Nvidia Stock Gains Momentum Amid Analyst Optimism and Opportunities

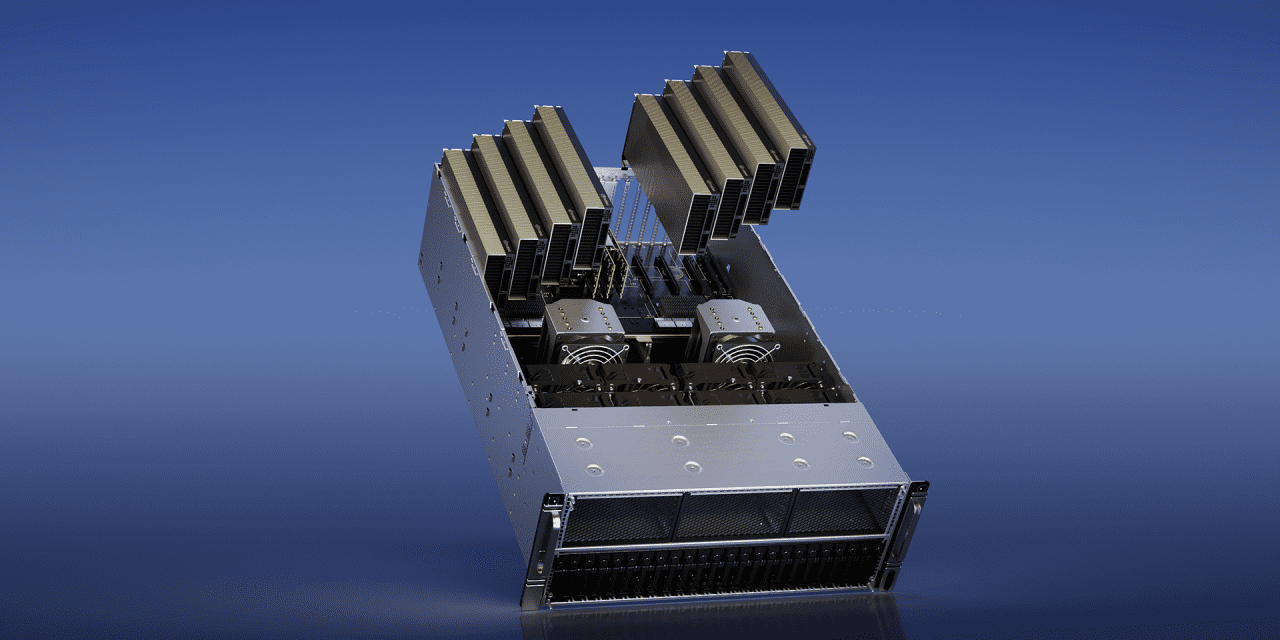

Nvidia's stock rose 1.3% after a recent 6% dip, with J.P. Morgan viewing the decline as a buying opportunity and maintaining a $250 target, citing strong order pipelines and strategic options trading, amidst competitive pressures from Google's TPUs.