Oregon Senate Walkout Blocks Vote on Gas-Tax Ballot Change

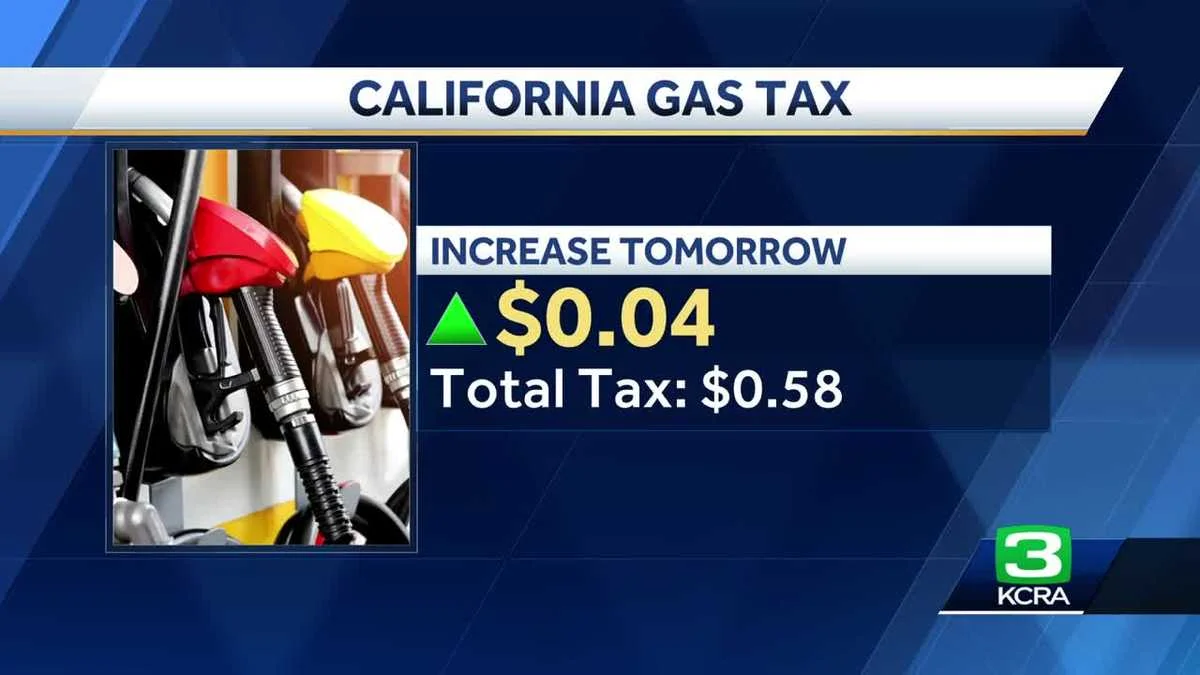

Oregon Republicans skipped the Senate floor, denying the 20-member quorum as Democrats move SB 1599 to force a May primary vote on a gas-tax increase and related fees; the GOP argues the timing and legality are contentious, echoing past walkouts and highlighting tensions over transportation funding and other hot-button bills.