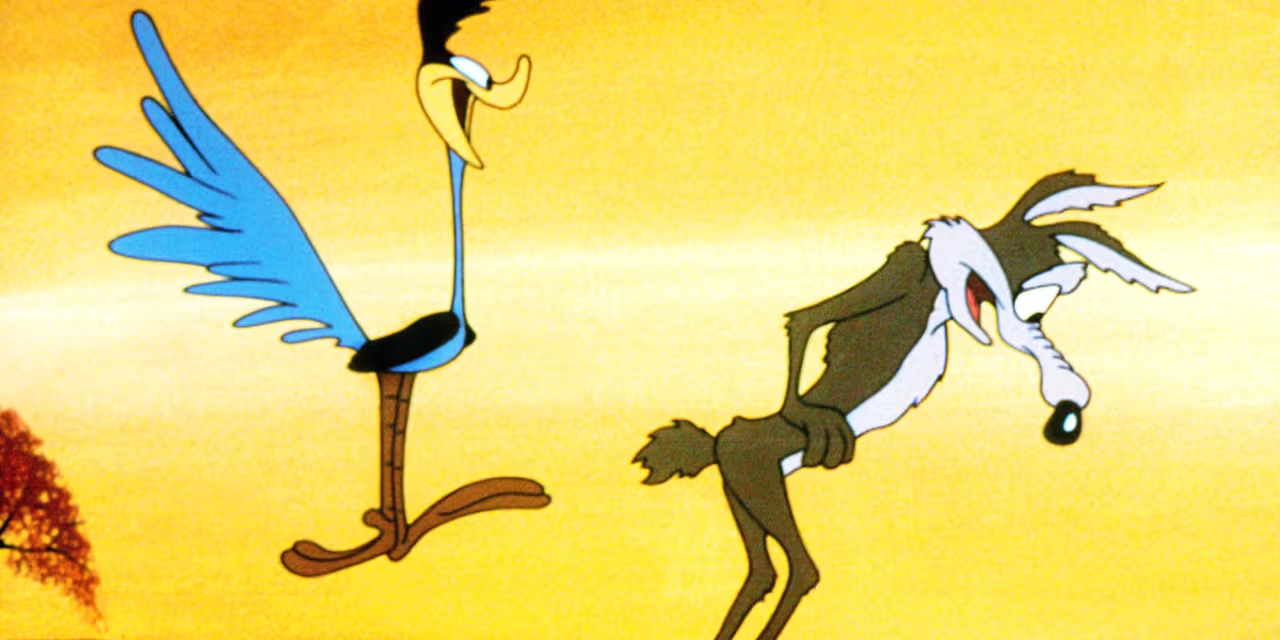

Wall Street's Biggest Bear Warns S&P 500 Nearing a Wile E. Coyote Moment

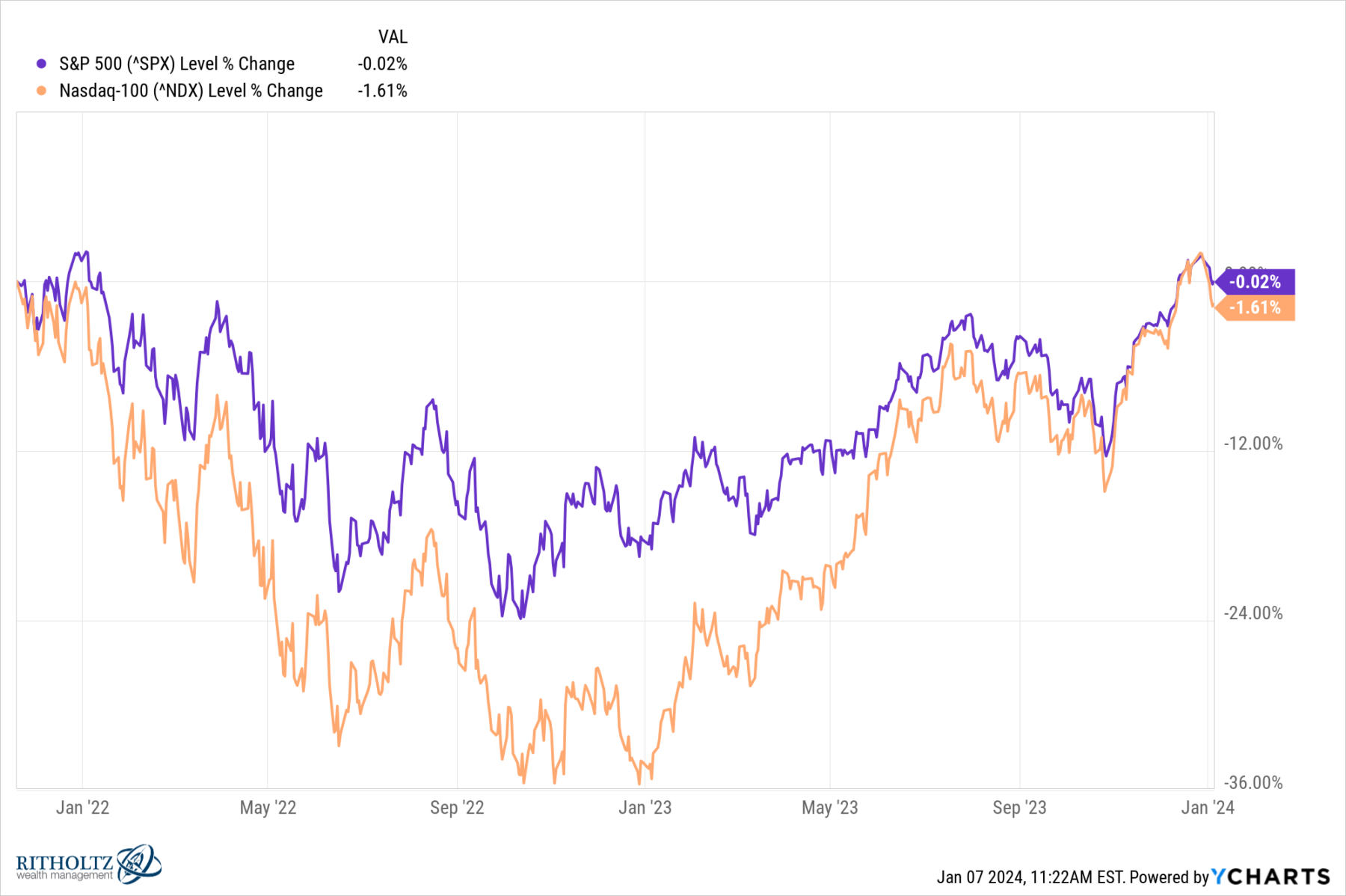

Wall Street's most bearish strategist, Peter Berezin of BCA Research, warns that the S&P 500 is nearing a 'Wile E. Coyote' moment, indicating a potential sharp decline due to economic concerns such as weak consumer spending, housing, and payroll data, along with geopolitical and fiscal risks. His models suggest below-average returns in the short term, and he recommends an underweight position in U.S. stocks amid these risks.