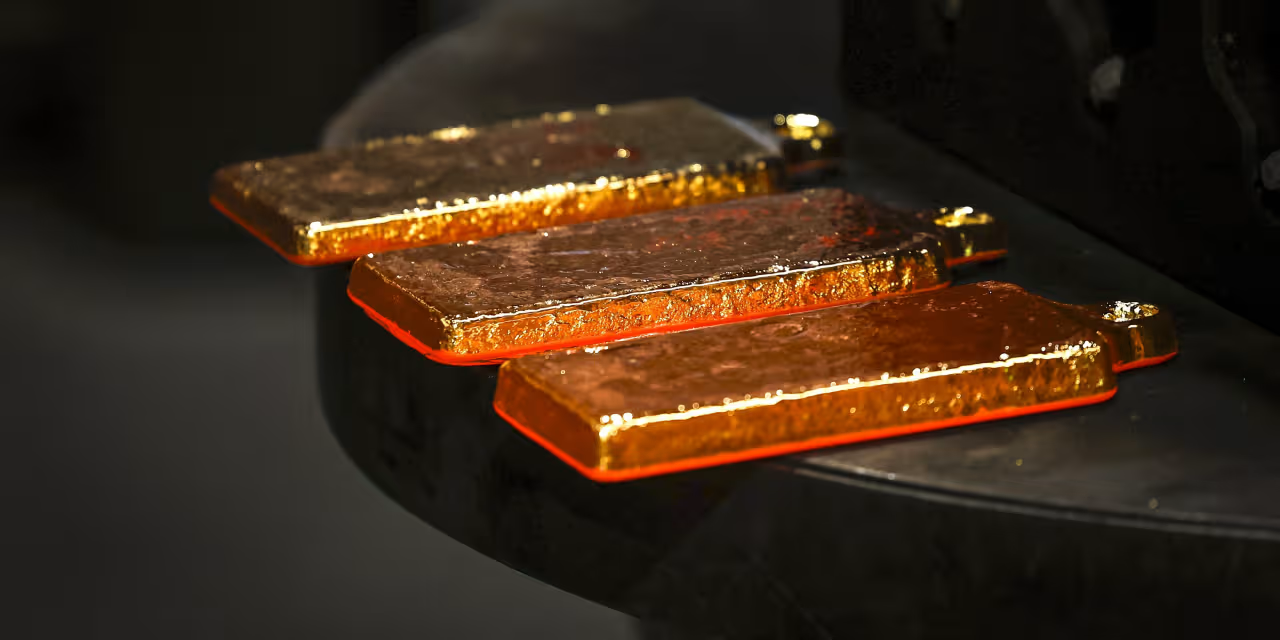

Gold Rally Gains Momentum as Investment Demand Hits All-Time High

Global gold demand reached a record in 2025 driven by geopolitical uncertainty and a surge in investment demand, sending gold futures above $5,500 an ounce and outpacing the S&P 500 as ETFs, bars, and coins collectively rose about 84% to 2,175 tons; analysts say the momentum from the “debasement” trade and ongoing risk environment could keep the rally alive into 2026.