S&P 500 Gains and Global Market Trends in 2025

The S&P 500 has gained 16% so far this year and is entering the final two months, prompting investors to consider whether to lock in gains.

All articles tagged with #financialmarkets

The S&P 500 has gained 16% so far this year and is entering the final two months, prompting investors to consider whether to lock in gains.

Mortgage demand in the US remained largely unchanged last week as financial markets adjusted to the implications of a Trump presidency, with mortgage rates rising to their highest since July. The Mortgage Bankers Association reported a slight 0.5% increase in total application volume, marking the first rise in seven weeks. While refinance applications fell 2%, purchase applications rose 2%, driven by loans backed by the FHA and VA. The market is experiencing volatility due to election-related factors and expectations for future fiscal policy changes.

The Federal Reserve has announced another cut in interest rates, aiming to stimulate economic growth and address concerns over slowing economic activity. This move is part of the Fed's ongoing monetary policy adjustments to support the financial markets and maintain economic stability.

Prediction markets have shifted significantly in favor of Donald Trump as early election results come in, with his odds of winning rising sharply across various platforms. States traditionally aligned with either party have been called, but no swing states have been decided yet. Trump's improved performance in states like Florida and Virginia has contributed to this shift. Financial markets are also reacting, with increases in the dollar, Treasury yields, Bitcoin, and shares of Trump-related companies. Previously, Kamala Harris had shown strong momentum in prediction markets.

A record number of activist investor campaigns have been launched against companies, signaling a significant uptick in shareholder activism. These investors are increasingly challenging company management and strategies, aiming to influence corporate decisions and potentially drive changes to unlock shareholder value. This trend underscores the evolving dynamics within corporate governance and the financial markets.

Despite the low prices of Chinese stocks, investors remain cautious, suggesting that the stocks may not be as attractive as their bargain prices imply. The Financial Times article discusses the hesitancy in the market, indicating that even with discounts, there could be underlying issues deterring investment, such as economic uncertainties or regulatory concerns. The article is behind a paywall, with subscription offers for those interested in accessing the full analysis and other financial journalism from FT.

Thrift Savings Plan (TSP) portfolios concluded the year 2023 on a positive note, indicating a period of growth for retirement savings accounts. This performance reflects a favorable trend in financial markets, which may benefit federal employees and retirees who invest in TSP. The article does not provide specific performance figures but suggests an optimistic outlook for those with TSP accounts.

Andy Lee has carved out a unique and profitable role in the financial markets by investing in tax receivable agreements (TRAs), which are complex financial arrangements benefiting early investors in companies. Despite their growing popularity, TRAs remain obscure, with many investors unaware of their mechanics or even their existence. Lee's expertise in this niche area has earned him the title of the 'king' of this particular hustle on Wall Street.

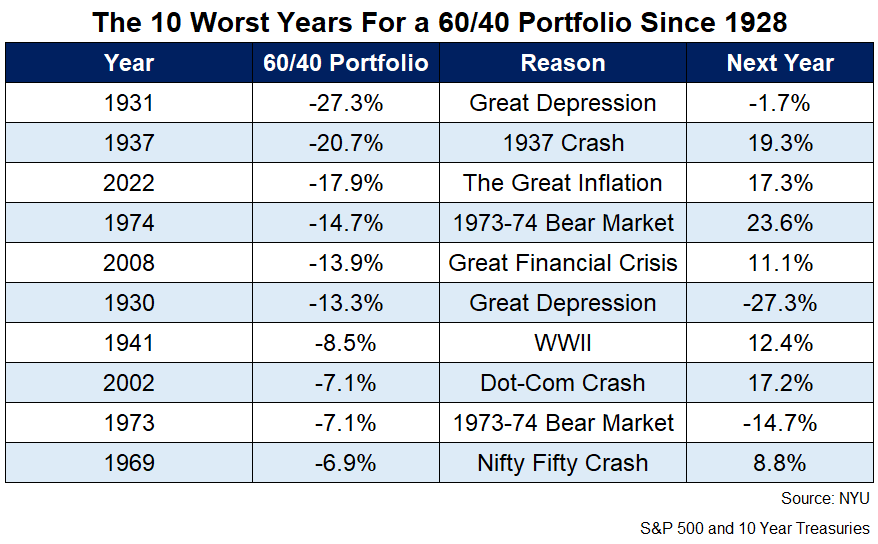

After a dismal performance in 2022, financial markets experienced a significant rebound in 2023. The S&P 500, Nasdaq 100, and various other indices, including international stocks, posted strong gains. Bonds also recovered, with the 10-year Treasury bond yielding a near 4% return. Factors contributing to the positive year included no recession, a drop in inflation, stable unemployment rates, and lower gas prices. The article suggests that historically, bad years like 2022 often present opportunities for long-term investors, and 2023's recovery seems to have proven this point. Looking ahead, the author plans to explore the historical trends following good financial years to speculate on what 2024 might hold.

Despite a year marked by significant fluctuations, the US 10-year Treasury yield ended 2023 nearly where it started, closing at 3.87% compared to the previous year's 3.83%. The yield experienced a low of 3.25% during a regional banking crisis in the spring and a peak of 5.02% during an October debt rout, indicating potential volatility ahead. Other notable changes in the bond curve include a decrease in two-year yields by 11.3 basis points and an increase in 30-year yields by 9 basis points over the year.

Warren Buffett's Berkshire Hathaway enters 2024 with a $371 billion portfolio, heavily concentrated in just eight companies, including Apple, Bank of America, and Coca-Cola, which together make up 85% of the portfolio's value. The portfolio also includes significant investments in financials and cyclical businesses, with a recent focus on energy stocks like Chevron and Occidental Petroleum, reflecting expectations of high crude oil prices. Additionally, Berkshire's portfolio features over $1 billion investments in 20 other companies and smaller holdings that could be influenced by Buffett's investment lieutenants, highlighting a diverse yet strategic approach to investing.