Fund Managers Brace for US Tech Sector Downturn

Fund managers are preparing for a potential downturn or 'reckoning' in the US technology sector, highlighting concerns about the sector's future stability and investment risks.

All articles tagged with #fund managers

Fund managers are preparing for a potential downturn or 'reckoning' in the US technology sector, highlighting concerns about the sector's future stability and investment risks.

Fund managers recommend three dividend stocks as potential sources of passive income, emphasizing their appeal for investors seeking steady returns. These stocks are seen as attractive options for those looking to generate income from their investments in the current financial markets.

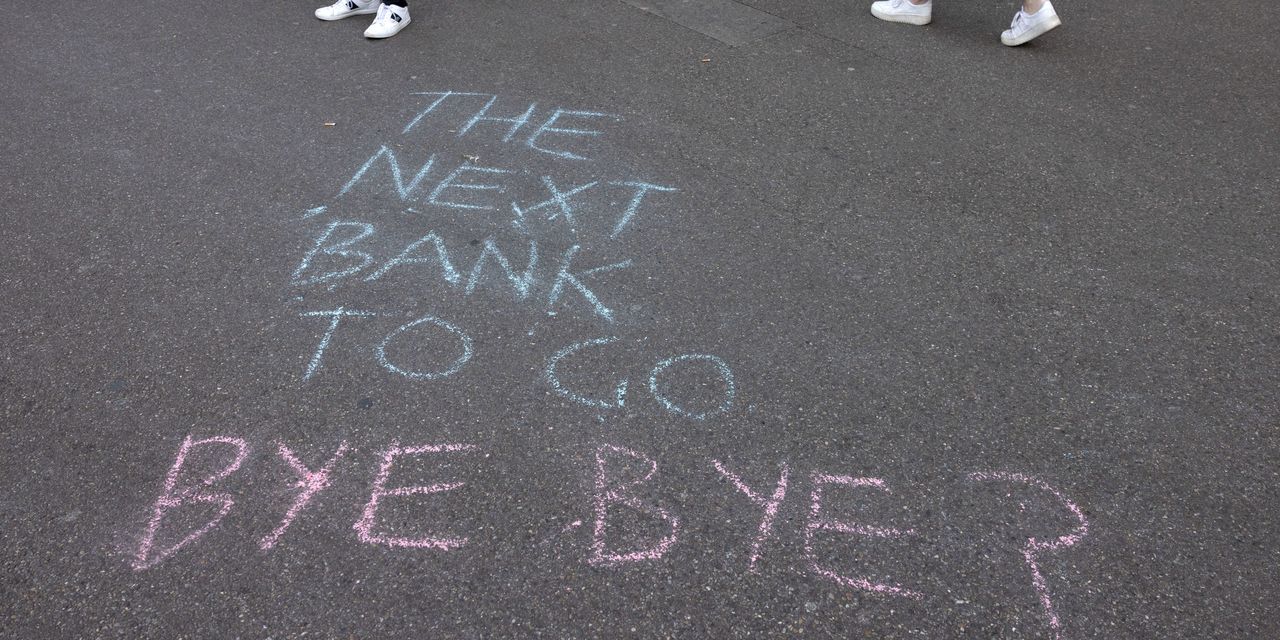

Fund managers are increasingly concerned that trouble in the commercial real estate sector could lead to a credit crisis in the U.S., with the potential for a systemic credit event identified as a top risk to markets. About $1.5 trillion in commercial mortgage debt is due by the end of 2025, and steeper borrowing costs, tighter credit conditions, and declining property values due to remote work have increased the risk of default. Small and regional banks, which hold about 80% of the sector's outstanding debt, are at the center of the potential upheaval, with concerns that lending standards could become significantly more restrictive. Treasury Secretary Janet Yellen has downplayed the potential impact on the banking system, stating that while there may be additional bank stress and financial losses, it is not expected to pose a systemic risk.

Money managers are increasingly concerned about the potential for a systemic credit event as real estate market turmoil raises alarms globally. The deepening disquiet in US commercial real estate and Chinese property markets has become the third-biggest worry for respondents in a recent survey, trailing higher inflation and geopolitics. Fears were compounded by stronger-than-expected inflation numbers, denting hopes for Federal Reserve interest rate cuts to alleviate real estate pressure. Smaller banks are particularly vulnerable to the downturn in commercial real estate, with concerns about potential solvency runs and default rates. The Fed is coordinating with lenders to work through expected losses, but nearly 40% of fund managers see US commercial real estate as the most likely source of a credit event.

Bank of America's latest fund manager survey reveals bullish sentiment, with cash levels down and a focus on tech. Investors are no longer predicting a recession, but concerns about inflation persist. The survey highlights crowded trades, including long US$ and short China stocks, prompting caution and contrarian trade suggestions from BofA.

