US Core CPI Surprises with November Rise, Impacting Rate Cut Timing

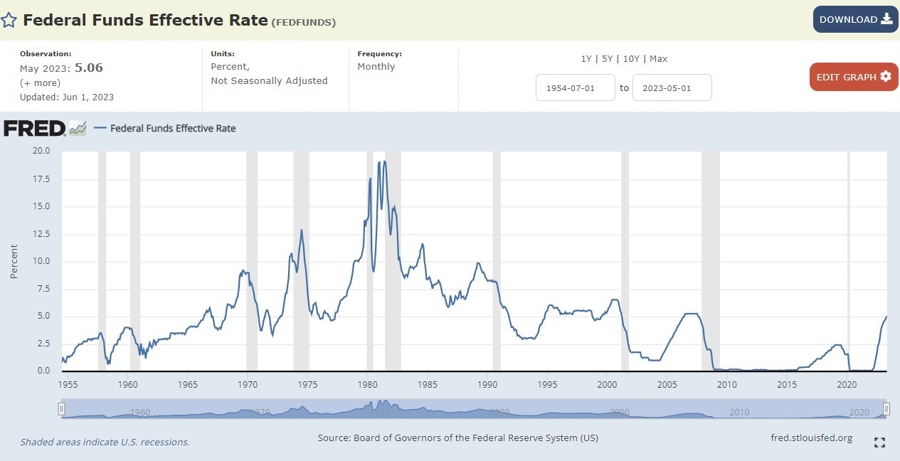

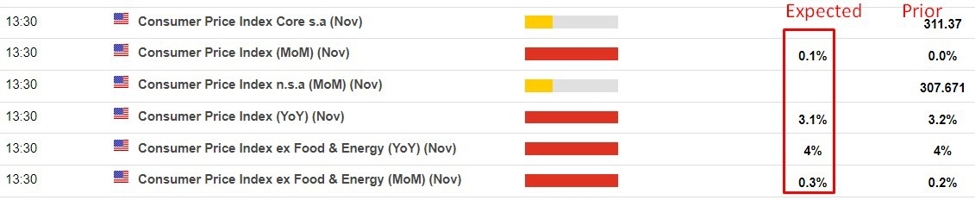

The upcoming US inflation data for November, specifically the Core CPI, could impact future rate cut timing as markets will be watching for any unexpected rise above expectations. If the data comes in above the upper end of estimates, ongoing pricing pressures will likely influence the timing of rate cuts. Conversely, if the data falls below the lower range of estimates, it could have the opposite effect.