over the month, indicating a decline in future construction. Building permits are also down by 7.2% compared to the same time last year. The low supply of existing homes on the market is providing a favorable backdrop for homebuilders, keeping prices elevated despite efforts by the Federal Reserve to cool the economy and suppress housing inflation. The National Association of Home Builders/Wells Fargo Housing Market Index fell to its lowest reading since January 2023, reflecting lower levels of buyer traffic and decreased housing affordability due to higher interest rates. Rates are expected to remain elevated as the Federal Reserve signals a longer period of peak interest rates.

Amazon plans to deploy new AI and robotics technology in its warehouses to improve delivery times and safety, while J.B. Hunt reports a 30% drop in profits due to lower shipping demand. United Airlines shares slide after forecasting earnings impact from flight suspensions in Israel. Nvidia and AMD shares fall following new AI chip restrictions imposed by the White House. Housing starts are projected to increase in September.

US home builders increased construction in July, with housing starts rising 3.9% from June, beating market expectations. Single-family housing starts, which account for most of the construction, rose 6.7% in July. The increase in new residential construction reflects a housing market where buyers are seeking affordable homes due to high prices and low inventory in the existing home market. However, completed homes declined 11.8% from June, and building permits were essentially flat. Builder sentiment dropped for the first time this year in August due to higher mortgage rates, high construction costs, and material shortages. Despite challenges, demand for new construction remains supported by a lack of resale inventory.

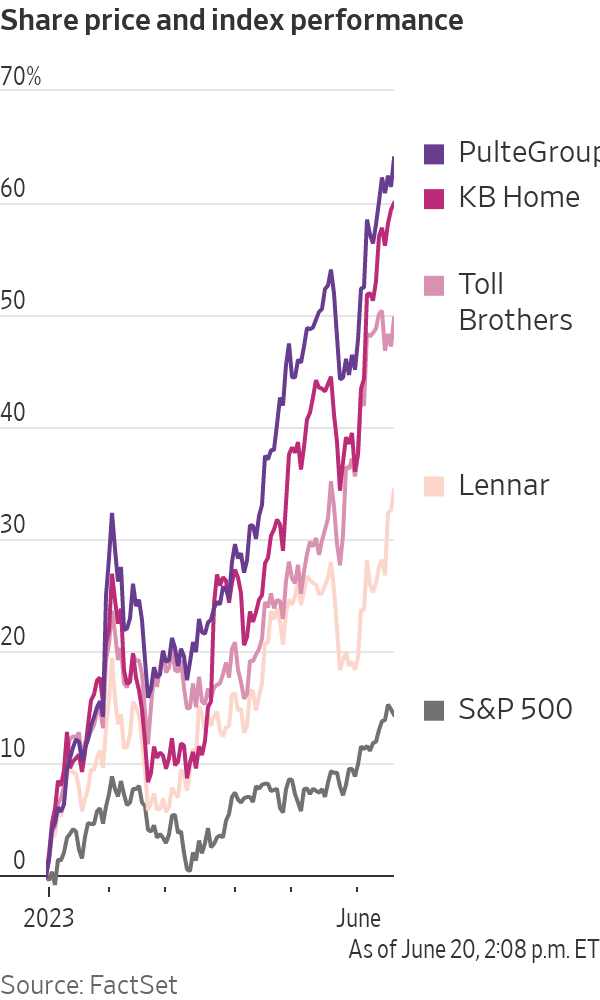

Homebuilder stocks continue to perform well despite high mortgage rates, with May housing starts rising 22% from April to over 1.6 million units, exceeding economists' expectations and marking the highest reading since last April.