The world's top 20 hedge funds saw record profits of $67 billion in 2023, surpassing the pandemic-era rally of 2021, with the industry as a whole recording gains of $218 billion after fees. The leading funds, including TCI, Citadel, and Viking, accounted for one-third of the annual profits despite managing less than a fifth of the industry's assets. Buoyed by the stock market's strong performance, these funds showcased savvy stock selection strategies, with TCI leading the pack with $12.9 billion in profits and a 33% gain in 2023, while Citadel made $8.1 billion in profits and holds the title of the most successful hedge fund in history with $74 billion in gains since inception.

Fund managers are expressing their most positive sentiment towards the stock market since January 2022, according to a survey by Bank of America. The S&P 500 is trading just 1% away from its record close, and the Dow Jones Industrial Average has reached record territory. The survey reveals that fund managers expect a "Goldilocks '24" scenario, with policy driving asset prices. The majority believe that interest rate hikes are over and anticipate rate cuts in the first half of 2024. Bonds and technology stocks are seen as the biggest winners in this environment. However, concerns remain about a potential hard landing for the economy, high inflation, and geopolitical turmoil.

Despite the stock market's strong performance in 2023, a significant number of professional investors are still underperforming their benchmarks, according to data from Fundstrat. Around 65% of large-cap fund managers are trailing their benchmark by an average of 6.5%. This underperformance could lead investors to chase this year's winning trades in the final weeks of the year, potentially putting pressure on them to catch up. The concentrated gains of popular stocks like Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia have contributed to the performance challenges for large-cap managers. This year's market rally, led by a few stocks overrepresented in the index, has created a perfect storm for active managers.

There are two reasons why selling in the Nasdaq could escalate. Firstly, fund managers may opt to close the books for the year and invest in three-month Treasury bills, which currently yield 5.48% annually, to secure their gains and be ready for 2024. Secondly, technical analysis suggests a potential head-and-shoulders pattern forming in the S&P 500 and Nasdaq Composite, with a measured target close to a 6.4% decrease. If the neckline slope on the Nasdaq doesn't hold, heavy selling in megacap tech stocks could occur as the allure of the AI trade diminishes.

Many fund managers who avoided investing in Nvidia, whose shares have tripled this year, are now facing underperformance compared to their benchmarks. Only 15% of nearly 330 mutual funds benchmarked to the S&P 500 held an above-index weight in Nvidia, while 85% of funds that held a below-average weight in the stock underperformed the index. Concerns about valuation, chip demand, and the future of AI have kept some investors away. Nvidia's stock currently trades at a higher valuation compared to the Nasdaq 100. The underperformance of fund managers in megacap growth stocks, including Nvidia, has been a primary headwind to mutual fund performance this year.

Fund managers are the least bearish in over a year, according to Bank of America, erasing a previous buy signal. The surprise rate cuts in China are impacting stock futures, potentially reflecting the economic troubles in the country. Retail sales data is expected to be released later, which may provide further insight into the market's performance.

CNBC's Jim Cramer provided insights on how to interpret earnings reports and make informed investment decisions. He categorized companies into groups such as continually good quarters (PulteGroup, Sherwin-Williams, General Electric, Alphabet), first good quarter (NXP Semiconductors, Danaher), last bad quarter (Danaher), first bad quarter (RTX), and confusing quarters (GE HealthCare). Cramer emphasized the importance of understanding a company's performance before buying or selling stocks and highlighted potential buying opportunities during a company's last bad quarter.

Fund managers fear a systemic credit crunch as the biggest tail risk this month, according to Bank of America's latest global fund manager survey. The most likely sources of a credit event are U.S. shadow banking, U.S. corporate debt, and developed-market real estate. Investors see an additional 75 basis points of Federal Reserve rate hikes in this cycle with rates peaking at 5.25%-5.5%. Over four in 10 fund managers say a recession is headed in the next 12 months. The survey also found fund managers are more bullish on Eurozone stocks than U.S. stock, the most overweight they have been on Europe since October 2017.

According to the latest BofA fund manager survey, the likelihood of a US recession is back on the rise for the first time since November 2022, with 42% of fund managers surveyed seeing a recession happening within the next 12 months, up from 24% in February. While fund managers aren't in universal agreement on a recession, they are almost in unison on the economy being stagnant over the next 12 months, with 80% of those surveyed expecting a stagflationary economy to persist.

A systemic credit event has replaced stubborn inflation as the key risk to markets for increasingly pessimistic investors, according to Bank of America Corp.’s latest global survey of fund managers. The most likely source of a credit event is US shadow banking, followed by US corporate debt and developed-market real estate, according to the poll, which canvassed 212 fund managers with $548 billion under management. The poll showed investor sentiment is “close to levels of pessimism seen at lows of past 20 years,” with the likelihood of a recession rising again for the first time since November.